- United States

- /

- Insurance

- /

- NYSE:PGR

Is There Now an Opportunity in Progressive After Strong Q1 2025 Earnings Growth?

Reviewed by Bailey Pemberton

Thinking about what to do with Progressive stock right now? You are not alone. Whether you are eyeing potential growth or reassessing risks, the company has definitely kept investors guessing lately. The past year saw Progressive’s share price dip by 1.5%, which might not sound like much, but it comes after impressive longer-term results: a 105.7% gain over three years and 174.3% growth over the last five. Clearly, there has been a lot of momentum in the big picture, even though the latest monthly and yearly numbers have been a bit softer.

Some of these fluctuations reflect broader market dynamics. Shifts in the insurance landscape, investor appetite for defensive sectors, and changing expectations about how quickly companies can grow profitability all play a role. Even in the face of modest recent returns, many see Progressive as a steady, adaptive company positioned well for different economic cycles. The stock is up just 1.2% year-to-date, but that stability could signal confidence from long-term holders as much as it does caution among headline-chasing traders.

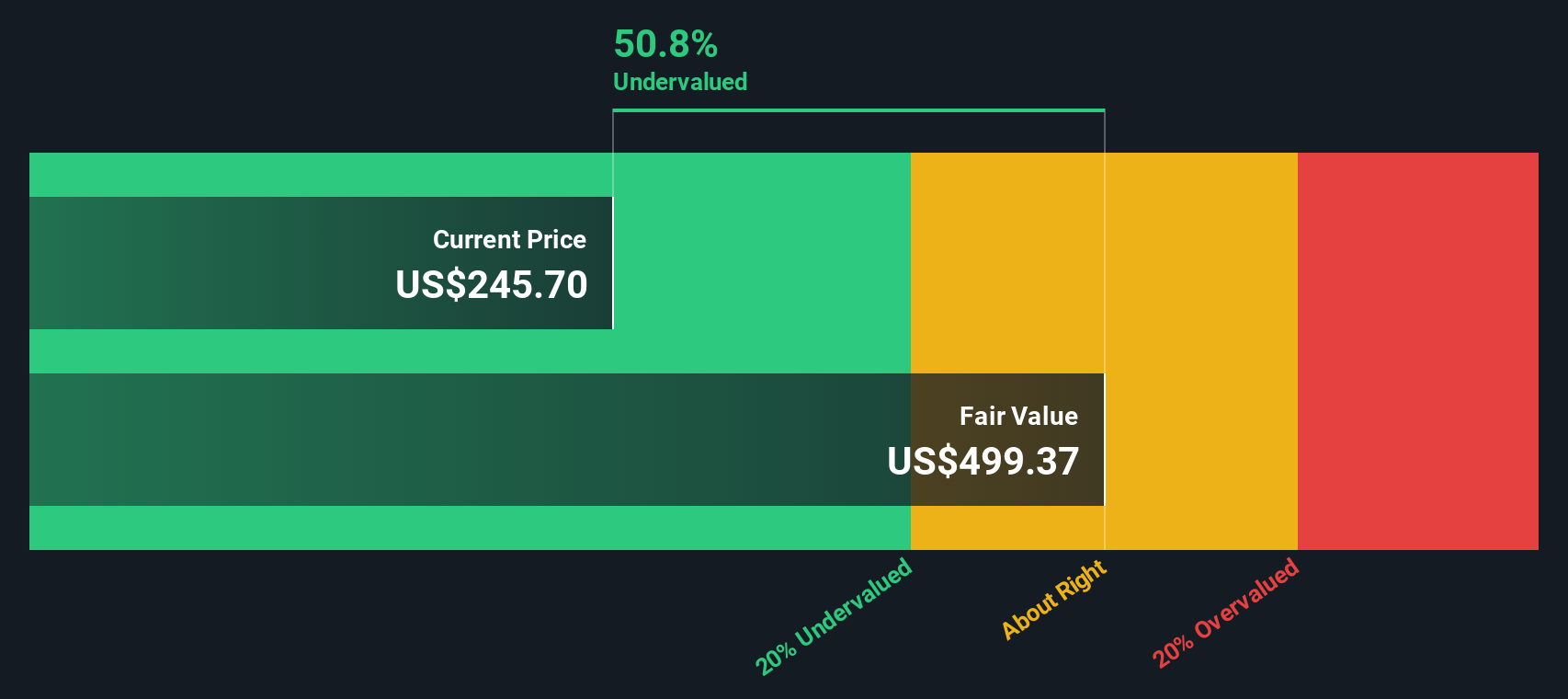

For those considering valuation, Progressive currently scores a 3 out of 6 on our undervaluation checks. That means it is undervalued in half of the metrics we track. There is room for optimism, but also reason for a closer look.

So, how does Progressive’s price stack up when you compare it to key valuation yardsticks? Let’s break down the main valuation checks. Stay tuned for an approach that could give you an even smarter perspective on whether Progressive is truly a bargain today.

Why Progressive is lagging behind its peers

Approach 1: Progressive Excess Returns Analysis

The Excess Returns valuation model evaluates a company by looking at how much profit it generates beyond its cost of equity, rather than just the absolute returns. This method highlights the efficiency of Progressive's investments and how those translate into potential value for shareholders.

For Progressive, the current book value stands at $55.62 per share, while stable earnings per share are estimated at $20.72, based on a consensus from 11 analysts. The company’s cost of equity is $4.99 per share, and the average return on equity is 28.16 percent. With these numbers, the excess return—meaning earnings above the cost of equity—amounts to $15.74 per share. Further, analysts expect the stable book value to grow to $73.59 per share in coming years.

Based on this methodology, the model estimates Progressive's intrinsic value at $499.37 per share. Compared to the stock’s current price, this implies the shares are trading at a sizable 51.2 percent discount to intrinsic value. By these measures, Progressive appears to be substantially undervalued at this time.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 51.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

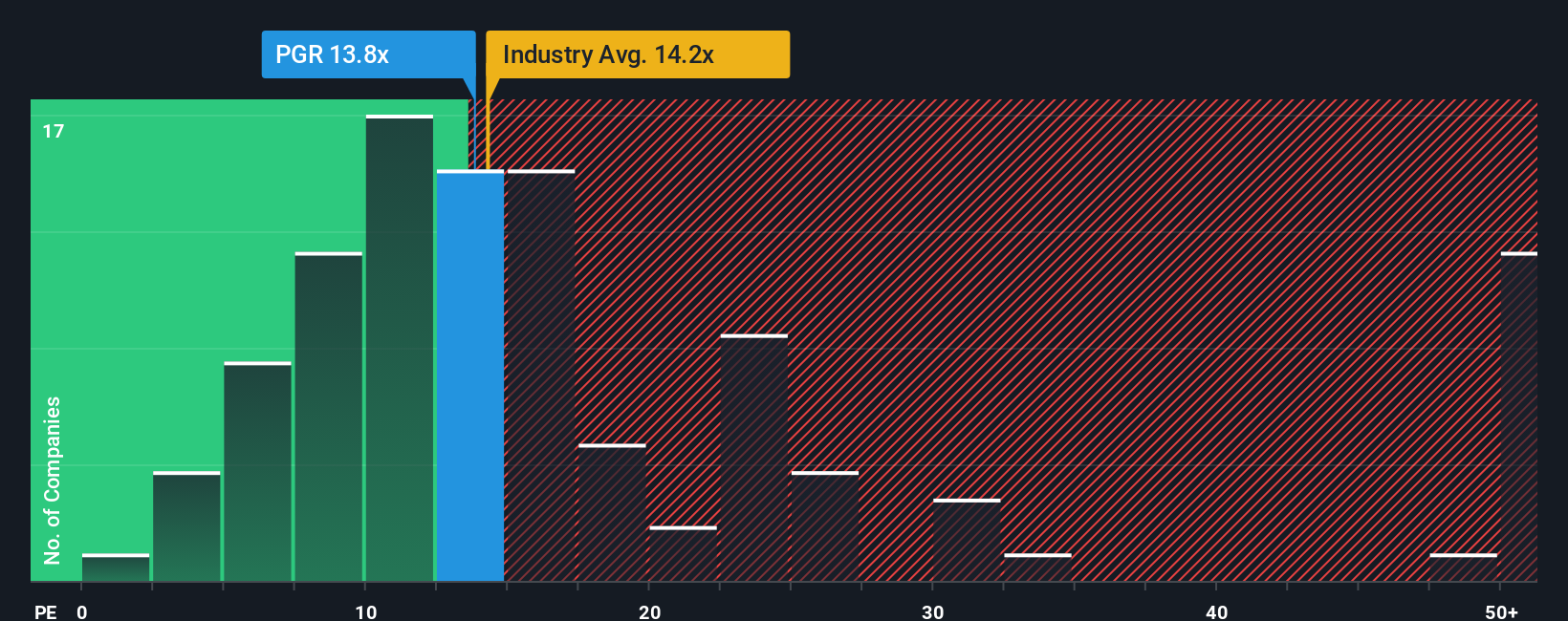

Approach 2: Progressive Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Progressive, as it reflects how much investors are willing to pay for a dollar of earnings. This measure is particularly relevant when a business has steady profits because it helps assess whether the stock is priced attractively relative to its earnings generation.

Growth expectations and perceived risks play a big role in determining what a "normal" or "fair" PE ratio should be. Companies with stronger projected earnings growth or lower risk profiles usually command higher PE ratios, while slower-growing or riskier stocks often trade at lower levels.

Progressive currently trades at a PE ratio of 13.7x. This is slightly below the average for the insurance industry, which is 14.0x, and is higher than the typical peer, which averages 11.4x. However, to avoid potential pitfalls of simple comparisons, we introduce Simply Wall St’s Fair Ratio. This is a proprietary benchmark that considers Progressive's growth outlook, profit margins, industry characteristics, and market cap, as well as its risk profile. The Fair Ratio for Progressive is calculated at 12.1x, making it a more tailored guide to what the company’s valuation ought to be.

Looking at Progressive’s actual PE ratio of 13.7x compared to its Fair Ratio of 12.1x, the stock appears to be trading a bit above its fair value based on these comprehensive factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progressive Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective on a company’s story, linking what you believe about its future, such as growth rates, margins, and risks, to a financial forecast and ultimately a fair value for the stock.

Narratives are a powerful tool that go beyond the numbers, letting investors connect their unique insights or convictions to projected outcomes. On Simply Wall St’s Community page, you can contribute or follow Narratives quickly and easily, seeing how your view stacks up against millions of others.

With Narratives, you can see how changes in Progressive’s news, results, or industry trends instantly update the story and the fair value, helping you decide whether the current share price presents an attractive entry or exit opportunity.

For example, some investors are forecasting Progressive’s fair value to be as high as $399.21 per share, anticipating robust revenue and earnings growth. Others see it as low as $189.00, reflecting more cautious assumptions about competition and margin pressure. This illustrates how Narratives can capture different viewpoints on the same stock.

Do you think there's more to the story for Progressive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives