- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (PRU): Evaluating Valuation as Joseph Wolk Joins Board to Strengthen Strategic Direction

Reviewed by Kshitija Bhandaru

Prudential Financial (PRU) is drawing attention from investors after announcing Joseph Wolk will join its board as an independent director, effective September 30, 2025. He brings decades of executive experience to the role.

See our latest analysis for Prudential Financial.

Joseph Wolk’s high-profile appointment follows a proactive period for Prudential Financial, including expanded retirement solutions partnerships and a fresh round of debt financing. While the latest share price sits at $104.02, momentum has remained subdued, with a 1-year total shareholder return just under flat along with single-digit results over three and five years. Still, strategic board moves and steady dividend growth suggest management is aiming to reignite confidence in the company’s long-term direction.

If you’re interested in finding more companies with strong leadership and growth ambitions, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and the company posting consistent dividend growth, the question emerges: is Prudential Financial undervalued, or is the market already pricing in expectations for future growth?

Most Popular Narrative: 10.1% Undervalued

Prudential Financial’s current share price is trailing behind the narrative fair value, which is based on future earnings growth and margin expansion. The narrative draws on demographic shifts and digital initiatives as key value drivers for the company.

Demographic changes, particularly an aging population and rising global life expectancy, are creating increased long-term demand for retirement income and insurance solutions. This positions Prudential to grow revenue as the addressable market expands, especially through U.S. and international business lines.

Ever wondered why this valuation expects a major shift in Prudential’s growth profile? One of the key assumptions powering this fair value involves confidence in rising margins and expanding global reach. Ready to see how these numbers stack up to past performance? Uncover what’s driving the narrative’s bullish outlook by reading the full analysis.

Result: Fair Value of $115.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legacy annuity runoff and ongoing regulatory changes could challenge Prudential’s margin gains and could weigh on growth momentum in key international markets.

Find out about the key risks to this Prudential Financial narrative.

Another View: Market Multiples Question the Discount

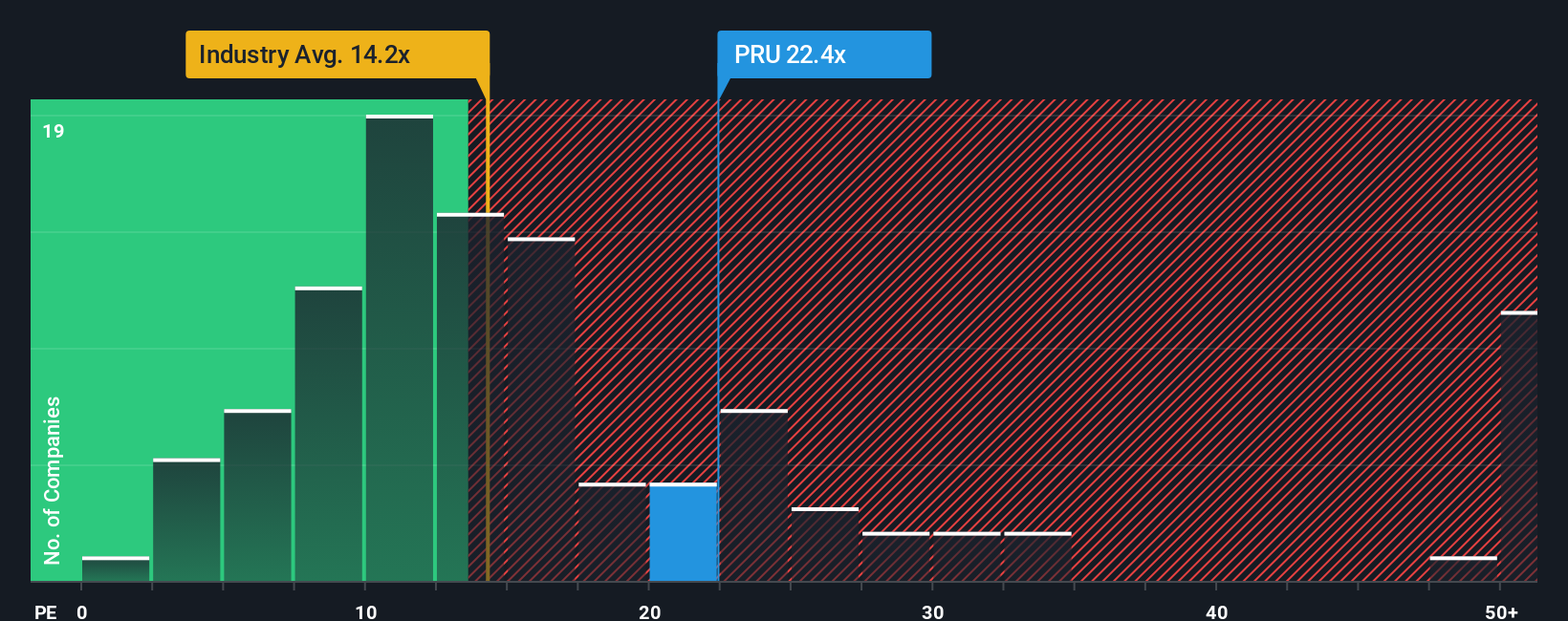

While the narrative points to undervaluation, a look through the lens of the price-to-earnings ratio paints a more cautious picture. Prudential Financial’s PE ratio of 22.7x stands higher than both industry and peer averages, and it is also above the fair ratio of 20.1x. This suggests the market is pricing in a premium that may signal valuation risk rather than opportunity. Is the optimism justified, or is the stock ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prudential Financial Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Prudential Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There’s a world of opportunity beyond Prudential Financial. The smartest investors always keep their radar tuned for fresh trends and emerging opportunities. Let Simply Wall Street’s Trackers guide you toward your next winning move.

- Tap into potential market disruptors by analyzing these 900 undervalued stocks based on cash flows setting themselves up for a breakthrough based on strong cash flows and solid fundamentals.

- Unleash your portfolio’s income prospects by browsing these 19 dividend stocks with yields > 3% offering attractive yields and consistent returns for dividend-focused strategies.

- Charge ahead of tech trends by reviewing these 24 AI penny stocks making headlines in the world of artificial intelligence and redefining industry standards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives