- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (WRB) Margin Beat Reinforces Constructive Narrative Despite Slower Growth Forecasts

Reviewed by Simply Wall St

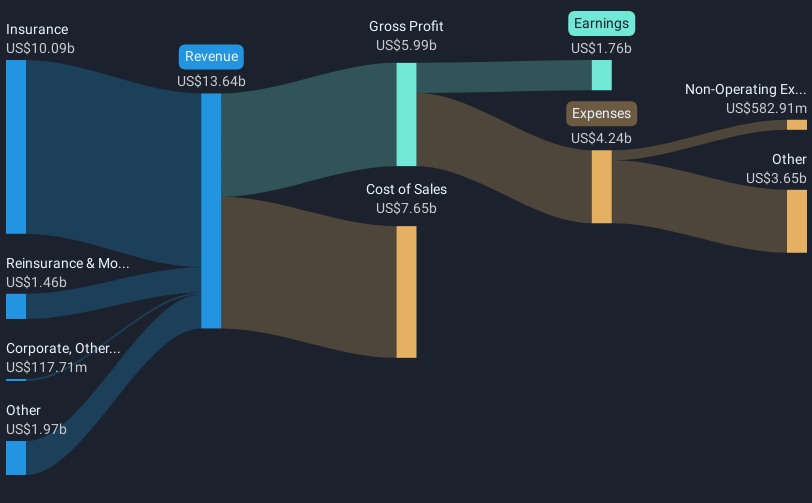

W. R. Berkley (WRB) posted net profit margins of 13% for the recent period, improving from 12% a year ago. Earnings surged 20.8% over the past year, outpacing the company’s five-year annual average growth of 19%. The combination of rising profits and stronger margins grabs attention. However, with revenue projected to grow just 1.6% per year and earnings at 1.5%, both trailing the broader US market, investors may question whether the current momentum is sustainable as the company trades at a Price-to-Earnings Ratio of 14.9x, higher than peers and industry averages.

See our full analysis for W. R. Berkley.Now we will see how these headline results compare to the dominant market narratives. Let’s see which themes the data supports and where the story gets challenged.

See what the community is saying about W. R. Berkley

Margins Reach 13.8% Target by 2028

- Analysts expect profit margins to climb from 12.3% currently to 13.8% over the next three years, signaling continued gains in underwriting and pricing discipline beyond recent improvements.

- According to the analysts' consensus view, strong specialty focus and disciplined risk selection are driving high-margin growth opportunities for W. R. Berkley.

- This specialty strategy, alongside favorable market pricing, is cited as supporting margin expansion and positioning the company to capture further bottom-line gains.

- Consensus highlights that a “hard market” in liability lines, such as commercial auto, should help sustain the company’s higher combined ratios and rate environment, further boosting profitability.

What does this margin trajectory reveal about W. R. Berkley's market edge and future prospects for investors? 📊 Read the full W. R. Berkley Consensus Narrative.

Premium Valuation Despite Modest Revenue Growth

- W. R. Berkley is trading at a price-to-earnings ratio of 15.6x on current numbers and would need to trade at 16.8x by 2028 to match consensus expectations, while the current US insurance industry average is 14.3x, highlighting a sizable premium.

- Consensus narrative acknowledges that even with this premium, prudent capital management and higher investment yields could justify the valuation if expected margin expansion materializes.

- However, the analyst price target of $74.80 is nearly identical to the current share price of $75.00, suggesting the stock is seen as fairly valued unless earnings or multiples improve further.

- Consensus stresses the need for ongoing profit and margin gains to support current share price levels. Future disappointments could quickly erode the premium.

Dividend Sustainability Faces Scrutiny

- The main risk identified is the limited sustainability of W. R. Berkley’s dividend, despite current profitability and margin improvements.

- Consensus narrative notes that continued margin and earnings gains would help support the dividend, but warns that rising competition, inflation, and catastrophe risks could put pressure on payout stability.

- Investors must monitor reserve adequacy and management’s response to industry headwinds to ensure dividend support remains intact.

- Consensus flags slow digital adoption and US market concentration as added vulnerabilities that could further test dividend reliability moving forward.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for W. R. Berkley on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to look at the results from a fresh angle? Share your perspective and shape your narrative in just a few minutes. Do it your way

A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Although W. R. Berkley boasts improving margins, it faces doubts about the sustainability of its dividend because of industry headwinds and market concentration.

If steady, reliable income matters to you, check out these 1993 dividend stocks with yields > 3% for companies delivering consistent yields and stronger dividend track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion