- United States

- /

- Insurance

- /

- NYSE:PGR

Should You Reconsider Progressive Shares After Recent 6% Weekly Drop?

Reviewed by Bailey Pemberton

If you are weighing your options with Progressive, you are not alone. After years of impressive returns, the stock has hit a patch of turbulence lately. In just the past week, shares slipped by 6.0%, and over the last month, they have fallen 7.4%. Year-to-date, the decline stands at 6.2%, with a 1-year drop of 8.3%. Yet, step back and the longer-term picture still tells a very different story. Progressive’s stock price has soared an incredible 89.8% over the last three years and 163.1% over five years. Clearly, this is a company with momentum on its side, even if recent volatility signals renewed uncertainty or shifting risk perceptions among investors.

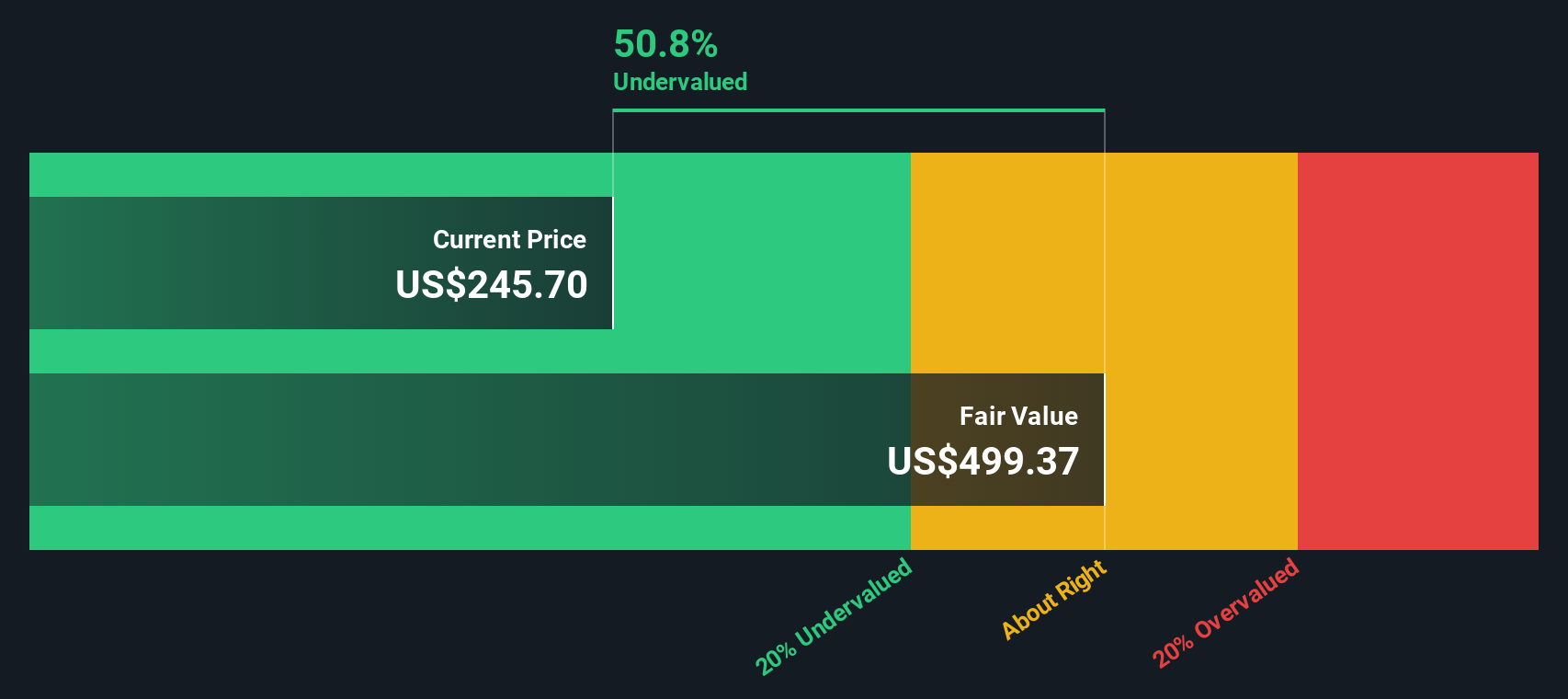

When it comes to valuation, Progressive’s scorecard is mixed. Out of six major valuation checks, it comes away with a score of 3, suggesting it appears undervalued by half of the standard measures analysts use. That places the stock in an interesting spot for those seeking value, growth, or something in between.

So, does the recent pullback open up a new opportunity, or is there more downside yet to come? Let’s dig into the key valuation approaches investors rely on, and later in the article, I will show you an even sharper way to think about what Progressive is truly worth.

Why Progressive is lagging behind its peers

Approach 1: Progressive Excess Returns Analysis

The Excess Returns valuation model looks at how much value a company creates above the cost of its equity capital. In simple terms, it asks if Progressive is generating profits beyond what its shareholders require as a minimum return, and if so, how much those "excess" profits are worth in dollar terms for each share.

Using this approach, Progressive stands out for its high return on invested equity. The average return on equity sits at an impressive 27.47%, suggesting the company is highly efficient in turning shareholder capital into earnings. Analysts estimate the stable earnings per share at $20.18, with a stable book value per share of $73.44. The current cost of equity is $4.98 per share, implying Progressive’s excess return is $15.20 per share.

Based on these metrics, the Excess Returns model estimates the intrinsic value of Progressive at $484.73 per share. This is significantly higher than the current market price, indicating the stock trades at a 53.5% discount relative to its estimated fair value. In short, by this standard, Progressive appears to be dramatically undervalued in today’s market.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 53.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Progressive Price vs Earnings

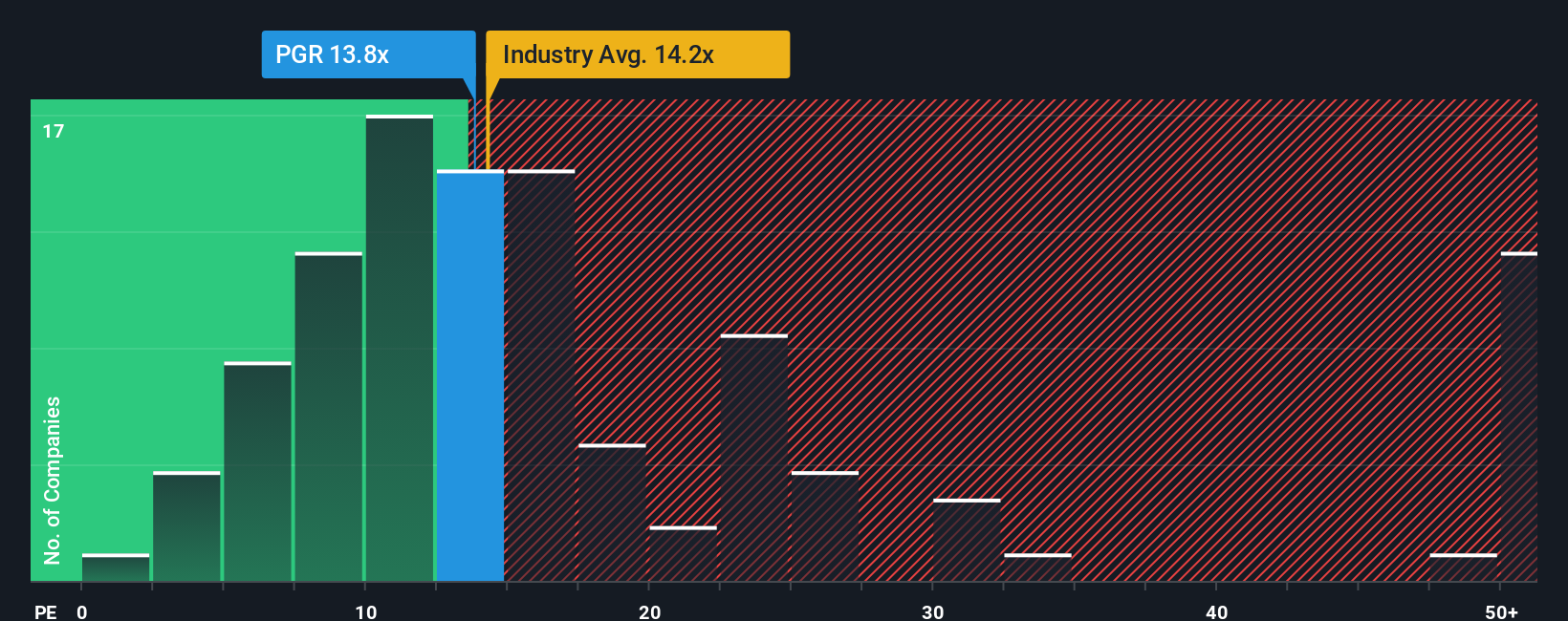

For profitable companies like Progressive, the price-to-earnings (PE) ratio is a time-tested and widely used valuation metric. It quickly tells you how much investors are willing to pay today for a dollar of the company's earnings. The PE ratio often reflects expectations for future growth and adjusts for perceived risks. A higher PE can signal optimism about the business, while a lower PE might suggest uncertainty or sluggish growth prospects.

Progressive's current PE ratio stands at 12.35x. When stacked against the industry average of 13.18x and its peer group’s average of 9.85x, Progressive is priced slightly below the broad insurance sector but above the typical peer. These gaps hint at how investors view Progressive's growth prospects and risk profile relative to its closest competitors and the industry overall.

Simply Wall St’s “Fair Ratio” for Progressive is 11.82x. Unlike simple comparisons to industry or peer averages, the Fair Ratio blends important factors such as expected earnings growth, profit margins, risk, industry characteristics, and Progressive’s market cap. This provides a more tailored benchmark that reflects what investors should reasonably pay for the company today given its unique profile.

With Progressive trading at a 12.35x PE compared to the Fair Ratio of 11.82x, the valuation is just slightly above this proprietary estimate, but the difference is quite minor. This suggests the stock is priced about right, leaving neither a clear discount nor a significant premium at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progressive Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a way for you to translate your view of a company—your story about where it's headed—into numbers, such as your own forecasts for revenue, earnings, and margins, so you can see how they would impact its fair value.

Narratives connect the dots between the business story, a tailored financial forecast, and a resulting fair value, helping you make smarter buy or sell decisions by comparing your view of fair value with the current share price. Narratives are straightforward and accessible on Simply Wall St's Community page, where millions of investors share perspectives that update automatically whenever new news or earnings data arrives.

Imagine one investor believes Progressive will maintain leadership by leveraging advanced analytics and premium growth, resulting in a higher price target (e.g., $344.0). Another investor may be more cautious, focusing on margin pressure and competition, leading to a lower target (e.g., $189.0). Narratives let each person see if the current price offers a margin of safety for their unique outlook.

Do you think there's more to the story for Progressive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives