- United States

- /

- Insurance

- /

- NYSE:WRB

How Will Q3 Earnings and a New Proptech Bet Shape W. R. Berkley (WRB) Investors' Outlook?

Reviewed by Sasha Jovanovic

- W. R. Berkley Corporation recently announced it will report its fiscal Q3 2025 earnings after market close on Monday, October 20, 2025, with analysts anticipating a double-digit rise in earnings compared to the previous year.

- An interesting development is W. R. Berkley's investment in Notable, a pay-at-close home sale financing company, which could signal growing interest in expanding its presence in innovative property-related solutions.

- We'll explore how investor anticipation over strong underwriting and earnings performance may influence W. R. Berkley's forward-looking investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

W. R. Berkley Investment Narrative Recap

To be a shareholder in W. R. Berkley, you need to believe in the company's specialty insurance expertise, disciplined underwriting model, and its capacity to manage risk amid a market seeing both growth and competitive pressures. While the upcoming Q3 2025 earnings call and the investment in Notable highlight management's willingness to innovate and diversify, the main short-term catalyst remains strong underwriting results, with ongoing risks from heightened competition and shifting market pricing practices; recent developments do not materially alter this risk-reward balance.

The launch of Berkley Edge, a division focused on professional liability and casualty coverage for small and mid-sized businesses, stands out among the latest initiatives. This move could support future growth and capitalizes on heightened corporate demand for specialized insurance solutions, aligning closely with the upcoming earnings report as a source of optimism for those focused on W. R. Berkley's underwriting performance and potential for expanding net premiums.

However, investors also need to keep a close eye on how increased competition and less disciplined pricing in key markets are starting to...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley's outlook anticipates $14.3 billion in revenue and $2.0 billion in earnings by 2028. This scenario assumes flat revenue growth at 0.0% annually and a $0.2 billion increase in earnings over today's $1.8 billion.

Uncover how W. R. Berkley's forecasts yield a $72.73 fair value, a 5% downside to its current price.

Exploring Other Perspectives

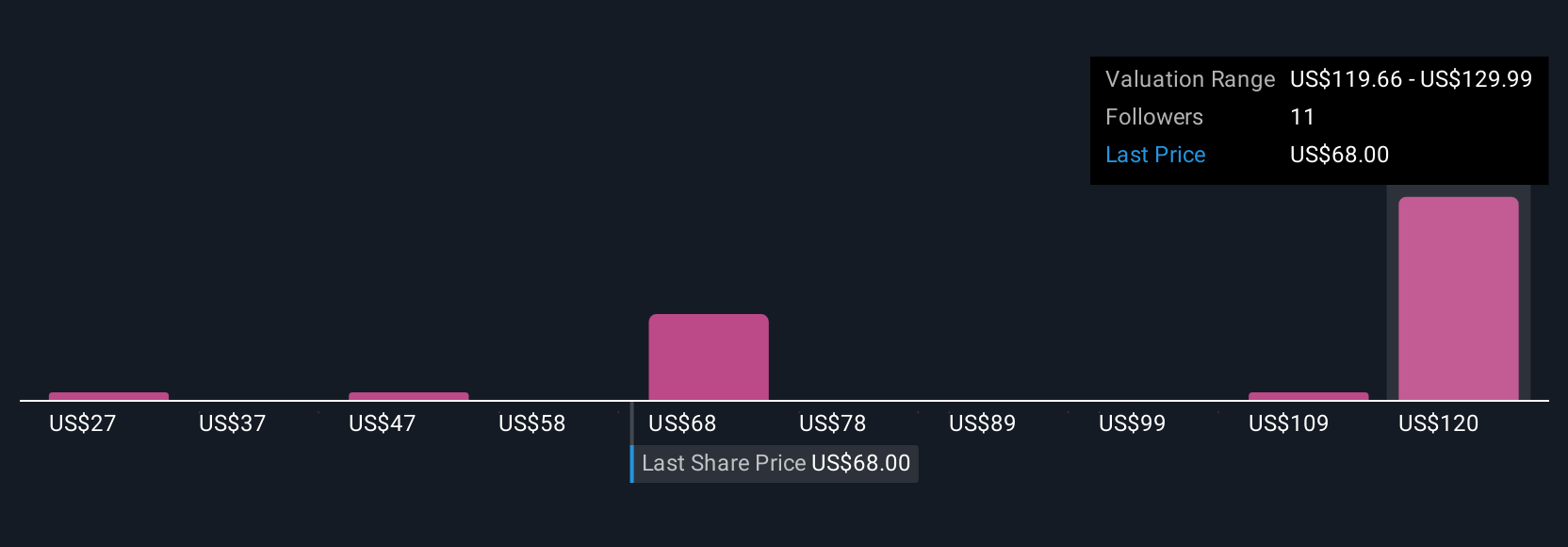

Six Simply Wall St Community members estimate fair value between US$26.69 and US$120.65, showcasing a wide divergence in expectations. Given W. R. Berkley’s exposure to growing competition and market shifts, make sure to explore several perspectives on its future direction.

Explore 6 other fair value estimates on W. R. Berkley - why the stock might be worth less than half the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives