- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

Aura Minerals (NasdaqGS:AUGO): Evaluating Valuation After Landmark IPO and Gold Price Surge

Reviewed by Simply Wall St

Aura Minerals (NasdaqGS:AUGO) wrapped up its Nasdaq IPO in July 2025, capturing nearly $196 million for new projects and acquisitions across Latin America. The launch of its Borborema gold mine, together with soaring gold prices, has drawn heightened investor optimism.

See our latest analysis for Aura Minerals.

With the IPO fueling new growth plans and gold prices climbing, Aura Minerals has seen impressive momentum. The stock notched a 32.8% share price return over the past month and total shareholder return is up a remarkable 258.7% in the last year. This points to both renewed investor enthusiasm and confidence in the company’s long-term strategy, even after such a significant run.

If Aura’s breakout year has you looking for your next opportunity, now’s a smart time to broaden your horizons and explore fast growing stocks with high insider ownership

With surging returns and ambitious expansion plans already in motion, investors now face a key question: Is Aura Minerals still trading below its true value, or has the market fully priced in the company’s blockbuster outlook?

Price-to-Sales of 4.3x: Is it justified?

With a price-to-sales (P/S) ratio of 4.3x, Aura Minerals currently trades well above the U.S. metals and mining industry average of 2.1x. This higher multiple signals that investors are expecting premium growth or profitability from Aura compared to its peers, despite its recent strong price appreciation.

The price-to-sales ratio measures how much investors are willing to pay per dollar of Aura's revenue. In capital-intensive industries like mining, P/S can offer insights when companies are unprofitable, highlighting market expectations for future top-line growth.

At 4.3x, Aura’s P/S is more than double the broader industry, indicating a rich valuation based on current sales. According to the fair value regression model, the fair price-to-sales ratio for Aura is 3.6x, which is well below the current level. This gap suggests the market may have moved ahead of fundamentals and could potentially revert to a lower multiple as expectations normalize.

Explore the SWS fair ratio for Aura Minerals

Result: Price-to-Sales of 4.3x (OVERVALUED)

However, slowing revenue growth and recent net losses could temper Aura’s momentum if gold prices reverse or if operational challenges emerge.

Find out about the key risks to this Aura Minerals narrative.

Another View: SWS DCF Model Paints a Different Picture

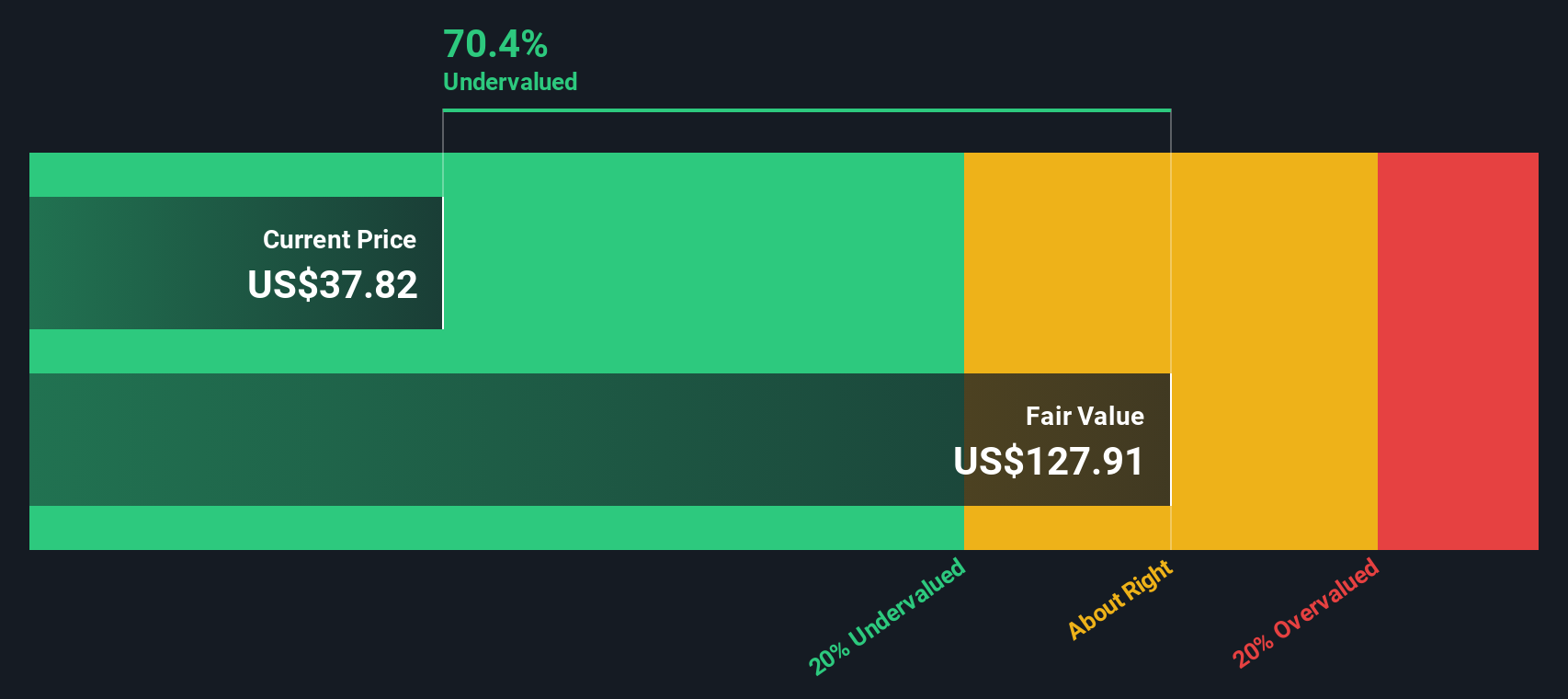

While Aura Minerals appears expensive on a sales multiple basis, our DCF model tells a starkly different story. According to the SWS DCF model, Aura is trading at a steep 66% discount to its fair value. This suggests the company could be dramatically undervalued. Is the market seeing a risk the model does not, or is this a rare opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aura Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aura Minerals Narrative

If you want to take a closer look at the numbers or have your own take on Aura Minerals, it’s easy to dig in and shape your own view in just a few minutes. Do it your way

A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the market, now is the time to broaden your opportunities beyond just one company and find your next breakout winner.

- Take the opportunity to review high-potential bargains among these 920 undervalued stocks based on cash flows before others spot them.

- Find reliable income plays by checking out these 15 dividend stocks with yields > 3% offering attractive yields above 3%.

- Explore the future of artificial intelligence by acting on opportunities within these 25 AI penny stocks delivering transformative growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.