- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR): Valuation Check After New Product Launches, AI Push, and Strong Growth Signals

Reviewed by Simply Wall St

Oscar Health (OSCR) just rolled out a string of ambitious product updates, including the launch of HelloMeno, an AI-powered agent named Oswell, and fresh health plan expansions across new states. These moves highlight the company’s focus on technology-driven growth and broader market reach.

See our latest analysis for Oscar Health.

Oscar Health’s wave of new products and bold expansion news has clearly caught investors’ attention, fueling a 14.8% share price return over the last month and an eye-catching 60.7% gain year-to-date. Over the long haul, shareholders are sitting on a staggering 511.5% three-year total return, showing that market momentum is building on top of the company’s fundamental progress and growth strategy.

If Oscar’s latest innovations sparked your interest, the next logical move is to explore other healthcare growth standouts. See the full list for free with See the full list for free.

But with shares soaring and future growth initiatives now out in the open, investors must ask themselves: is Oscar Health's explosive upside already reflected in the stock price, or does a genuine buying opportunity remain?

Most Popular Narrative: 85.8% Overvalued

Oscar Health's most followed narrative places its fair value far below the current closing price. This suggests that the surge in shares has pushed the stock well above what analysts believe is justified. It sets high expectations for upcoming years and raises the question of whether the business can achieve the rapid financial transformation now implied.

Analysts expect earnings to reach $245.4 million (and earnings per share of $1.12) by about September 2028, up from $-161.2 million today.

This narrative rests on a striking turnaround story. Profits swinging deep into the black, revenue ascending year after year, and margins improving dramatically fuel the case for this fair value. Want to discover the ambitious assumptions and the big leap analysts are betting on? Dive in to follow the numbers that could redefine Oscar Health's valuation.

Result: Fair Value of $11.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust digital adoption or AI-driven cost efficiencies could quickly reverse margins and profitability. This could force analysts and the market to rethink expectations.

Find out about the key risks to this Oscar Health narrative.

Another View: The Market’s Multiples Tell a Different Story

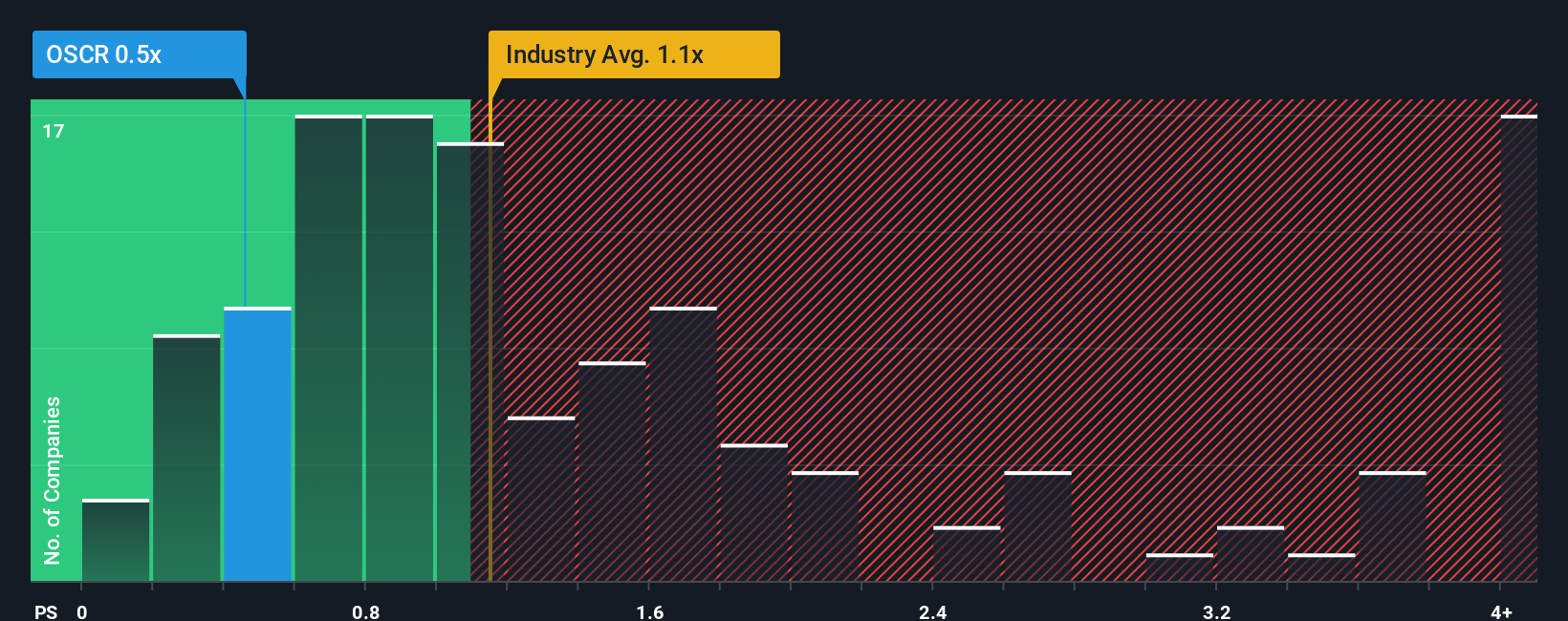

While analyst fair value models suggest caution, Oscar Health's current sales ratio sits at just 0.5x, notably lower than both the US Insurance industry average of 1.1x and peer average of 1.3x. The fair ratio is estimated at 0.8x. Such a wide gap challenges the idea that the market is excessively optimistic. Could investors be overlooking a genuine value play hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oscar Health Narrative

If you want to dig into the details and shape your own perspective, you can pull together a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Oscar Health.

Looking for More Smart Investment Ideas?

Don't settle for just one breakthrough stock. Use the Simply Wall Street Screener to uncover forward-thinking opportunities that other investors might be missing out on.

- Catch rising stars and seize the momentum with these 3584 penny stocks with strong financials, offering strong financials and untapped growth potential in overlooked sectors.

- Target reliable income streams by focusing on these 17 dividend stocks with yields > 3% and find stocks with yields above 3%, which may help in building steady portfolio returns.

- Tap into tomorrow’s trends by exploring innovation through these 79 cryptocurrency and blockchain stocks, featuring companies at the forefront of blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives