- United States

- /

- Insurance

- /

- NYSE:STC

Stewart Information Services (STC): Evaluating Valuation Against Recent Steady Performance and Growth

Reviewed by Kshitija Bhandaru

Stewart Information Services (STC) has seen its shares trade mostly sideways recently, with the stock essentially flat over the past week and showing a modest 8% lift over the past 3 months. Investors are likely paying attention to the company's fundamentals, including robust annual growth in both revenue and net income.

See our latest analysis for Stewart Information Services.

While Stewart Information Services has not made headlines with dramatic moves, its 1-year total shareholder return of 4.4% signals steady, if unspectacular, long-term progress as the market gauges its improved fundamentals. Momentum appears neutral for now, but the company’s sustained growth rates could reignite investor interest if conditions shift.

If you’re looking to expand your watchlist beyond the usual suspects, now might be the perfect opportunity to discover fast growing stocks with high insider ownership

With shares hovering near analyst targets despite solid growth, the question remains: is Stewart Information Services still trading below its true value, or has the market already priced in future upside for patient investors?

Most Popular Narrative: 4.6% Undervalued

The narrative consensus points to Stewart Information Services having a fair value about 4.6% above the last close price, hinting at a potential modest upside. Curiosity builds as these estimates hinge on the company exceeding current growth rates in the years ahead.

The company is experiencing significant growth in its Title segment, specifically in commercial services and asset classes like retail and energy, which could positively impact revenue and pretax income.

Is this valuation driven by predictions of rapid earnings gains, margin expansion, or something else entirely? Analysts are betting on a powerful combination of business drivers. What bold financial leaps are baked into this fair value? The answer might just surprise you.

Result: Fair Value of $75.9 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in the housing market or rising operational costs could quickly challenge these optimistic forecasts and reshape the outlook for Stewart Information Services.

Find out about the key risks to this Stewart Information Services narrative.

Another View: Market Multiples Tell a Different Story

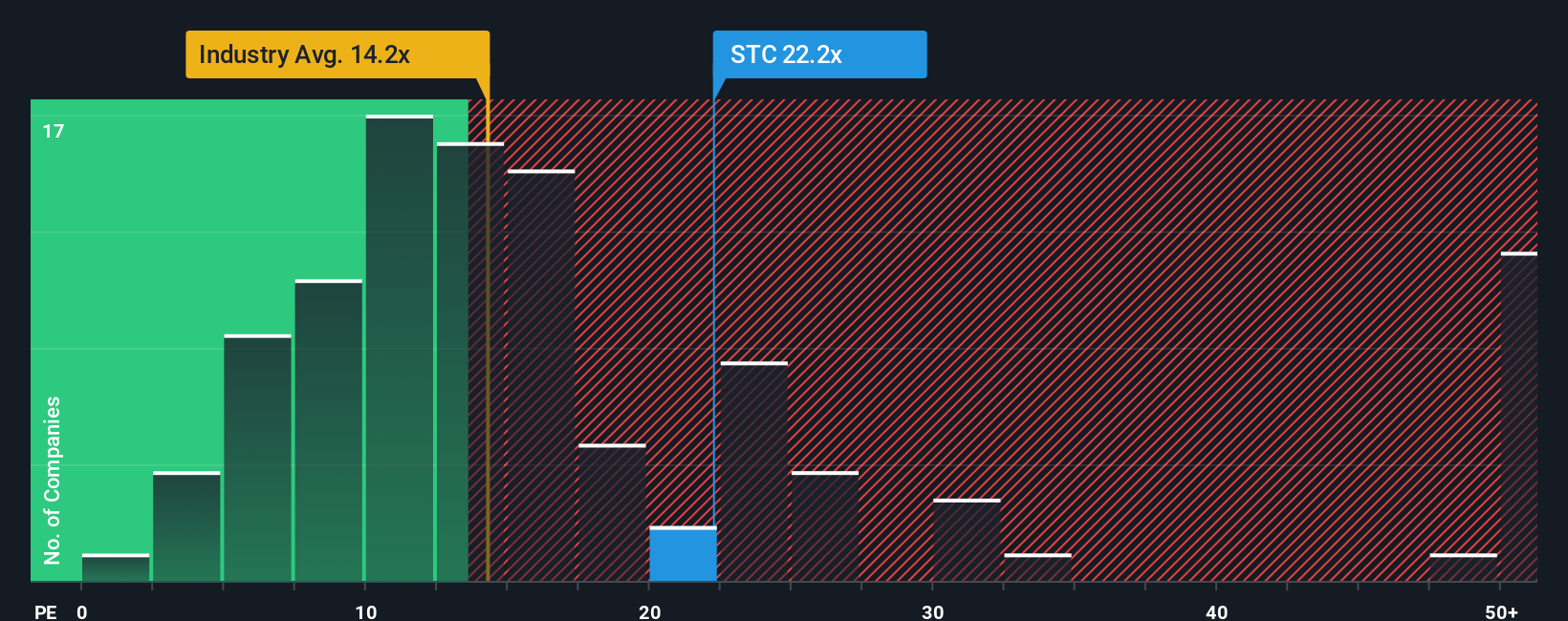

Switching perspectives, when we look at Stewart Information Services through the lens of price-to-earnings, the numbers send mixed signals. While the company appears good value compared to its peer average (23.1x vs. 48.3x), it is actually expensive relative to the broader industry (23.1x vs. 14x) and also trades above its fair ratio of 19.9x. This gap could indicate valuation risk if industry multiples contract. Will the market value continue to defy these averages, or is a correction coming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stewart Information Services Narrative

If you see the story unfolding differently or prefer to form your own view, you can dive into the data and craft a personalized perspective in just a few minutes, then Do it your way

A great starting point for your Stewart Information Services research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Take the lead and find your next potential winner with Simply Wall Street’s handpicked stock lists designed for real results.

- Target solid returns and reliable income with these 19 dividend stocks with yields > 3%, offering yields above 3% from financially healthy businesses.

- Capitalize on unstoppable industry trends by reviewing these 24 AI penny stocks, making waves in artificial intelligence and automation.

- Catch tomorrow’s standouts early by evaluating these 901 undervalued stocks based on cash flows that the market might be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives