- United States

- /

- Insurance

- /

- NYSE:PRA

ProAssurance (PRA): A Fresh Look at Valuation as Investors Reassess Subtle Stock Moves

Reviewed by Simply Wall St

Most Popular Narrative: 4.9% Overvalued

The prevailing market narrative sees ProAssurance as marginally overvalued, with the current share price sitting just above what analysts believe is fair based on future expectations.

New innovations, like the AI-ready web portal and tools for risk management, aim to enhance customer experience and operational workflows. These advancements may bolster revenue through improved client retention and acquisition. ProAssurance’s Workers' Compensation segment is leveraging partnerships and analytics to manage medical loss trends. This approach could improve future combined ratios and contribute to stronger net margins.

Are you ready to uncover the financial engine analysts believe is powering ProAssurance’s current price tag? Find out which profit margin forecasts, tough assumptions on future business conditions, and bold expectations for tech-driven gains are fueling this high-stakes fair value calculation. Curious to learn what makes analysts think this is the price that pins down the opportunity? Dive deeper and see which critical variables could redefine the company's growth story.

Result: Fair Value of $22.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent legal headwinds or rising competition could squeeze ProAssurance’s margins and challenge the optimistic outlook that analysts currently have for the stock.

Find out about the key risks to this ProAssurance narrative.Another View: What If the Numbers Tell a Different Story?

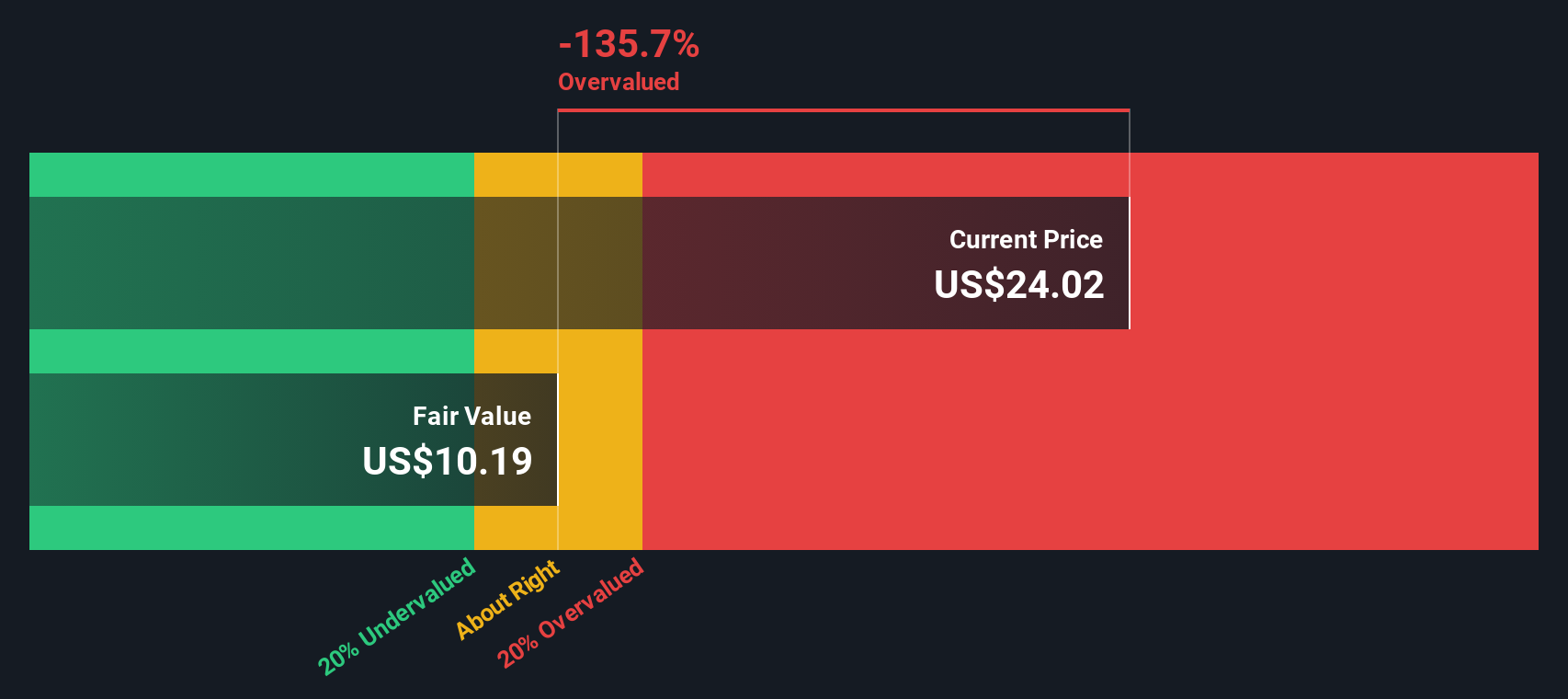

While most see ProAssurance as only slightly overvalued, our DCF model takes a more pessimistic stance and suggests the shares may be priced well above their fair value based on future cash flows. Could this hidden gap matter for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ProAssurance Narrative

If you feel these views miss the mark or simply want to see for yourself, you can shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ProAssurance.

Ready for Your Next Move?

Don’t just watch from the sidelines. Grab a head start with fresh investment ideas that could help your portfolio stand out in any market.

- Target companies with strong balance sheets and robust dividends by checking out dividend stocks with yields > 3%. This may transform your passive income strategy.

- Spot high-potential outperformers riding the artificial intelligence trend when you tap into AI penny stocks emerging at the forefront of machine learning and automation.

- Capitalize on cash flow bargains by uncovering undervalued stocks based on cash flows, which analysts believe are trading below intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PRA

ProAssurance

Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives