- United States

- /

- Insurance

- /

- NYSE:WRB

Will Slower Revenue Growth and Higher EPS Guidance Change W. R. Berkley's (WRB) Narrative?

Reviewed by Sasha Jovanovic

- Property casualty insurer W. R. Berkley reported its third-quarter earnings on Monday, with analysts expecting revenue to reach US$3.71 billion, reflecting 9% year-on-year growth, though slower than the previous year's pace.

- Despite the projected easing in revenue growth, analysts forecast an 18.3% increase in earnings per share, highlighting a continued focus on profitability amid broader market uncertainty related to potential trade and tax policy changes.

- We’ll assess how analysts’ expectations for EPS growth, despite slower revenue gains, could influence W. R. Berkley’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

W. R. Berkley Investment Narrative Recap

Owning shares in W. R. Berkley generally means believing in the company’s ability to grow earnings through disciplined underwriting and specialty insurance solutions, while navigating market challenges like shifting trade policy and industry competition. The latest earnings outlook, highlighting robust EPS growth despite moderating revenue gains, reinforces profitability as the near-term catalyst, while external policy shifts remain the principal risk; based on analyst commentary, the news event doesn’t materially alter this risk-reward balance.

Among recent announcements, the launch of Berkley Edge in August 2025 stands out, as it expands the firm’s reach into professional liability and casualty insurance for smaller and harder-to-place risks, linking directly to the demand for specialty products. This move supports a critical short-term catalyst: differentiated growth in specialty lines, which can help drive margin expansion even with sector-wide pricing or revenue headwinds.

On the other hand, investors should stay mindful of the growing competition and pricing discipline concerns, particularly as...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley's outlook anticipates $14.3 billion in revenue and $2.0 billion in earnings by 2028. This is based on a flat 0.0% annual revenue growth rate, and a $0.2 billion increase in earnings from the current $1.8 billion level.

Uncover how W. R. Berkley's forecasts yield a $73.53 fair value, in line with its current price.

Exploring Other Perspectives

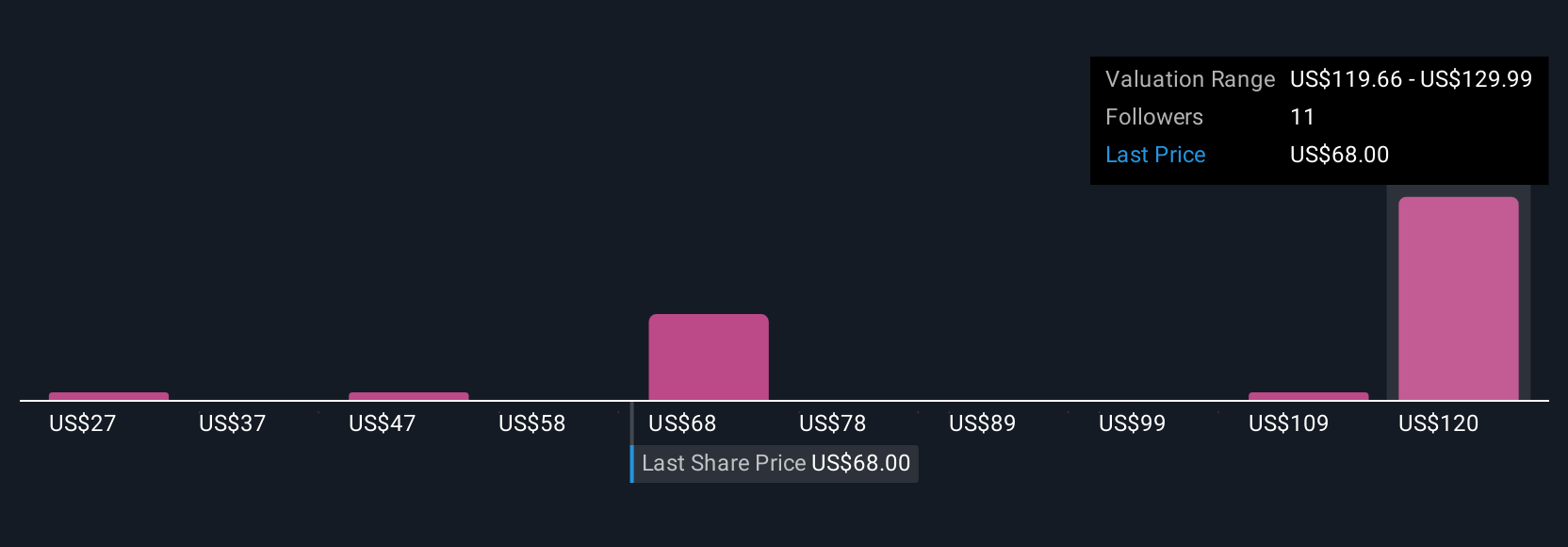

Simply Wall St Community members offered three fair value estimates for W. R. Berkley, ranging widely from US$26.69 to US$112.22 per share. With specialty insurance demand still underpinning the company’s outlook, you can see how opinions can diverge and why it’s worth exploring diverse analysis.

Explore 3 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 52% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives