- United States

- /

- Insurance

- /

- NYSE:WTM

White Mountains Insurance Group (WTM): Assessing Valuation After Major Reinsurance Deal Expands Growth Potential

Reviewed by Kshitija Bhandaru

White Mountains Insurance Group (WTM) has made a strategic move as its subsidiary, Bamboo Ide8 Insurance Services, completed a substantial reinsurance and sidecar transaction with Accredited and Greenshoots Re Ltd. This expands underwriting capacity for both new and existing programs and positions the group for further growth.

See our latest analysis for White Mountains Insurance Group.

Against the backdrop of this expanded reinsurance capacity and new partnership momentum, White Mountains Insurance Group has seen steady share price performance recently. Its 3-year total shareholder return of 25% and 5-year return of 94% highlight substantial long-term value creation, even as short-term returns remain muted. These strategic initiatives may signal building confidence for the future.

If this kind of strategic evolution excites you, why not take the opportunity to discover fast growing stocks with high insider ownership

With major partnerships fueling future prospects but recent performance lagging, the question remains: is White Mountains Insurance Group now trading at a discount, or is the market already factoring in the company’s next wave of growth?

Price-to-Earnings of 20.9x: Is it Justified?

White Mountains Insurance Group is currently trading at a price-to-earnings (P/E) ratio of 20.9x, which is notably higher than both the US Insurance industry average of 13.7x and the peer average of 13.3x. Despite the company's steady long-term returns, this high multiple suggests that investors are paying a premium compared to alternatives in the sector.

The price-to-earnings ratio reflects how much investors are willing to pay per dollar of reported earnings. For insurance companies like White Mountains, it helps gauge expectations for profit growth and overall business quality. A higher P/E generally means the market anticipates better prospects ahead. However, it can also point to overvaluation if near-term growth is uncertain.

At 20.9x, White Mountains is priced significantly above industry and peer benchmarks. This premium may not be fully justified, as recent earnings growth has been negative and return on equity remains low. If market sentiment shifts or results don't improve, the gap to average valuations could narrow quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.9x (OVERVALUED)

However, continued negative returns this year and a lack of recent earnings growth could quickly dampen investor enthusiasm if not reversed soon.

Find out about the key risks to this White Mountains Insurance Group narrative.

Another View: Discounted Cash Flow Perspective

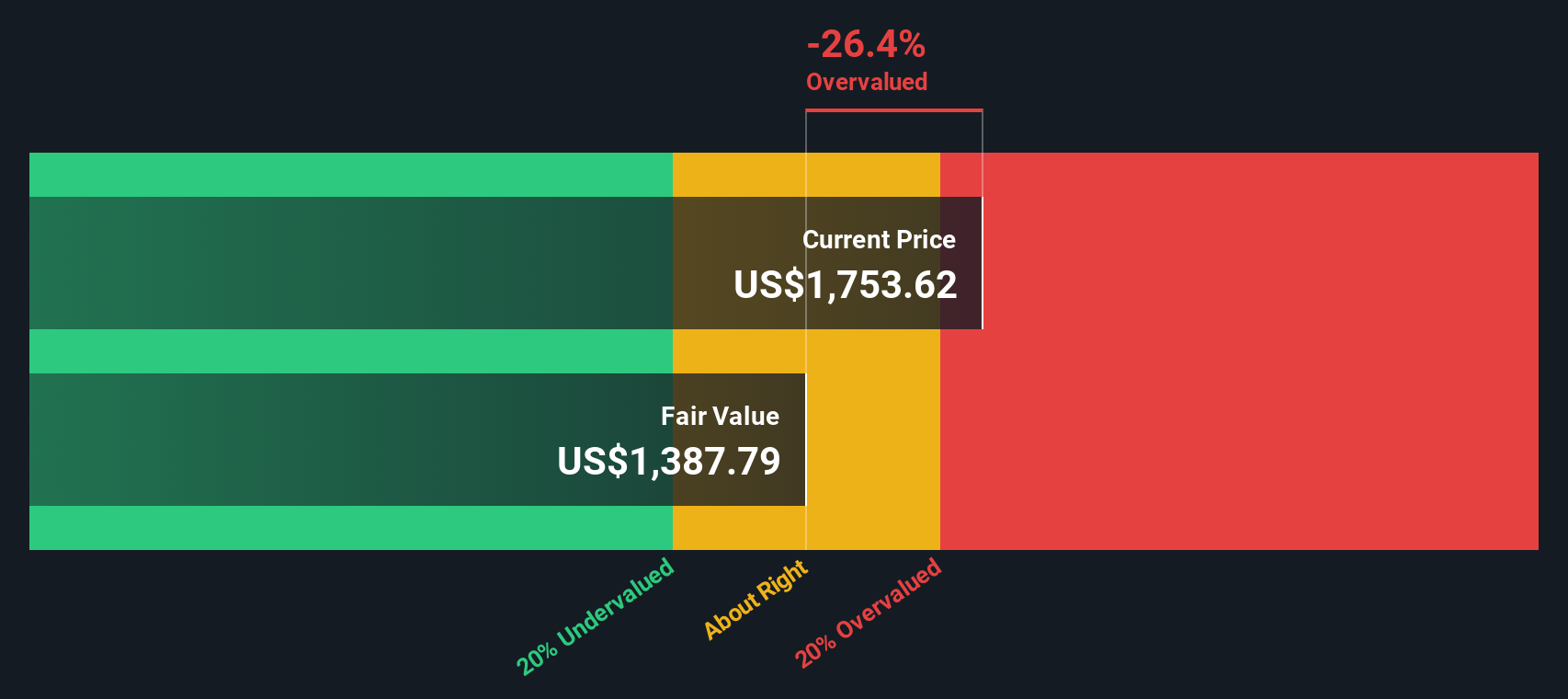

While the current price-to-earnings multiple makes White Mountains Insurance Group look expensive, our DCF model provides a different perspective. According to this method, the stock is trading above its estimated fair value of $1,387.79, suggesting it may be overvalued from a cash flow perspective. Does this change your confidence in its premium pricing, or is the market still betting on brighter days ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out White Mountains Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own White Mountains Insurance Group Narrative

If you want to dig deeper or have your own take on the numbers, you can quickly piece together and share your perspective. Do it your way with Do it your way.

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let market opportunities slip by while others build their portfolios. Use these smart shortcuts to pinpoint sectors and companies with the strongest potential today:

- Tap into future breakthroughs by checking out these 26 quantum computing stocks as they lead the race in next-generation computing and innovation beyond conventional tech stocks.

- Maximize steady earnings potential when you review these 19 dividend stocks with yields > 3% offering robust yields, helping you grow wealth with dependable payouts.

- Catch early-stage growth trends by starting with these 24 AI penny stocks at the forefront of artificial intelligence, before the crowd spots their full upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, provides insurance and other financial services in the United States.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives