- United States

- /

- Insurance

- /

- NYSE:ORI

What Old Republic International (ORI)'s $750 Million Share Buyback Means For Shareholders

Reviewed by Simply Wall St

- On August 19, 2025, Old Republic International Corporation announced that its Board of Directors authorized a share repurchase program of up to US$750 million.

- This move reflects management's intent to return capital to shareholders and may support underlying value through a reduced share count.

- We'll examine how the sizeable US$750 million buyback announcement could alter Old Republic International's existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Old Republic International Investment Narrative Recap

Old Republic International appeals to shareholders who believe in the long-term resilience of insurance and real estate-linked businesses, even during challenging cycles in housing and interest rates. The newly announced US$750 million share buyback may support short-term sentiment and help offset earnings pressure amid a weaker real estate market, but it does not fundamentally change the principal catalyst, improving real estate trends, or address the largest risk, namely prolonged softness in title insurance revenue due to higher mortgage rates.

Among recent developments, the Board’s decision on August 15, 2025, to raise the annual dividend by 9.4% is particularly relevant, as it reflects the company’s continued focus on direct capital returns to shareholders through both cash dividends and share repurchases. This sustained commitment to returning capital via multiple avenues may offer reassurance as the company navigates shifting market conditions and seeks to balance potential earnings headwinds and shareholder value initiatives.

Yet, despite efforts to support shareholder value through buybacks, investors should not overlook the risk posed by persistent high expense ratios and cost pressures in the Title Insurance segment, particularly if...

Read the full narrative on Old Republic International (it's free!)

Old Republic International's outlook projects $10.2 billion in revenue and $865.3 million in earnings by 2028. This assumes a 5.7% annual revenue growth rate and a decrease in earnings of $28.3 million from the current $893.6 million.

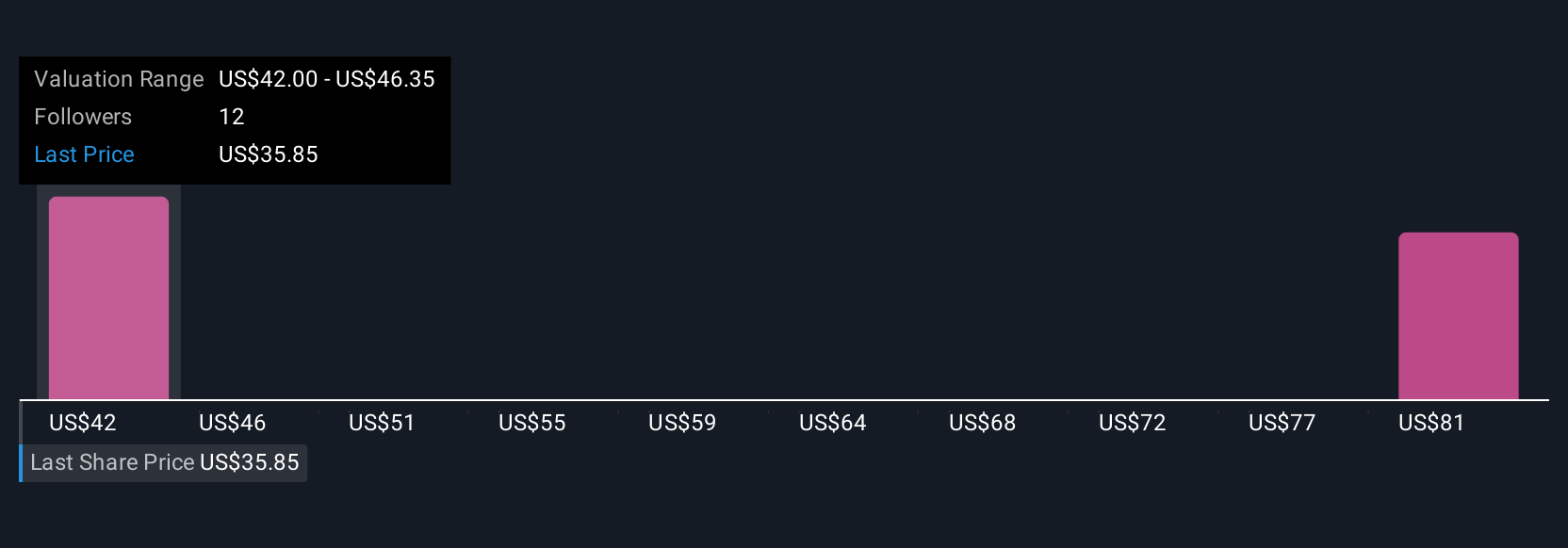

Uncover how Old Republic International's forecasts yield a $42.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair values for Old Republic International ranging from US$42.00 to US$68.26 across three distinct views. While many see upside in capital management, ongoing expense and cost risks are on the minds of several participants, highlighting the importance of exploring diverse investor outlooks.

Explore 3 other fair value estimates on Old Republic International - why the stock might be worth just $42.00!

Build Your Own Old Republic International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Old Republic International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Old Republic International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Old Republic International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives