- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR) Valuation in Focus as Analysts Lift Estimates Ahead of Earnings Growth Report

Reviewed by Kshitija Bhandaru

Progressive (PGR) is drawing plenty of attention ahead of its upcoming earnings report, with expectations for strong year-over-year growth in both earnings per share and revenue. Investors are taking note as analysts continue to raise their estimates, which points to positive business trends and a healthy performance outlook.

See our latest analysis for Progressive.

Progressive’s share price has moved sideways in recent months, but the bigger picture remains positive. Stable results, double-digit premium growth, and improving underwriting margins continue to support the stock’s status as a long-term compounder. Over the past three years, total shareholder return stands at an impressive 107.5%, underscoring steady outperformance and investor confidence in the company’s strategy and outlook.

If you’re looking to cast a wider net in today’s market, now is an excellent time to broaden your perspective and discover fast growing stocks with high insider ownership

With so much optimism already reflected in analyst estimates and the share price near all-time highs, investors now face a critical question: is Progressive undervalued, or is the market already pricing in the company’s next leg of growth?

Most Popular Narrative: 11.7% Undervalued

Progressive’s most widely followed narrative now values the company about 12% higher than the latest closing price, suggesting optimism around its future prospects. The focus is on how technology investments enhance Progressive's competitive positioning and potential for long-term growth.

Persistent growth in U.S. vehicle ownership, population, and rising vehicle complexity expand the addressable market and increase future demand for auto insurance, which should underpin sustained top-line revenue growth for Progressive.

Want to peek behind the curtain? This valuation is built on ambitious revenue growth, tighter profit margins, and a future multiple higher than what most insurers command. Curious about the bold assumptions driving analysts' fair value? Unlock the model’s secrets to see what sets this target apart.

Result: Fair Value of $278.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, with competition heating up and rising claims costs, any sustained pressure on margins could quickly shake confidence in the current bullish narrative.

Find out about the key risks to this Progressive narrative.

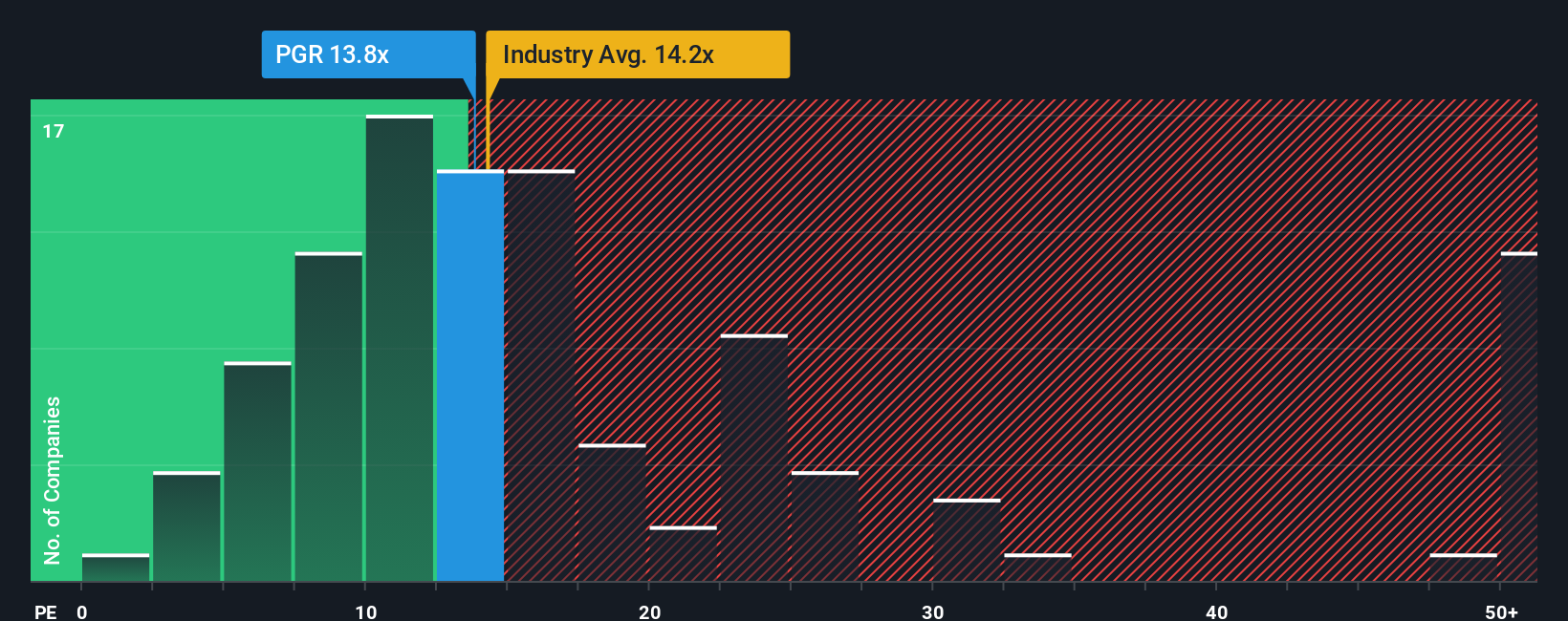

Another View: Multiples Suggest Caution

Looking through the lens of current price-to-earnings ratios, Progressive trades at 13.8x, which is pricier than its direct peers at 11.5x and above its fair ratio of 12.1x. This premium means expectations are already high, which could limit upside if growth stumbles or the market shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progressive Narrative

If you see things differently or want to dive deeper into the numbers on your own terms, you can easily craft a personal take in just a few minutes, so go ahead and Do it your way

A great starting point for your Progressive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. The market is full of standout companies waiting to be found. Your next smart investment could be a click away.

- Boost your income stream by targeting reliable payers with yields above 3% using these 19 dividend stocks with yields > 3% before the next payout season passes you by.

- Capitalize on industry-changing breakthroughs by checking out these 24 AI penny stocks at the forefront of artificial intelligence and automation.

- Seize undervalued potential for strong long-term returns as you scan these 896 undervalued stocks based on cash flows and position your portfolio ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives