- United States

- /

- Chemicals

- /

- NasdaqCM:BON

Fewer Investors Than Expected Jumping On Bon Natural Life Limited (NASDAQ:BON)

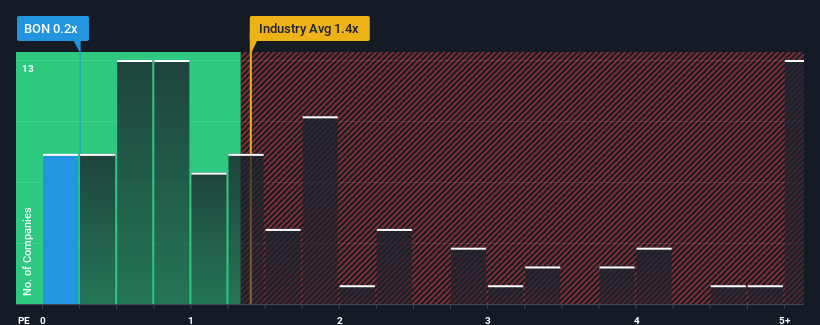

When close to half the companies operating in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.4x, you may consider Bon Natural Life Limited (NASDAQ:BON) as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bon Natural Life

What Does Bon Natural Life's Recent Performance Look Like?

Recent times have been pleasing for Bon Natural Life as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bon Natural Life will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Bon Natural Life's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 103% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.0%, which is noticeably less attractive.

With this information, we find it odd that Bon Natural Life is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Bon Natural Life's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Bon Natural Life currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Bon Natural Life (of which 2 are significant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bon Natural Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BON

Bon Natural Life

Engages in the research and development, manufacture, and sale of functional active ingredients extracted from natural herb plants in the People’s Republic of China and internationally.

Excellent balance sheet slight.