- United States

- /

- Insurance

- /

- NYSE:UNM

Is There Still Upside for Unum Group After Its 18.9% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Unum Group might be an undervalued gem or if its recent rally means the opportunity has passed you by? You're not alone, as there's a lot to unpack behind the numbers.

- In the past year, the stock has climbed an impressive 18.9% and soared 388.3% over 5 years. However, it has dipped by 3.3% in the last month, showing just how quickly investor sentiment can shift.

- Momentum in the insurance sector, changes in interest rates, and shifting industry expectations have all played a role in recent share price swings for Unum Group. Headline news about rising demand for employee benefits and policy changes affecting insurers have been driving interest and prompting analysts to revisit their outlooks.

- Right now, Unum Group earns a strong 6 out of 6 on our value assessment checks. From a pure numbers standpoint, there's a lot to like. However, not all valuation methods are created equal and there is an even smarter way to assess value that will be explored by the end of this article.

Approach 1: Unum Group Excess Returns Analysis

The Excess Returns valuation model assesses a company by looking at how much profit it generates above the required return for its investors. Simply put, it measures how well Unum Group turns its invested capital into shareholder value after accounting for the cost of equity.

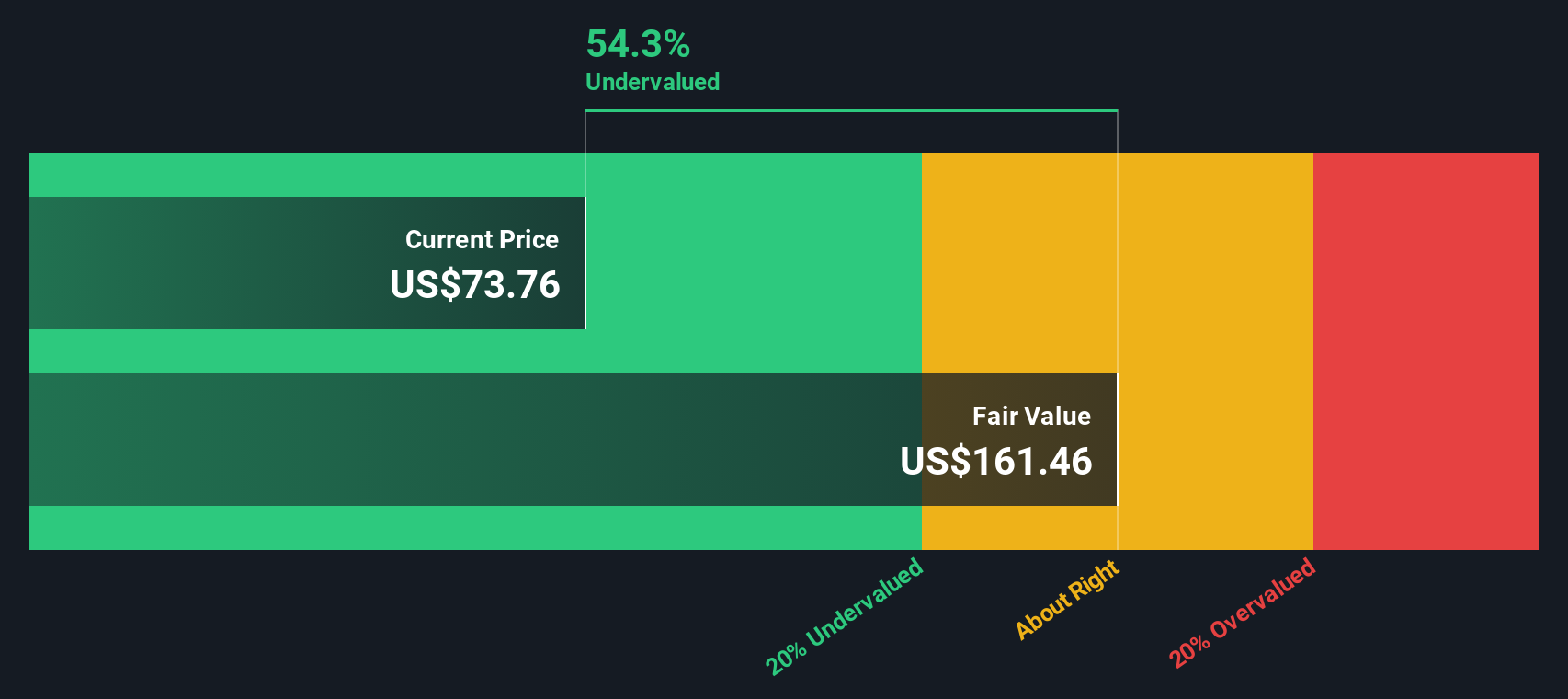

For Unum Group, the numbers tell a compelling story. The company’s book value sits at $65.76 per share, and analysts project a stable earnings per share (EPS) of $8.53, based on a weighted average of future Return on Equity estimates from four analysts. The cost of equity, which is what investors expect to earn in exchange for their capital, is $5.10 per share. This means Unum Group delivers an excess return of $3.43 per share, a sign of strong value creation for shareholders. The average Return on Equity has been a healthy 11.47%, while projections see the stable book value growing to $74.38 per share, according to data compiled from six analyst estimates.

Putting this all together, the Excess Returns analysis yields an estimated intrinsic value that is 54.6% higher than the current market price. This indicates a significant undervaluation by the market, suggesting that Unum Group may be a strong opportunity for value-focused investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Unum Group is undervalued by 54.6%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Unum Group Price vs Earnings

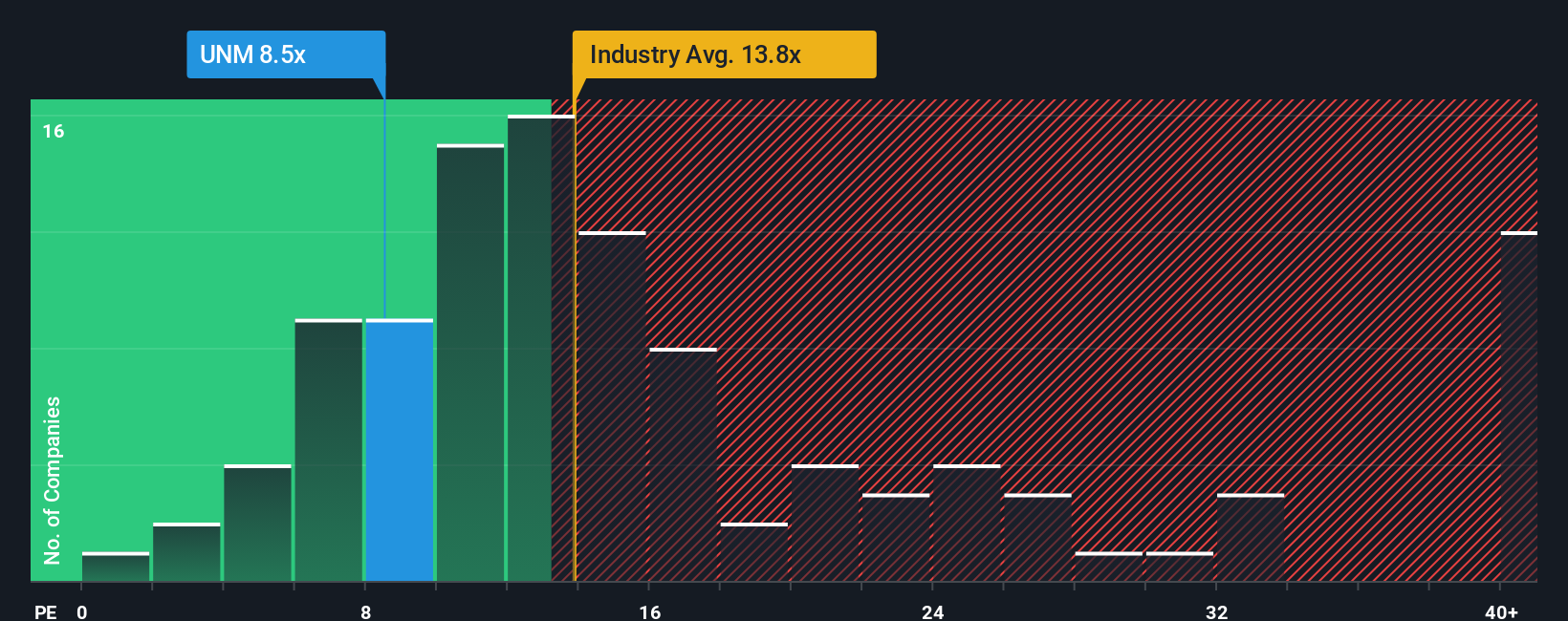

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies, as it provides a quick measure of how much investors are willing to pay today for a dollar of current earnings. A lower PE can signal an undervalued stock, while a higher one can reflect strong growth expectations or a premium for perceived stability.

It is important to remember that “fair” PE ratios are influenced by factors like a company’s growth prospects, risk profile, and the broader industry climate. Fast-growing or low-risk companies often command higher multiples, whereas stagnating or riskier businesses typically trade at a discount.

Currently, Unum Group trades at a PE ratio of 8.39x. To put this in context, the peer group averages about 9.99x, while the broader Insurance industry sits even higher at 13.19x. However, Simply Wall St’s ‘Fair Ratio’ for Unum Group is 12.24x. Unlike standard industry or peer benchmarks, this Fair Ratio is calculated uniquely for the company, incorporating its specific earnings growth, profit margin, market cap, risk factors, and its place within the industry. This approach provides a more tailored and meaningful comparison rather than just looking at the averages.

With its current PE ratio of 8.39x well below the Fair Ratio of 12.24x, Unum Group appears distinctly undervalued by this metric. This suggests there may be room for appreciation if the market comes to recognize its underlying strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unum Group Narrative

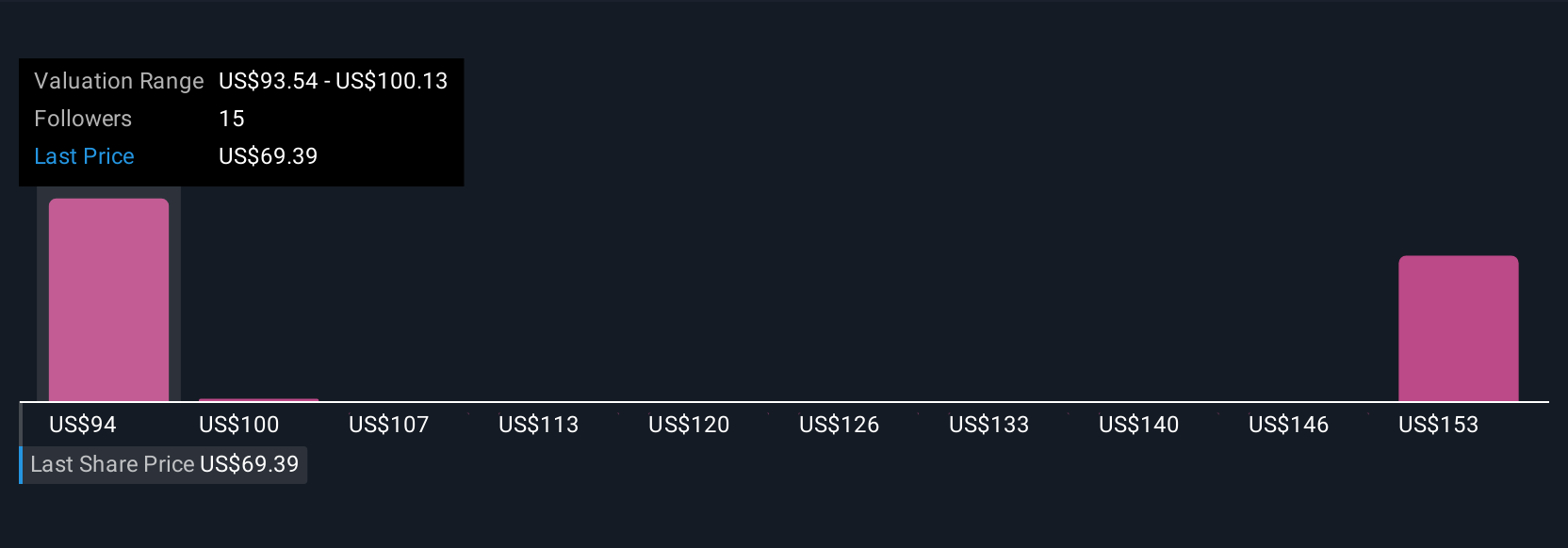

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple yet powerful approach where you build your own story about a company, making key assumptions about its future revenues, earnings, margins, and what you believe is a fair value, then see how those assumptions stack up against the current share price.

Instead of relying solely on ratios or analyst targets, Narratives help investors connect a company’s unique business story to a financial forecast and, ultimately, a fair value estimate. This means you are not just reviewing numbers in isolation, but understanding the real drivers behind them and expressing your own perspective.

Narratives are available to use within the Community page on Simply Wall St. Millions of investors are already creating and updating them with just a few clicks. They allow you to compare your view of fair value to the latest market price, helping decide if it might be the right time to buy, hold, or sell, and they refresh automatically as new news or earnings come in.

For example, some Unum Group investors believe recent digital investments and strong capital returns justify a fair value as high as $108.00, while others focus on earnings risks and set their fair value closer to $79.00.

Do you think there's more to the story for Unum Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNM

Unum Group

Provides financial protection benefit solutions in the United States, the United Kingdom, and Poland.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives