- United States

- /

- Insurance

- /

- NYSE:WTM

A Look at White Mountains Insurance Group’s Valuation as Leadership Transition Plans Unveiled

Reviewed by Simply Wall St

White Mountains Insurance Group (NYSE:WTM) is stepping into the spotlight following its announcement of significant leadership changes set for early 2026. Manning Rountree will retire as CEO at the end of the year, passing the reins to current President and CFO Liam Caffrey. The shakeup does not stop there: Giles Harrison, most recently from Zurich Insurance Group, will take over as President, and Michael Papamichael will become CFO. For investors weighing their next move, this planned succession puts a fresh lens on the company's direction and priorities at a pivotal moment.

In the bigger picture, White Mountains Insurance Group has delivered steady performance, with its share price up 2% over the past year and rising nearly 28% over three years. While this momentum is more modest compared to some periods, leadership has pointed to ongoing premium growth and recent acquisitions as key drivers. Notably, the stock has slipped almost 9% year to date as markets digest the implications of these executive changes and operational updates.

With these leadership shifts approaching and the share price adjusting, investors may be considering whether this transition will create a meaningful opportunity for White Mountains Insurance Group or whether the market is simply factoring in expectations for future growth.

Price-to-Earnings of 22.1x: Is it justified?

White Mountains Insurance Group is currently valued at a price-to-earnings (P/E) ratio of 22.1 times, which is notably higher than both the US Insurance industry average of 14.6 times and the peer group average of 13.2 times. This suggests that the stock is trading at a considerable premium to its industry and direct competitors.

The P/E multiple measures what investors are willing to pay today for each dollar of a company's current earnings. In the insurance sector, P/E ratios are closely watched because they reflect the market’s confidence in future profitability and risk.

A higher P/E may imply that investors expect above-average future growth or profitability from White Mountains, or they are pricing in less risk compared to peers. However, with the company's recent negative earnings growth and weaker profit margins, this elevated multiple could be challenging to justify without a clear path to accelerated earnings.

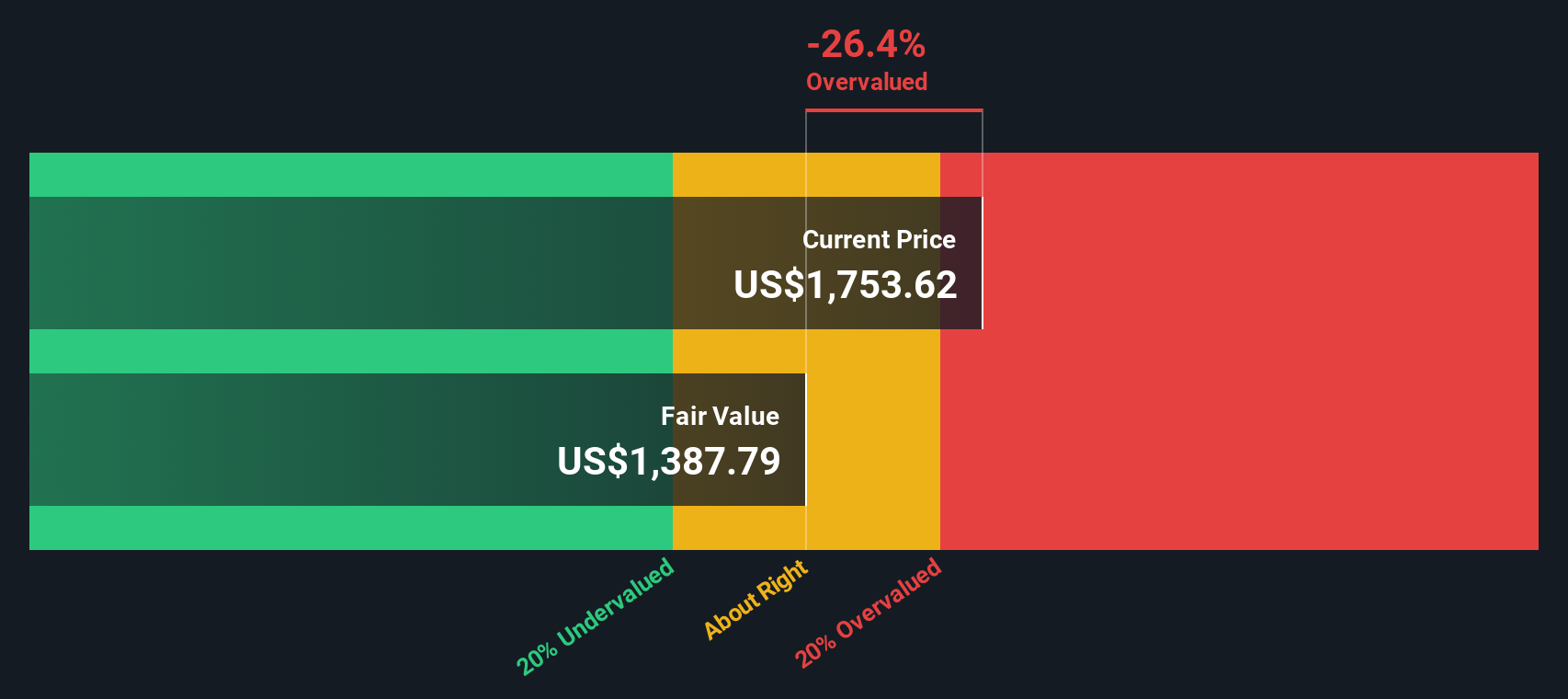

Result: Fair Value of $1387.79 (OVERVALUED)

See our latest analysis for White Mountains Insurance Group.However, any sustained weakness in earnings growth or prolonged underperformance relative to peers could quickly undermine confidence in White Mountains' current premium valuation.

Find out about the key risks to this White Mountains Insurance Group narrative.Another View: The SWS DCF Model Perspective

Taking a different angle, the SWS DCF model also points to White Mountains Insurance Group being overvalued, reinforcing what the market multiple suggests. However, can relying on both approaches tell the whole story? Or does it signal something deeper about future prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own White Mountains Insurance Group Narrative

If you see things differently or prefer to dig into the numbers on your own terms, starting your personalized analysis takes only a few minutes. Do it your way

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Sharpen your investing strategy right now and get ahead by uncovering a world of stocks tailored to your interests.

- Spot hidden value early by checking out undervalued stocks based on cash flows and consider stocks trading below their true worth.

- Tap into the future of healthcare by searching for breakthrough opportunities among healthcare AI stocks leading innovation in AI-driven medical technology.

- Accelerate your returns by focusing on dividend stocks with yields > 3% and find a portfolio of reliable companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, provides insurance and other financial services in the United States.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives