- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR): Revisiting Valuation After Analyst Upgrade and Bullish Options Signal Growing Investor Confidence

Reviewed by Simply Wall St

Oscar Health (OSCR) just caught traders attention after a wave of bullish options activity and a fresh analyst upgrade, which has put its structural strengths and long term growth story back in focus.

See our latest analysis for Oscar Health.

Those bullish options bets and the upgrade are landing just as Oscar’s 2025 year to date share price return of 26.79% builds on a massive three year total shareholder return of 527.01%. This suggests momentum is pausing rather than breaking.

If Oscar’s story has your attention, this is also a good moment to explore other innovative healthcare names through our curated healthcare stocks and see what else is gaining traction.

Yet with mixed analyst targets, recent options optimism, and losses still on the income statement, is Oscar Health quietly undervalued here, or is the market already pricing in its next chapter of growth?

Most Popular Narrative: 19.5% Overvalued

With the most followed fair value sitting at $14.38 against a last close of $17.18, the narrative argues that Oscar’s rally is running ahead of fundamentals.

The analyst price target for Oscar Health has been raised meaningfully, with fair value increasing from $12.88 to $14.38 per share. Analysts attribute this change to stronger long term revenue growth prospects, slightly lower perceived risk, and higher future earnings multiples, despite modestly lower margin assumptions.

Want to see what justifies paying up for a still unprofitable insurer? This narrative leans on accelerating membership, expanding margins, and a punchy future earnings multiple. Curious which revenue and earnings milestones have to be hit to defend that valuation and why the discount rate barely budges even as risks stack up? Read on to unpack the math behind this call.

Result: Fair Value of $14.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger than expected digital efficiencies and faster margin recovery from aggressive repricing could quickly make today’s fair value appear outdated.

Find out about the key risks to this Oscar Health narrative.

Another View: Multiples Point to Value, Not Excess

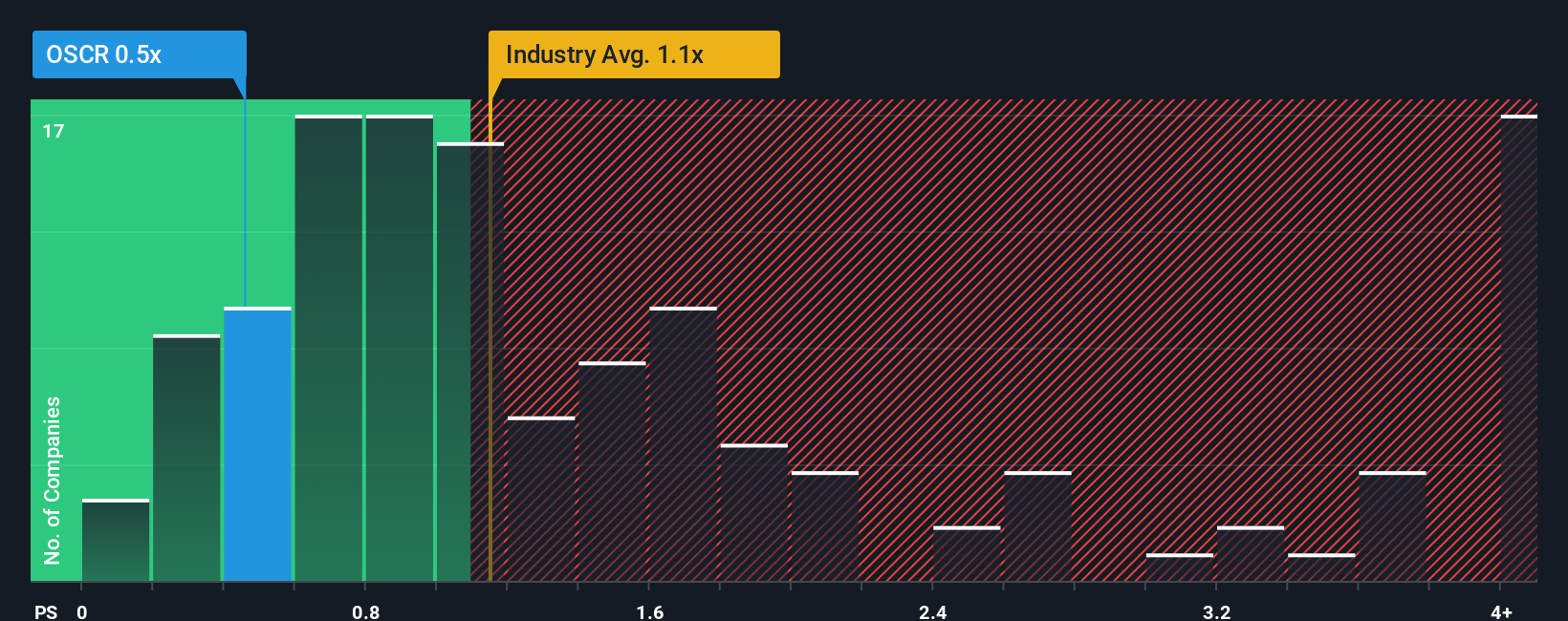

While the narrative calls Oscar Health about 19.5% overvalued on future earnings, its current price to sales ratio of 0.4 times undercuts the US Insurance industry at 1.1 times and a fair ratio of 0.7 times. That gap may indicate potential upside if sentiment normalizes, or a possible value trap if profitability disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oscar Health Narrative

If this perspective does not quite fit your view, or you would rather dive into the numbers yourself, you can build a custom narrative in just minutes, Do it your way.

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall St’s Screener, so the next big move does not pass you by.

- Capitalize on market mispricing by targeting companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows, where cash flow strength takes center stage.

- Ride powerful innovation trends by focusing on these 26 AI penny stocks that harness artificial intelligence to reshape industries and earnings potential.

- Strengthen portfolio income by seeking reliable payers with these 15 dividend stocks with yields > 3% that can help support long term returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026