- United States

- /

- Insurance

- /

- NYSE:STC

How Does Stewart Information Services Stack Up After Recent Real Estate Industry Volatility?

Reviewed by Bailey Pemberton

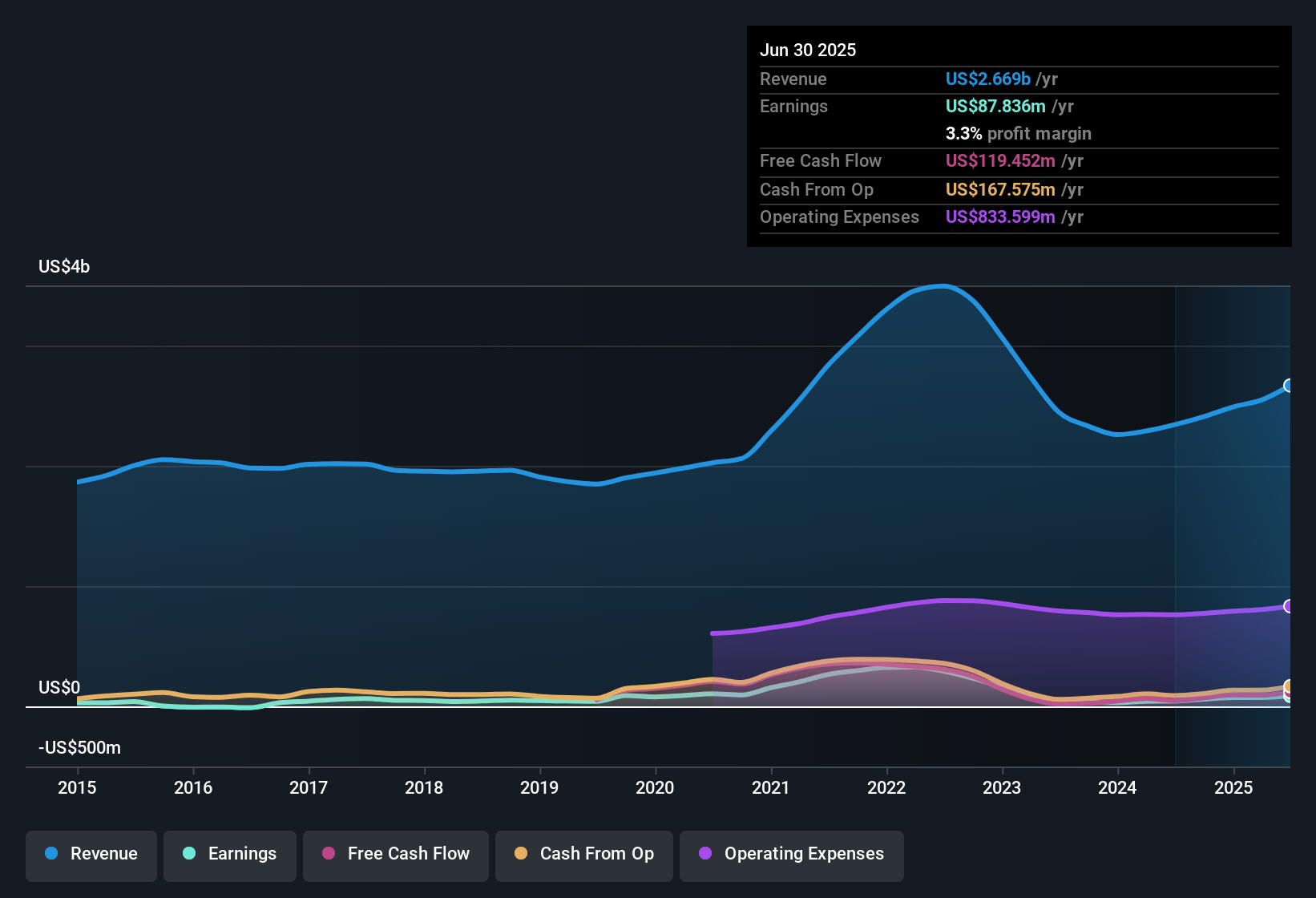

If you have Stewart Information Services stock on your watchlist and you’re on the fence about what to do next, you’re not alone. The stock has seen some ups and downs in the short term, slipping about 1.6% over the past week and down 1.5% for the month. However, zooming out reveals a different picture. Investors have seen a 10% gain year to date and a 7.8% climb over the past year. Looking at an even longer timeframe, the returns stand out further, with an 85% jump over three years and a total gain of 82.6% over five years.

What is driving these trends? Much of the momentum can be traced to evolving market conditions. As interest rates shift and the real estate market adapts, Stewart Information Services is navigating a unique landscape. Investors appear to be recalibrating their sense of risk and opportunity, which has created movement in the share price. Whether you are intrigued by those longer-term gains or wary of recent dips, the real question centers on value: is Stewart Information Services actually undervalued, or has the market already priced in its potential?

To answer that, let’s look at the hard numbers. Based on six core valuation checks, the company scores a 1, which means it is considered undervalued in just one out of six metrics. Before making a decision, it is helpful to break down what those checks actually measure, how they apply to Stewart Information Services, and explore a more thorough approach for assessing a stock’s true worth.

Stewart Information Services scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Stewart Information Services Excess Returns Analysis

The Excess Returns valuation model focuses on how much value a company generates over and above its cost of equity. In other words, it analyzes whether Stewart Information Services is creating real wealth for shareholders by delivering returns greater than what it costs to fund its equity capital. This method reviews both profitability and the efficiency of invested capital over time.

For Stewart Information Services, the most recent figures show a Book Value of $51.46 per share and a stable earnings per share (EPS) of $3.18, calculated using the median return on equity from the last five years. Meanwhile, the Cost of Equity stands at $3.38 per share, with an average return on equity of 6.38%. These inputs result in an excess return of -$0.20 per share, indicating the company is not currently generating returns above its equity cost. The stable Book Value, drawn from the median over five years, is $49.82 per share.

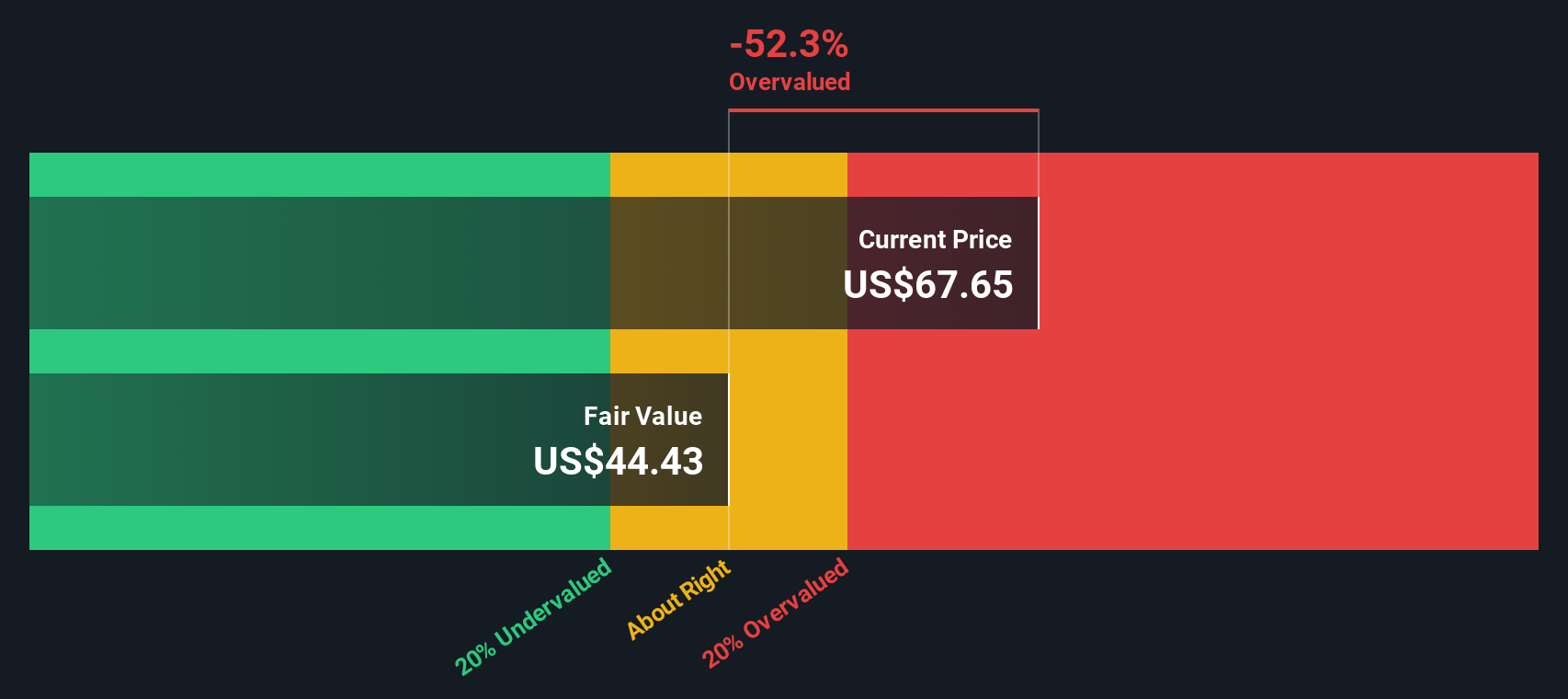

This model estimates the intrinsic value of Stewart Information Services at $44.43 per share. Given the implied intrinsic discount of -63.1%, the analysis suggests the stock is currently 63.1% overvalued based on its excess returns.

Result: OVERVALUED

Our Excess Returns analysis suggests Stewart Information Services may be overvalued by 63.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Stewart Information Services Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like Stewart Information Services. It is straightforward and allows for easy comparisons, since it tells you how much investors are willing to pay per dollar of current earnings. For businesses that have consistent profits, the PE ratio helps shed light on how the market values those earnings streams.

It is important to remember that a "normal" PE ratio is shaped by factors such as growth potential and risk. Stronger expected growth or lower risk usually leads to a higher fair PE, while slower growth or higher uncertainty typically warrants a lower one.

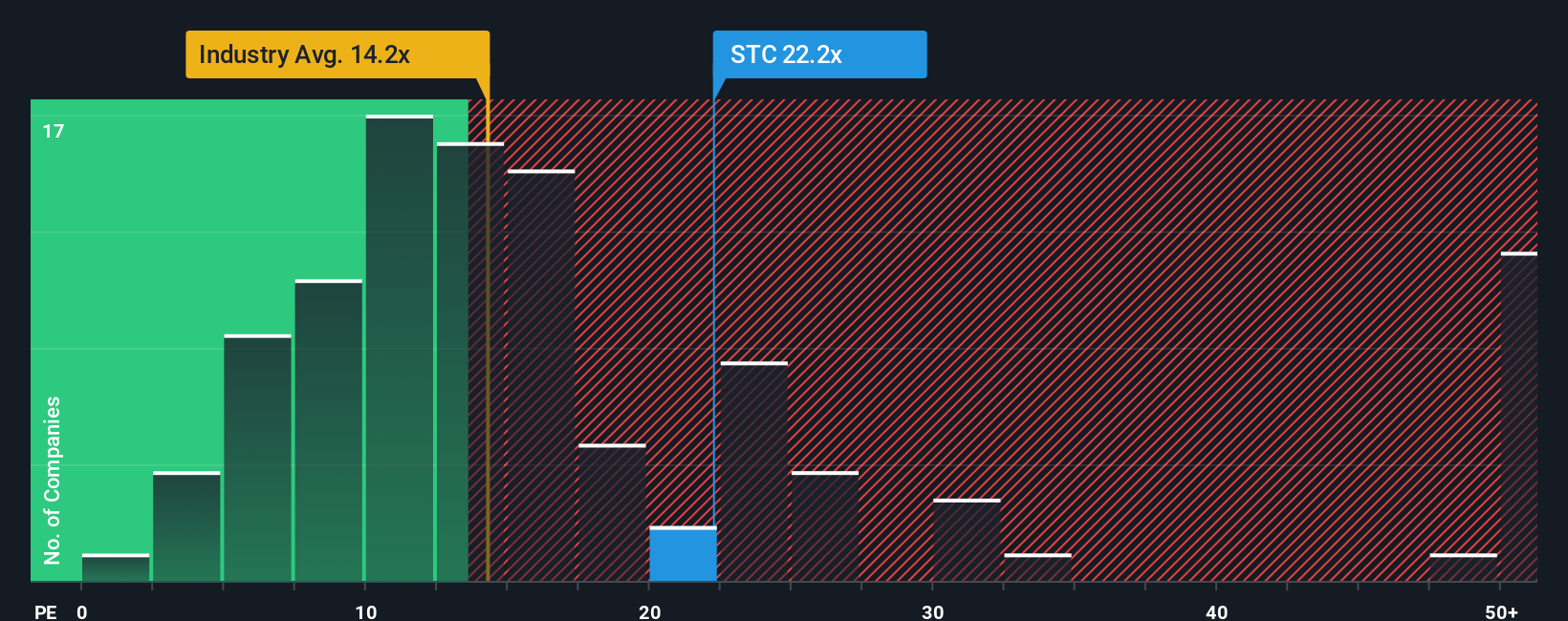

Currently, Stewart Information Services trades at a PE of 23.1x. That is notably higher than the Insurance industry average at 14.2x, and it also sits below the peer group average of 48.3x. The “Fair Ratio” is a proprietary metric from Simply Wall St that estimates what PE the stock deserves after factoring in the company’s earnings growth, risks, profit margins, industry, and market cap. For Stewart Information Services, this Fair Ratio is 19.9x.

The Fair Ratio offers a more tailored lens than a simple peer or industry comparison, as it adjusts for nuances that averages and sector medians can miss. When you compare Stewart’s actual PE with its Fair Ratio, the difference suggests the stock may be trading at a slight premium to its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Stewart Information Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Rather than relying solely on financial ratios or historical data, a Narrative lets you share your unique perspective on Stewart Information Services by outlining your forecasts for future revenue, earnings, and margins. This approach puts numbers in context with a clear story.

With Narratives, you connect the company’s business story to a set of assumptions and a financial forecast, which in turn generates a fair value that reflects your view. This makes valuation more personal, dynamic, and transparent, as you see not just what the numbers are, but why they make sense for you.

Simply Wall St’s platform, used by millions of investors, features Narratives on its Community page, so you can easily build, update, and compare custom stories for Stewart Information Services and thousands of other companies. By comparing your Narrative’s fair value to the actual share price, you gain a clear framework for deciding whether to buy, hold, or sell. Narratives also stay current as new earnings or news are released.

For example, some investors expect opportunity from improved housing services and see a fair value over $75 per share, while others caution that ongoing uncertainty could mean the true value is well below the current price.

Do you think there's more to the story for Stewart Information Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)