- United States

- /

- Metals and Mining

- /

- NasdaqCM:ABAT

Will ABAT’s Response to the DOE Grant Loss Reveal the Resilience of Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, American Battery Technology Company confirmed that the U.S. Department of Energy terminated a US$115 million grant intended for the construction of its lithium hydroxide project in Nevada, prompting the company to continue developing the project with over US$52 million raised from investors and to appeal the DOE’s decision.

- This development spotlights the volatility in U.S. battery supply chain funding and American Battery Technology’s efforts to maintain project progress amid shifting federal support.

- We’ll explore how the grant termination and the company's response are shaping the American Battery Technology investment narrative and future project viability.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is American Battery Technology's Investment Narrative?

For those considering American Battery Technology, the big picture matters now more than ever. Investors need confidence in the company’s ability to deliver on the huge potential of domestic lithium supply, especially through the Tonopah Flats Lithium Project, which just published a strong pre-feasibility study with multibillion-dollar economic projections. However, the surprise termination of the US Department of Energy’s US$115 million grant is a clear shakeup, this event raises questions around access to capital and government support, which were seen as important short-term catalysts before the news. While ABTC’s rapid investor fundraising has helped keep development moving, and the company is appealing the DOE decision, this funding gap could introduce delays, higher financing costs, or even tighter liquidity at a time when operating losses remain significant and cash runway is short. The risk of further share price swings and even potential delisting warnings can no longer be ignored after the market’s sharp reaction.

But with federal support suddenly uncertain, timing risk for project milestones is a reality investors should not overlook.

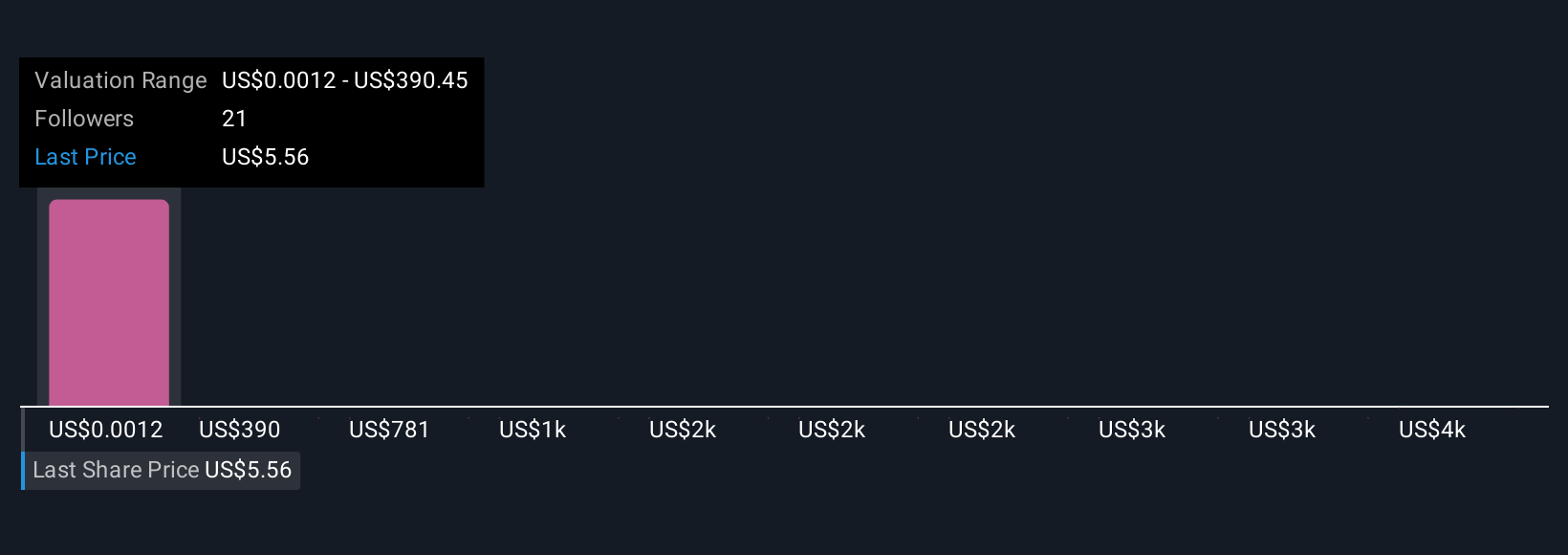

In light of our recent valuation report, it seems possible that American Battery Technology is trading beyond its estimated value.Exploring Other Perspectives

Explore 13 other fair value estimates on American Battery Technology - why the stock might be worth less than half the current price!

Build Your Own American Battery Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Battery Technology research is our analysis highlighting 6 important warning signs that could impact your investment decision.

- Our free American Battery Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Battery Technology's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABAT

American Battery Technology

Operates as a battery materials company in the United States.

Medium-low risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives