- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR) Reports Half-Year Revenue of US$42 Billion and Net Income of US$6 Billion

Reviewed by Simply Wall St

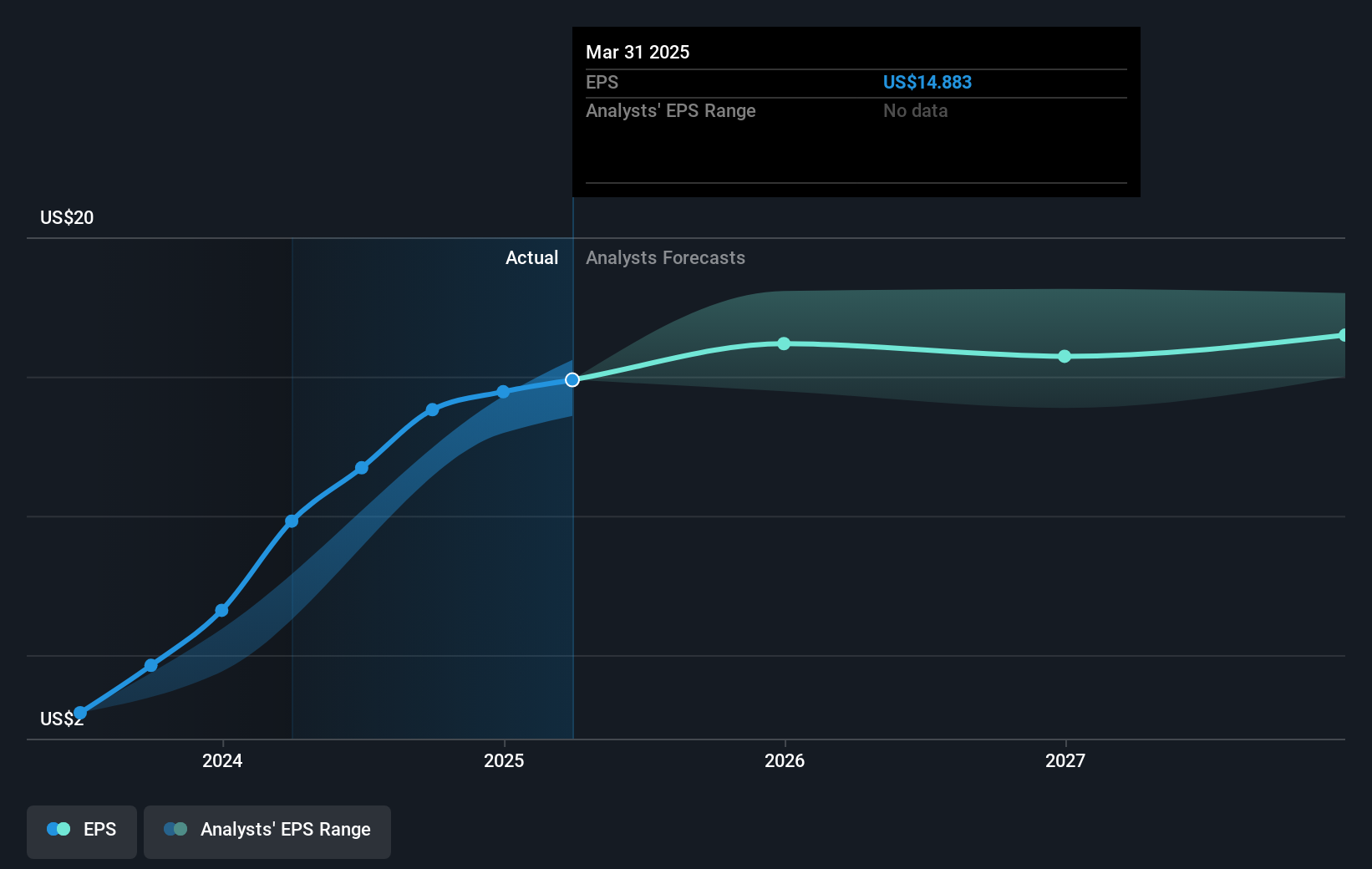

The Progressive Corporation (PGR) recently announced robust financial performance for the first half of 2025, including a significant rise in revenue to USD 42,413 million and an increase in net income to USD 5,742 million. Despite these positive earnings results, Progressive's stock price declined by 4% over the last week. While this drop might seem at odds with the company’s strong financials, it aligned with a generally volatile market environment, influenced by uncertainties surrounding the Federal Reserve's direction amid President Trump's ongoing criticisms of its leadership. These market conditions likely contributed to Progressive's share price movement.

The recent decline of Progressive Corporation’s stock price by 4% over the last week, despite strong financial performance, underscores the volatile market environment driven by uncertainties about the Federal Reserve's direction. This backdrop aligns with investor concerns, possibly impacting sentiment even with Progressive's strategic initiatives to acquire cost-effective policies and focus on technology.

Over the past five years, Progressive's total shareholder return, including both share price and dividends, reached an impressive 201.01%. This strong return reflects the company's ability to grow through both strategic expansion and capital management. In the last year alone, Progressive outperformed both the broader US market and the US Insurance industry, which returned 10% and 7.4% respectively.

Looking forward, the current news impacts revenue and earnings forecasts as Progressive still targets a revenue increase to $102.6 billion by 2028 and earnings growth to $9.9 billion. However, potential challenges related to tariffs and competitive pressures could influence the ability to maintain these forecasts. While analysts have set a consensus price target of US$286.80, Progressive’s current share price of US$242.20 indicates an 18.41% discount, suggesting room for future growth in line with earnings and revenue projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives