- United States

- /

- Insurance

- /

- NYSE:TRV

The Bull Case For Travelers (TRV) Could Change Following Another Strong Earnings Surprise Pattern – Learn Why

Reviewed by Sasha Jovanovic

- In recent quarters, Travelers Companies has consistently delivered earnings results that far surpassed analyst expectations, including a very large earnings surprise in the past quarter and another substantial beat the quarter before. This pattern highlights a trend of outperformance that has contributed to heightened investor confidence ahead of its next earnings report, originally anticipated on October 16, 2025.

- Travelers’ repeated ability to outperform earnings forecasts signals effective risk management and operational efficiency, which can set it apart within the competitive insurance sector.

- We'll look at how Travelers’ strong record of significant earnings surprises could influence its investment narrative and future growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Travelers Companies Investment Narrative Recap

To be a shareholder in Travelers Companies, you need to believe that disciplined underwriting, consistent earnings delivery, and focus on risk management will continue to drive value despite competitive and climate-related headwinds. The recent earnings surprises reinforce confidence for the upcoming results, but the potential impact on short-term catalysts, such as robust profitability and expense controls, remains modest, while catastrophe losses and competitive shifts in auto insurance continue to be the most immediate risks to monitor.

Among recent announcements, the launch of the "Risk. Regulation. Resilience. Responsibility." initiative stands out. This effort addresses pressure points around insurance affordability and availability, tying directly into investor concerns about rising claims and operating costs from more frequent weather events, a central risk and a current catalyst, given recent strong earnings results.

Yet, in contrast to recent earnings momentum and rising investor optimism, there are industry-specific risks investors should not overlook, particularly concerning…

Read the full narrative on Travelers Companies (it's free!)

Travelers Companies' narrative projects $49.1 billion revenue and $5.0 billion earnings by 2028. This requires a 0.9% annual revenue decline and a $0.2 billion decrease in earnings from $5.2 billion today.

Uncover how Travelers Companies' forecasts yield a $291.20 fair value, in line with its current price.

Exploring Other Perspectives

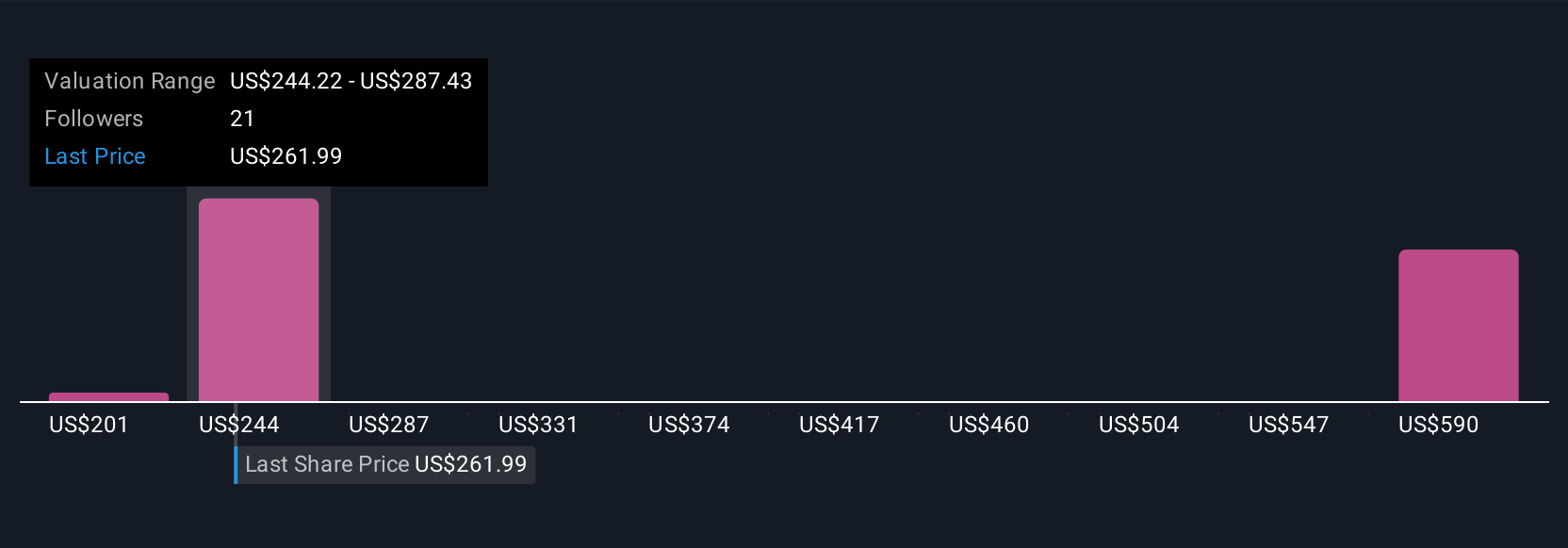

Four retail investors in the Simply Wall St Community provided fair value estimates for Travelers, ranging sharply from US$228.84 to US$596.72. As you consider these diverging perspectives, remember that the risk of higher catastrophe losses could materially influence future profitability and shareholder returns, your view should reflect these multiple dimensions.

Explore 4 other fair value estimates on Travelers Companies - why the stock might be worth 20% less than the current price!

Build Your Own Travelers Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travelers Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travelers Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travelers Companies' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives