- United States

- /

- Insurance

- /

- NYSE:PRA

How Investors Are Reacting To ProAssurance (PRA) Analyst Upgrade and Surge in Institutional Interest

Reviewed by Sasha Jovanovic

- In recent weeks, ProAssurance received a consensus "Hold" recommendation from six ratings firms, while Zacks Research raised its rating to "strong-buy" and institutional investors and hedge funds significantly increased their shareholdings.

- This combination of analyst upgrade and heightened institutional interest signals a shift in market sentiment and renewed confidence in the company’s outlook.

- We’ll examine how the increased institutional ownership may impact ProAssurance’s investment narrative and future performance expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ProAssurance Investment Narrative Recap

To be a ProAssurance shareholder today, you would need to believe in the company’s ability to weather difficult insurance market conditions and continue to drive operating improvements, even as major legal and competitive risks persist. While the recent analyst upgrade and increase in institutional holdings reflect a positive shift in sentiment, these events do not fundamentally alter the ongoing challenges related to margin pressure and legal cost management faced in the near term.

The most relevant recent announcement is the acquisition deal with The Doctors Company, which was approved by stockholders in June 2025 and is expected to close in the first half of 2026. This transaction is directly relevant to near-term catalysts by providing price certainty at US$25.00 per share, but it also raises questions for shareholders about the company’s path and risk if the deal does not finalize as expected.

However, investors should also keep a close eye on the increasingly competitive environment and its impact on...

Read the full narrative on ProAssurance (it's free!)

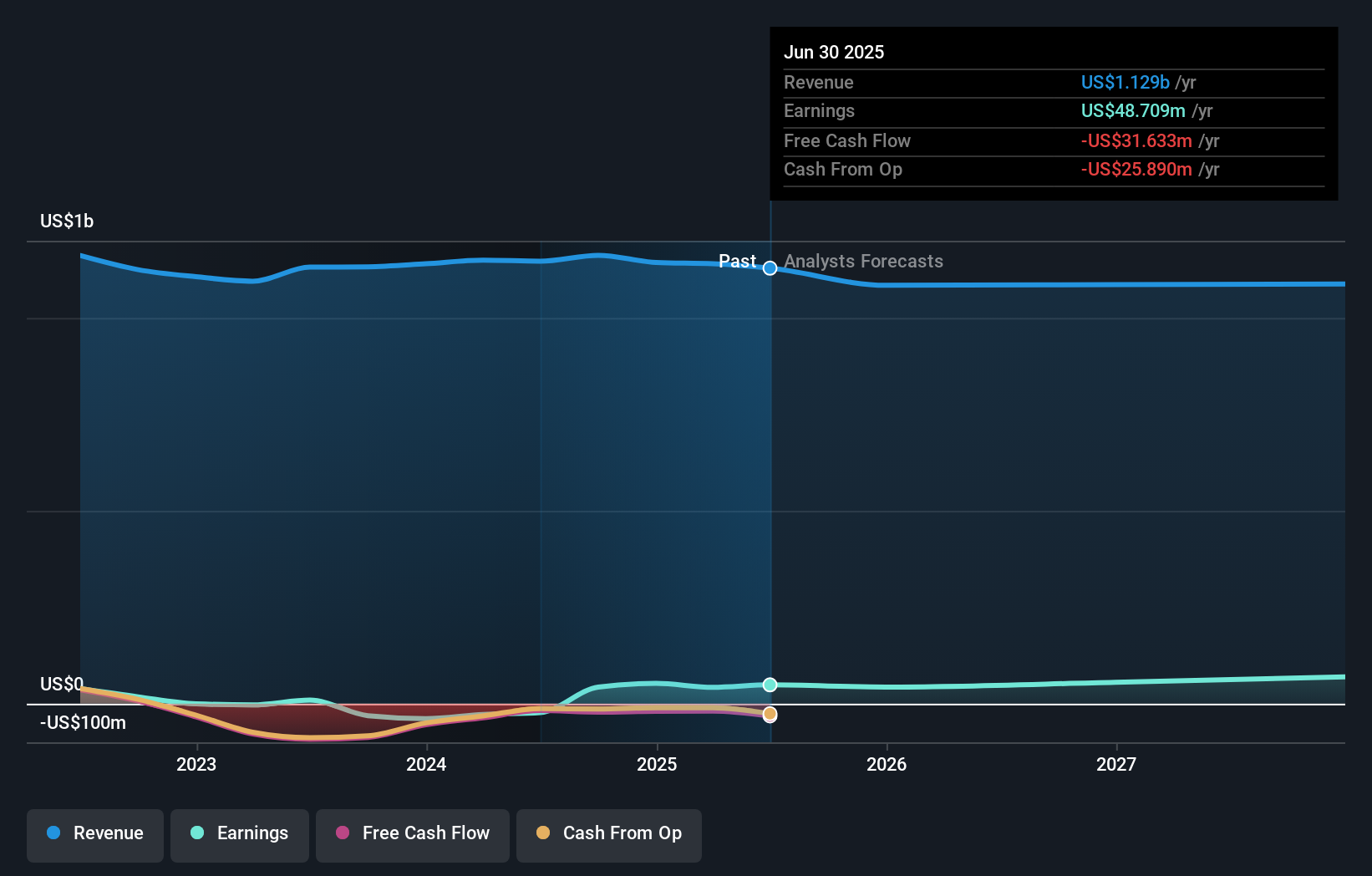

ProAssurance's outlook anticipates $1.0 billion in revenue and $73.1 million in earnings by 2028. This scenario implies a 2.5% annual revenue decline and a $24.4 million increase in earnings from the current $48.7 million.

Uncover how ProAssurance's forecasts yield a $25.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community places ProAssurance at US$25. These views precede the latest institutional moves and the buyout deal, showing how opinions can differ and highlighting the need to consider multiple perspectives.

Explore another fair value estimate on ProAssurance - why the stock might be worth as much as $25.00!

Build Your Own ProAssurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ProAssurance research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ProAssurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ProAssurance's overall financial health at a glance.

No Opportunity In ProAssurance?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRA

ProAssurance

Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives