- United States

- /

- Chemicals

- /

- NasdaqCM:ALTO

Alto Ingredients, Inc.'s (NASDAQ:ALTO) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Alto Ingredients, Inc. (NASDAQ:ALTO) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 56% share price decline over the last year.

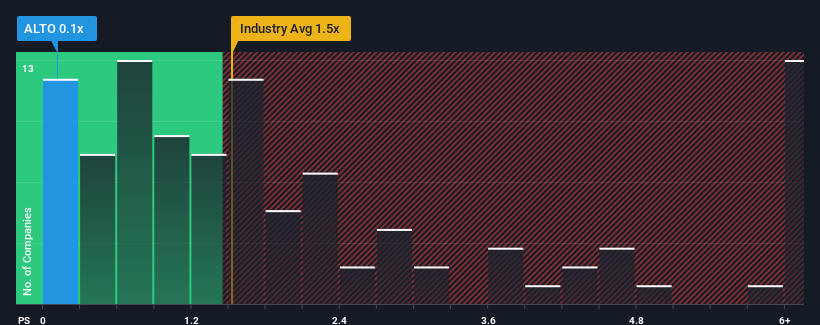

Although its price has surged higher, given about half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Alto Ingredients as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Alto Ingredients

How Alto Ingredients Has Been Performing

With revenue that's retreating more than the industry's average of late, Alto Ingredients has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alto Ingredients.Is There Any Revenue Growth Forecasted For Alto Ingredients?

The only time you'd be truly comfortable seeing a P/S as low as Alto Ingredients' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 43% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 6.5% over the next year. Meanwhile, the broader industry is forecast to expand by 3.9%, which paints a poor picture.

With this in consideration, we find it intriguing that Alto Ingredients' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Alto Ingredients' P/S

Despite Alto Ingredients' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Alto Ingredients' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Alto Ingredients that you should be aware of.

If you're unsure about the strength of Alto Ingredients' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALTO

Alto Ingredients

Produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives