- United States

- /

- Insurance

- /

- NYSE:OSCR

Could Oscar Health’s (OSCR) AI Ambitions Redefine Its Competitive Edge in Specialty Insurance?

Reviewed by Sasha Jovanovic

- Elektra Health and Oscar Health recently announced the launch of HelloMeno, the first menopause-focused health plan available on the ACA marketplace, aiming to support 2.3 million women over 45 with comprehensive, low-cost care in 11 states for 2026 open enrollment.

- This collaboration introduces a new model of specialty-focused insurance, highlighting Oscar Health's commitment to digital innovation and underserved markets through unique programs and advanced AI tools.

- We’ll examine how Oscar Health’s integration of AI-powered member support could shape its investment narrative amid ongoing industry headwinds.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Oscar Health Investment Narrative Recap

To be a shareholder in Oscar Health, you need to believe in the company's ability to use technology and specialized products like HelloMeno to drive sustainable growth and improve margins in a challenging ACA market. While the launch of menopause-focused plans and AI-powered features demonstrates innovation, these do not immediately offset the main short-term risk: unpredictable claims costs, which continue to pressure profit margins across the industry. The recent news does not materially change this risk, and reimbursement headwinds remain a critical watchpoint.

The introduction of the Oswell AI agent stands out as particularly relevant to Oscar’s investment narrative, as it illustrates the company’s ongoing focus on digital health solutions designed to create value for members and clinicians. These new tools could enhance operational efficiency, support personalized care, and differentiate Oscar in a market sensitive to both rising medical costs and member experience, key factors influencing future performance catalysts.

Yet, contrasting these innovations, the volatility of medical claims remains a risk investors should be aware of if Oscar’s plan repricing fails to fully...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's outlook anticipates $12.4 billion in revenue and $245.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.9% and represents an increase in earnings of $406.6 million from the current figure of -$161.2 million.

Uncover how Oscar Health's forecasts yield a $12.38 fair value, a 37% downside to its current price.

Exploring Other Perspectives

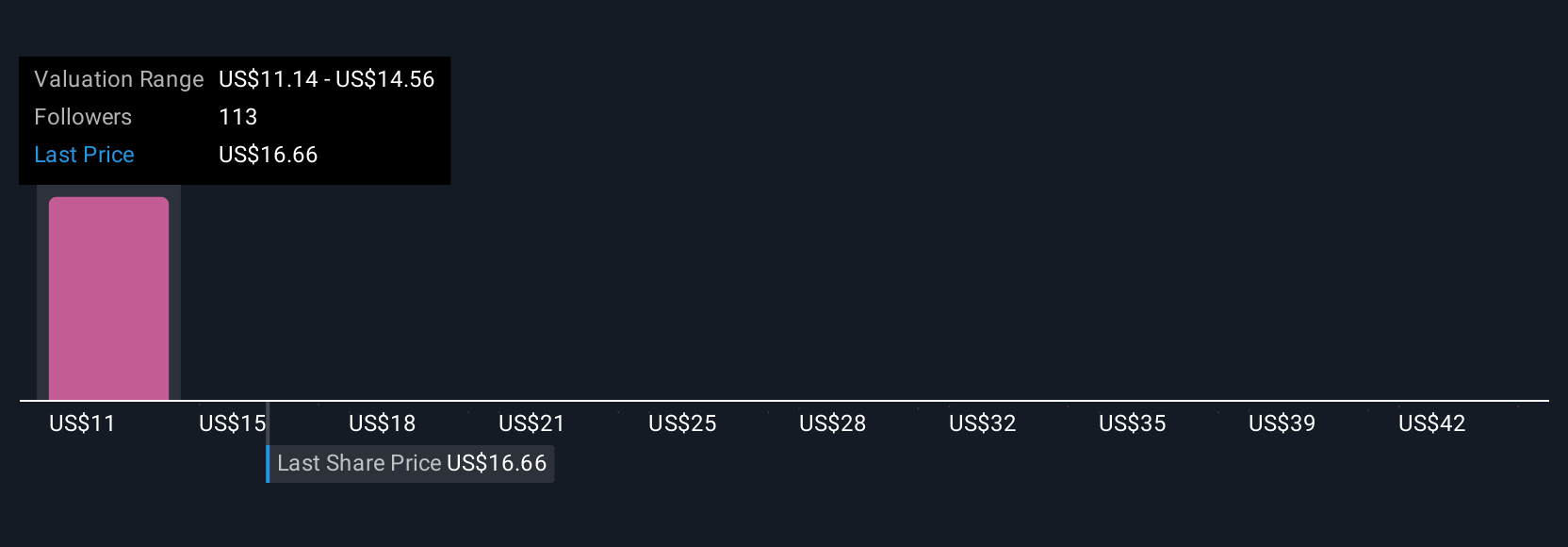

Twenty-three fair value estimates from the Simply Wall St Community range from US$11.52 to US$66 per share. As you weigh these varying opinions, keep in mind that uncertain claims costs affecting margins remain at the center of the company’s performance outlook.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth over 3x more than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives