- United States

- /

- Insurance

- /

- NYSE:PRI

Does Primerica’s Five-Year 147% Surge Signal Room for Growth Despite Recent Slide?

Reviewed by Bailey Pemberton

Deciding what to do with Primerica stock right now might feel like staring at a puzzle with a few missing pieces. Over the past year, shares have slid by 4.1%, and they’re down 5.5% over the past month. Yet, if you zoom out, the long-term picture tells a very different story. Primerica is up a staggering 147.7% over the past five years. Recent news has drawn attention to how changes in the industry and consumer behaviors are affecting the dynamics for insurers, and that has rippled through the market’s perception of players like Primerica.

So what’s actually going on with the stock price? Sentiment seems to have shifted a bit in the short term, as some investors reassess risk and opportunity amid evolving industry headlines. But the solid multi-year run suggests that confidence in the company’s fundamentals remains strong. And, for those who like numbers, here’s a key stat: based on six standard valuation checks, Primerica scores a 4. That means the company is currently undervalued in four of those six metrics, a signal that could excite value-focused investors looking for hidden gems amid the market noise.

Of course, not all valuation methods are created equal, and some deliver a clearer picture than others. Let’s dig into how Primerica stacks up across these popular approaches, then explore a fresh perspective on understanding what the stock might truly be worth.

Why Primerica is lagging behind its peers

Approach 1: Primerica Excess Returns Analysis

The Excess Returns model evaluates how much value a company can generate above its cost of equity, revealing whether its underlying business is producing genuine surplus profits for shareholders. For Primerica, this approach highlights the company’s ability to sustain impressive returns on invested capital. This is especially important in industries where growth and profitability can fluctuate with market cycles.

Primerica’s book value currently stands at $70.90 per share. Its stable earnings per share are estimated at $24.93, sourced from a consensus of seven analyst forecasts focused on future Return on Equity. The company’s cost of equity is $5.66 per share, so its excess return, or what it earns above this hurdle, totals $19.27 per share. This is supported by a robust average return on equity of 29.86%, suggesting Primerica’s capital allocation is not just efficient but exceptional. Looking forward, analysts project the company’s stable book value to reach $83.49 per share, underlining confidence in long-term growth potential.

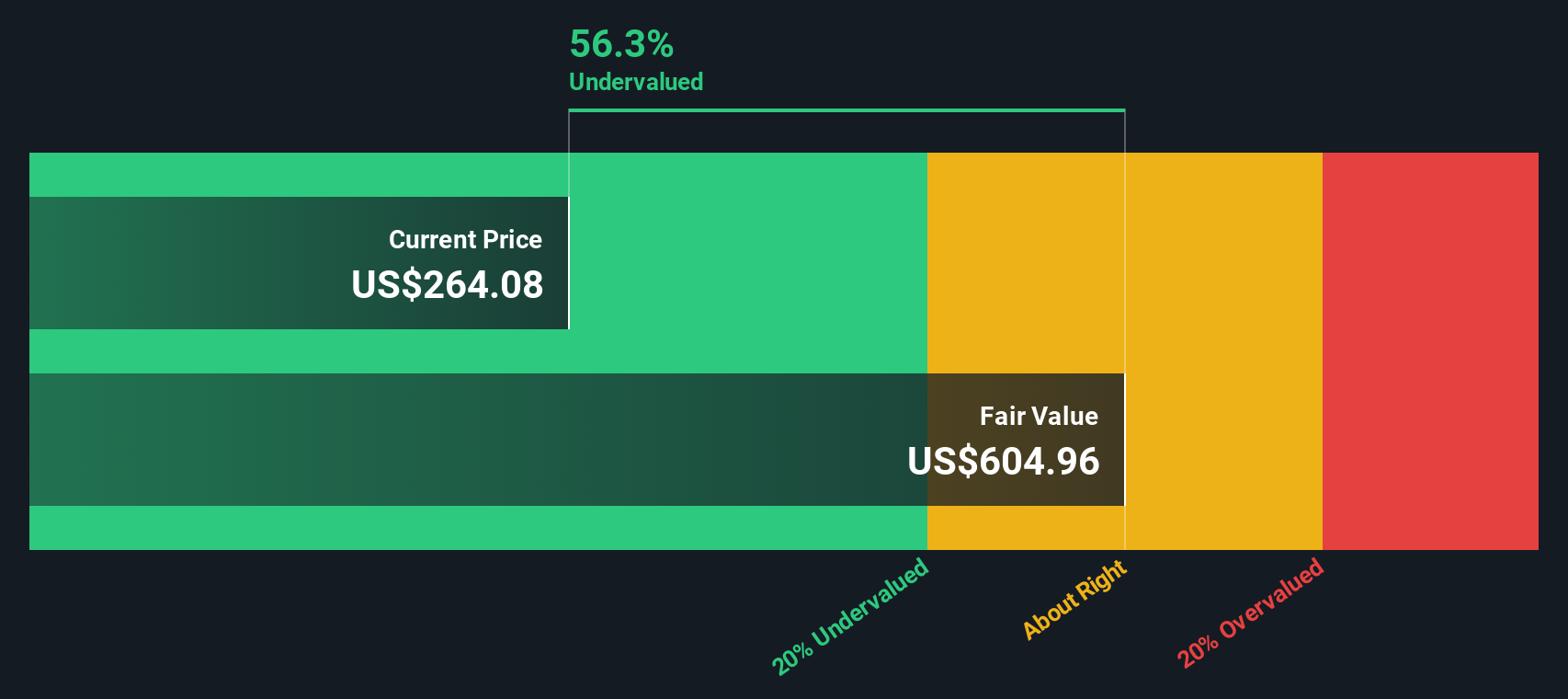

The intrinsic value calculated using the Excess Returns model is $604.96 per share, which is 56.7% higher than the current stock price. This large gap implies that Primerica is significantly undervalued under this framework, especially for investors focused on underlying business strength and capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Primerica is undervalued by 56.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Primerica Price vs Earnings

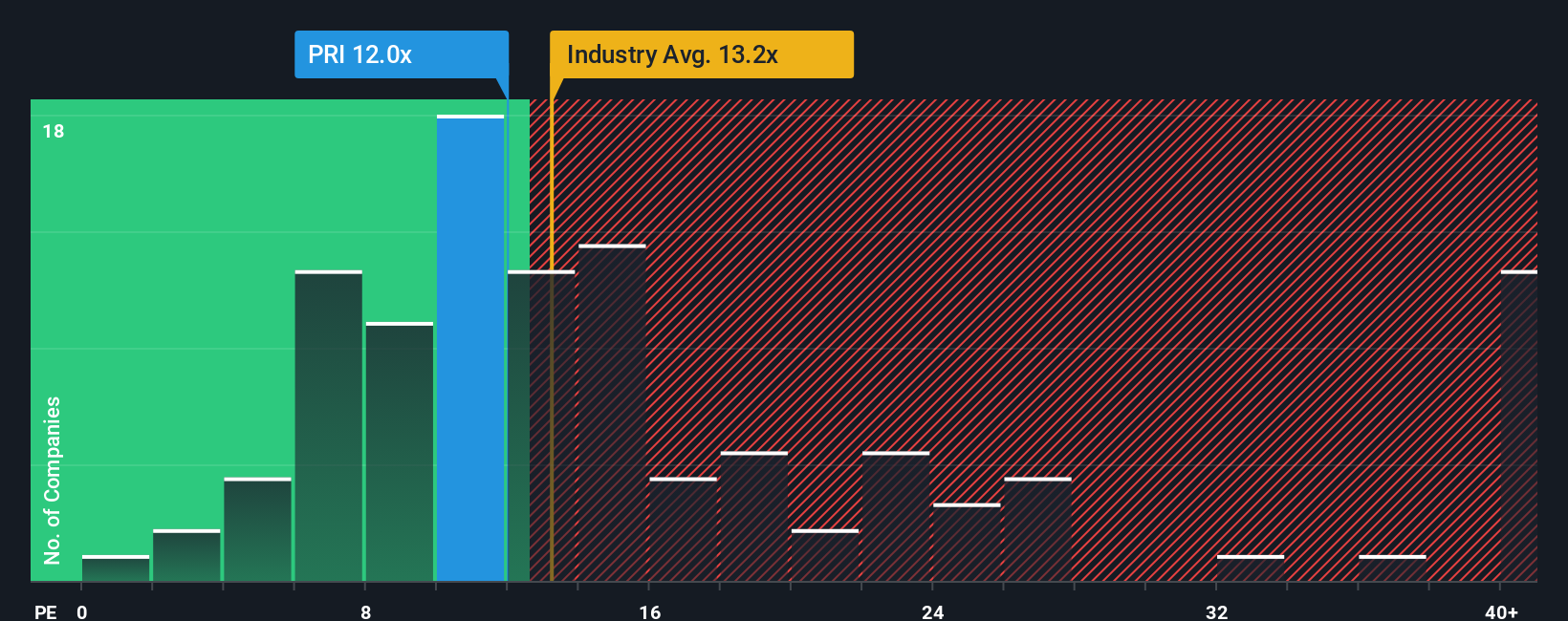

The Price-to-Earnings (PE) ratio is a favored metric for valuing established, profitable companies like Primerica because it directly compares the stock price to the business’s actual earnings power. This makes it especially relevant for insurers, where steady profits are often the norm and can provide useful context for reasonable valuation ranges.

The “right” PE ratio for a company depends on a mix of factors, including earnings growth potential, market risks, and investor sentiment. Rapidly growing businesses or those considered less risky tend to attract higher PE multiples, while companies with uncertain prospects may trade at lower ratios.

Primerica is currently valued at a PE ratio of 12.0x. For context, the average PE ratio across the insurance industry is 13.5x, and the peer group averages 9.6x. This places Primerica slightly below the industry but above its immediate peers. This could reflect its stable profitability and perhaps some caution incorporated into its price.

Simply Wall St uses a Fair Ratio to estimate the multiple a stock deserves based on its unique fundamentals, factoring in growth, profitability, risk, industry, and market cap. The Fair Ratio for Primerica comes out at 12.1x, which suggests that the current valuation is almost exactly in line with what its performance and outlook justify. This tailored approach gives a more nuanced perspective compared to broad industry or peer averages.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Primerica Narrative

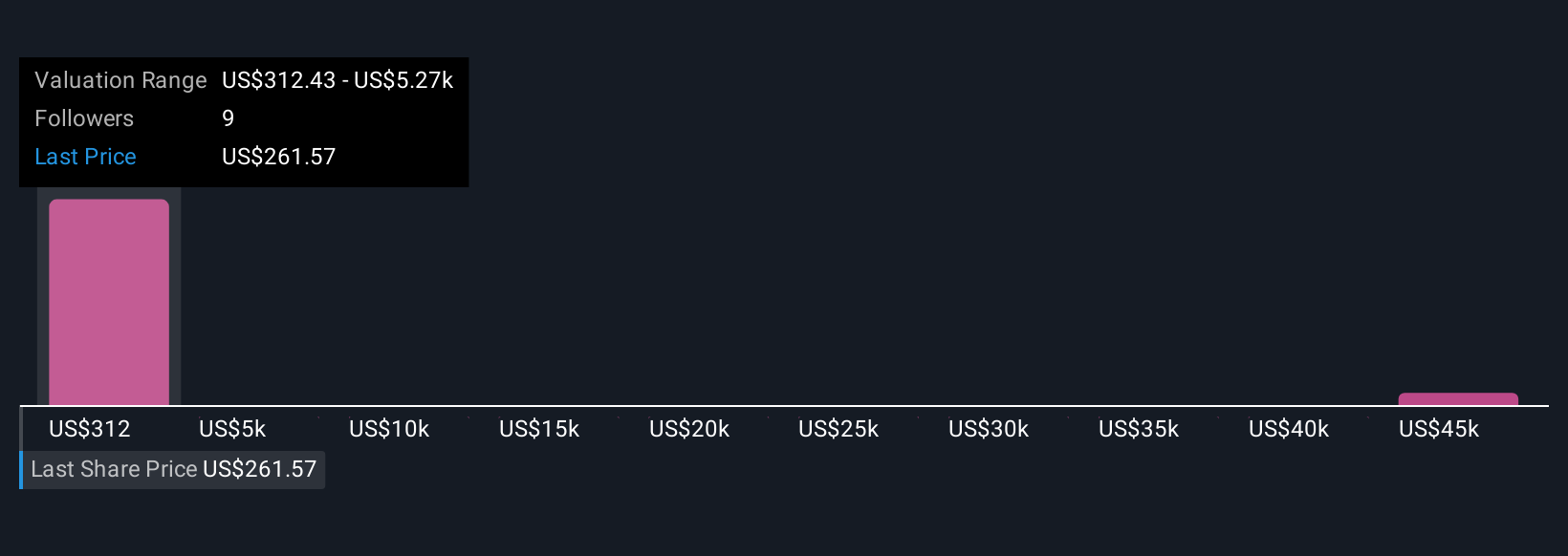

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Put simply, a Narrative lets you tell the story behind the numbers, tying together your view of Primerica’s future revenue, earnings, and margins to create a financial forecast and an estimate of fair value. This approach connects what is happening in the business and industry to a data-driven outlook, making your investment thesis more concrete and actionable.

Narratives make stock analysis accessible to everyone by offering a framework to track your perspective and see how it compares to others, all right on the Simply Wall St Community page, used by millions of investors. With Narratives, you can see at a glance whether your forecasted fair value is above or below the current price, helping you decide if it is time to buy or sell. In addition, Narratives are dynamic; they update automatically as new information, such as earnings results or news, is released, giving you a living, evolving investment summary.

For example, some investors believe Primerica should be worth as much as $340 per share based on strong demographic trends and digital expansion, while others see more risk and value it at just $288, showing how different stories and expectations shape each fair value target.

Do you think there's more to the story for Primerica? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRI

Primerica

Provides financial products and services to middle-income households in the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives