- United States

- /

- Insurance

- /

- NYSE:STC

Stewart Information Services (STC): Assessing Valuation After $129 Million Equity Raise and New Shelf Registration

Reviewed by Simply Wall St

Stewart Information Services (STC) just raised about $129 million through a follow on equity offering and paired it with a fresh omnibus shelf registration, a classic move to boost financial flexibility while nudging dilution worries.

See our latest analysis for Stewart Information Services.

The follow on offering and new shelf come after a solid run, with the share price up year to date and a three year total shareholder return of 87.03 percent, suggesting underlying momentum is still intact despite the latest dip.

If you are weighing how this kind of capital raise fits into a broader strategy, it can help to compare STC with other financials and discover fast growing stocks with high insider ownership.

With the stock still up this year, trading below the average analyst target but boasting strong multi year returns, is Stewart Information Services quietly undervalued at this level, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 10.5% Undervalued

With Stewart Information Services last closing at $71.63 versus a narrative fair value near $80, the story leans toward upside built on improving fundamentals.

Analysts expect earnings to reach $214.5 million (and earnings per share of $9.58) by about April 2028, up from $73.3 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, down from 24.8x today.

Want to see the math behind that jump in earnings and margins, and the lower future multiple baked in, without guessing the exact numbers? Read on.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a prolonged housing slump and persistently higher operating costs could cap transaction volumes and margins, which may undermine the upbeat earnings and valuation case.

Find out about the key risks to this Stewart Information Services narrative.

Another View: Multiples Flash a Caution Signal

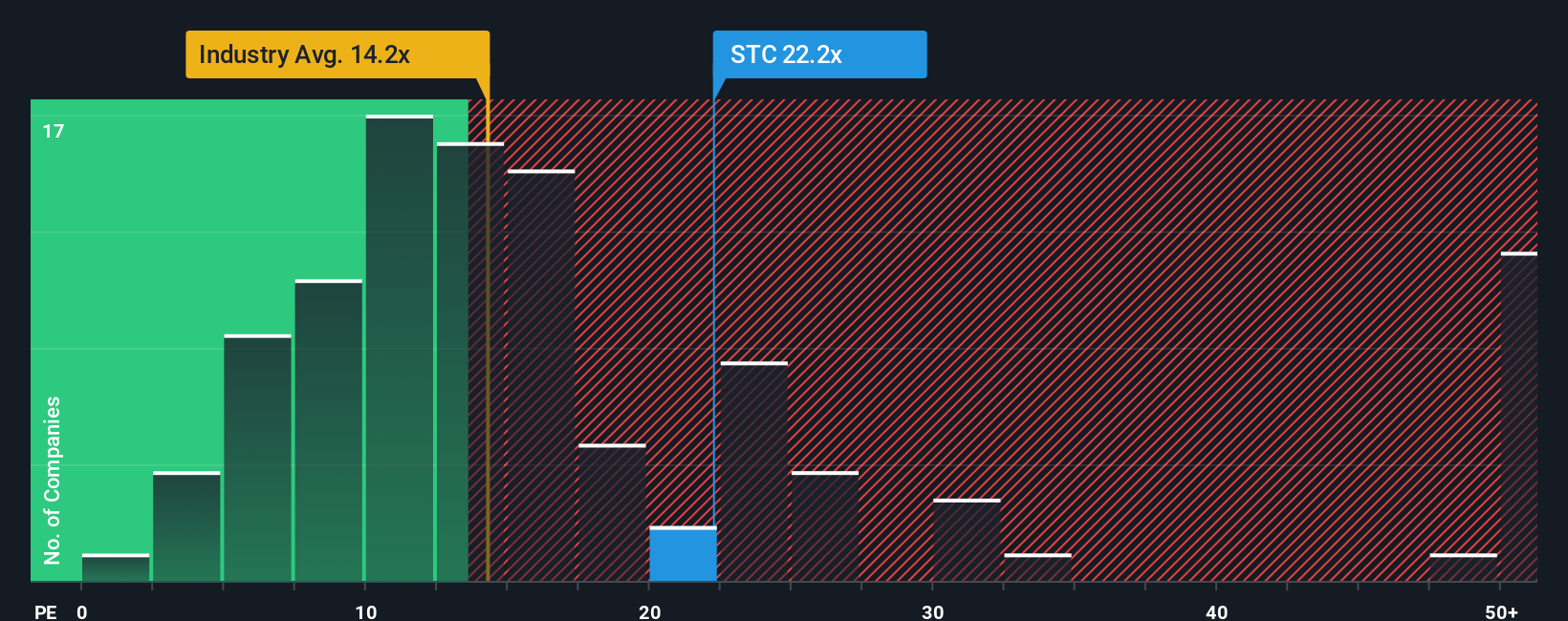

While the narrative fair value points to upside, the current 21.2x earnings multiple is well above both peers at 16.9x and the industry at 13.4x, and even tops a fair ratio of 17.6x. That premium suggests less margin for error if growth stumbles, so which lens do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stewart Information Services Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stewart Information Services.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover fresh, data driven stock ideas tailored to your strategy.

- Capitalize on potential mispricing by targeting quality companies trading below intrinsic value through these 907 undervalued stocks based on cash flows, and position yourself ahead of a possible re rating.

- Harness the growth of intelligent automation by focusing on innovators in medical diagnostics, decision support, and treatment planning with these 29 healthcare AI stocks.

- Strengthen your income stream by zeroing in on dependable payers using these 10 dividend stocks with yields > 3%, and avoid leaving reliable yield on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion