- United States

- /

- Insurance

- /

- NYSE:RNR

AM Best’s Upgraded Outlook Could Be a Game Changer for RenaissanceRe Holdings (RNR)

Reviewed by Sasha Jovanovic

- In recent days, AM Best revised the outlooks for RenaissanceRe Holdings and its subsidiaries to positive, citing improved operating performance, reduced volatility, and strong market leadership in key reinsurance lines.

- This outlook revision also highlighted the company's robust balance sheet, well-developed enterprise risk management, and capacity to raise capital across market cycles.

- We'll explore how this positive shift in AM Best's outlook, crediting strong risk management, could influence RenaissanceRe's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

RenaissanceRe Holdings Investment Narrative Recap

To be a shareholder in RenaissanceRe Holdings, you need conviction in the company’s disciplined risk management and its ability to grow profitably in catastrophe reinsurance, despite ongoing exposure to high-severity weather events and pricing cycles. AM Best’s recent upgrade to a positive outlook is an encouraging sign, but it does not materially change the most immediate catalyst: the management of catastrophe risk in a potentially volatile season. The company’s biggest near-term risk remains the financial impact of multiple severe cat losses if they occur within a short timeframe.

Among recent announcements, RenaissanceRe’s reported Q2 2025 net income of US$835.35 million stands out as especially pertinent, reinforcing AM Best’s confidence in their operating performance and balance sheet strength. Strong recent earnings, alongside share buybacks and steady dividends, support the narrative of robust capital strength. Still, future results will hinge on the effectiveness of underwriting discipline in a market prone to frequent, severe catastrophes.

Yet, investors should be aware that even with enhanced risk management and a strong capital position, the concentration of property catastrophe exposure means...

Read the full narrative on RenaissanceRe Holdings (it's free!)

RenaissanceRe Holdings is expected to generate $10.4 billion in revenue and $1.5 billion in earnings by 2028. This reflects a -7.2% annual revenue decline and a $0.4 billion decrease in earnings from the current $1.9 billion level.

Uncover how RenaissanceRe Holdings' forecasts yield a $280.62 fair value, a 8% upside to its current price.

Exploring Other Perspectives

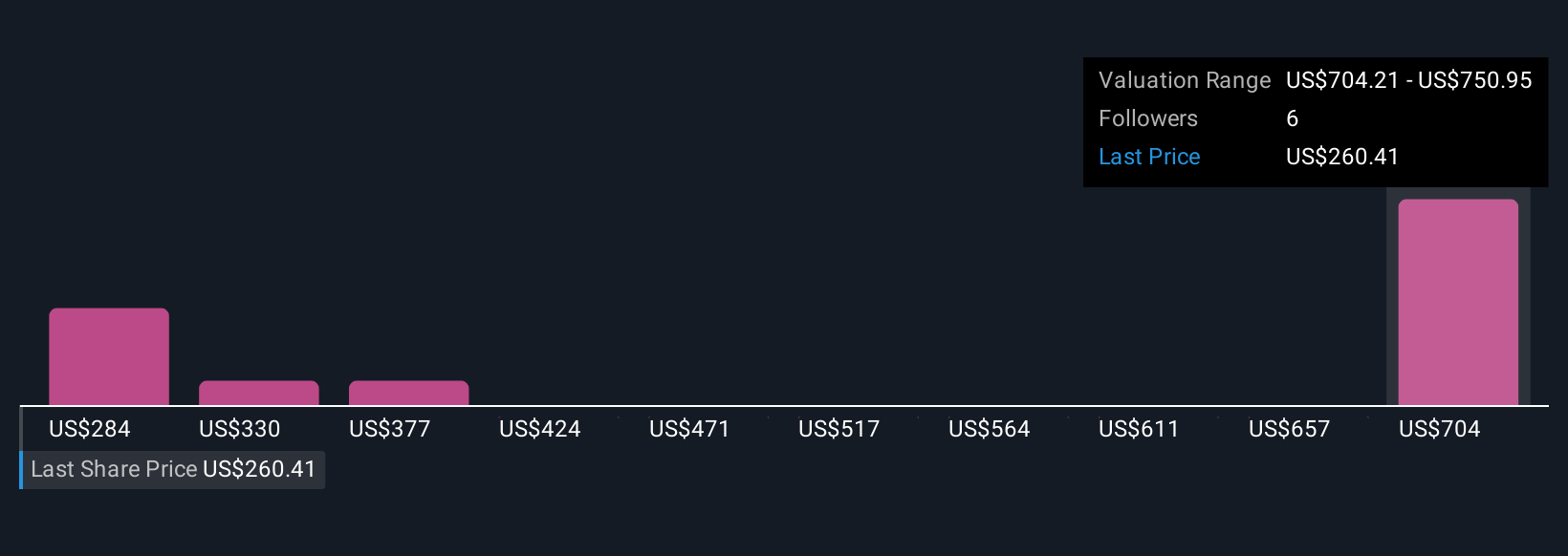

Simply Wall St Community members shared four fair value estimates for RenaissanceRe, spanning a wide US$280.62 to US$736.55 range. These differing views stand against the ongoing catalyst of heightened reinsurance demand and underscore why investors may weigh market conditions so differently, consider exploring several views to form your own perspective.

Explore 4 other fair value estimates on RenaissanceRe Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own RenaissanceRe Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RenaissanceRe Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RenaissanceRe Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RenaissanceRe Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNR

RenaissanceRe Holdings

Provides reinsurance and insurance products in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives