- United States

- /

- Insurance

- /

- NYSE:MMC

Will MMC’s New AI-Driven HR Tools Signal a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Mercer, a subsidiary of Marsh & McLennan Companies, recently launched two AI-driven HR platforms, Workforce Insights and Aida, aimed at equipping HR professionals with data-backed insights and benchmarking tools for workforce management.

- This move underscores Marsh & McLennan's increasing focus on artificial intelligence to enhance client offerings and service differentiation within the evolving HR consulting space.

- We'll examine how this emphasis on AI-powered consulting solutions could influence Marsh & McLennan's long-term growth narrative and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Marsh & McLennan Companies Investment Narrative Recap

To be a Marsh & McLennan Companies (MMC) shareholder, one needs confidence that rising global risk complexity and growing regulatory requirements will sustain demand for MMC’s specialized risk and insurance advisory services, despite cyclical challenges. The launch of Mercer’s AI-powered HR platforms, Workforce Insights and Aida, supports the company’s push into AI and advanced analytics; however, this does not materially shift the primary short-term catalyst, which remains international demand for insurance solutions, nor does it directly mitigate the most pressing risk, being continued softness in property and reinsurance pricing.

Of the recent announcements, the appointment of Renee McGowan as Chief Commercial Officer, International, stands out as relevant, particularly as the company continues to pursue overseas growth and broaden the reach of new digital offerings like Mercer’s platforms. With global expansion a key driver for near-term top-line growth, successful integration of advanced consulting tools in international markets may become more critical if mature regions see increased pricing pressure.

In contrast, investors should be aware that persistent weakness in commercial insurance pricing remains a material headwind to...

Read the full narrative on Marsh & McLennan Companies (it's free!)

Marsh & McLennan Companies' outlook projects $30.7 billion in revenue and $5.3 billion in earnings by 2028. This is based on an anticipated 5.9% annual revenue growth rate and an increase in earnings of $1.2 billion from the current $4.1 billion.

Uncover how Marsh & McLennan Companies' forecasts yield a $232.42 fair value, a 16% upside to its current price.

Exploring Other Perspectives

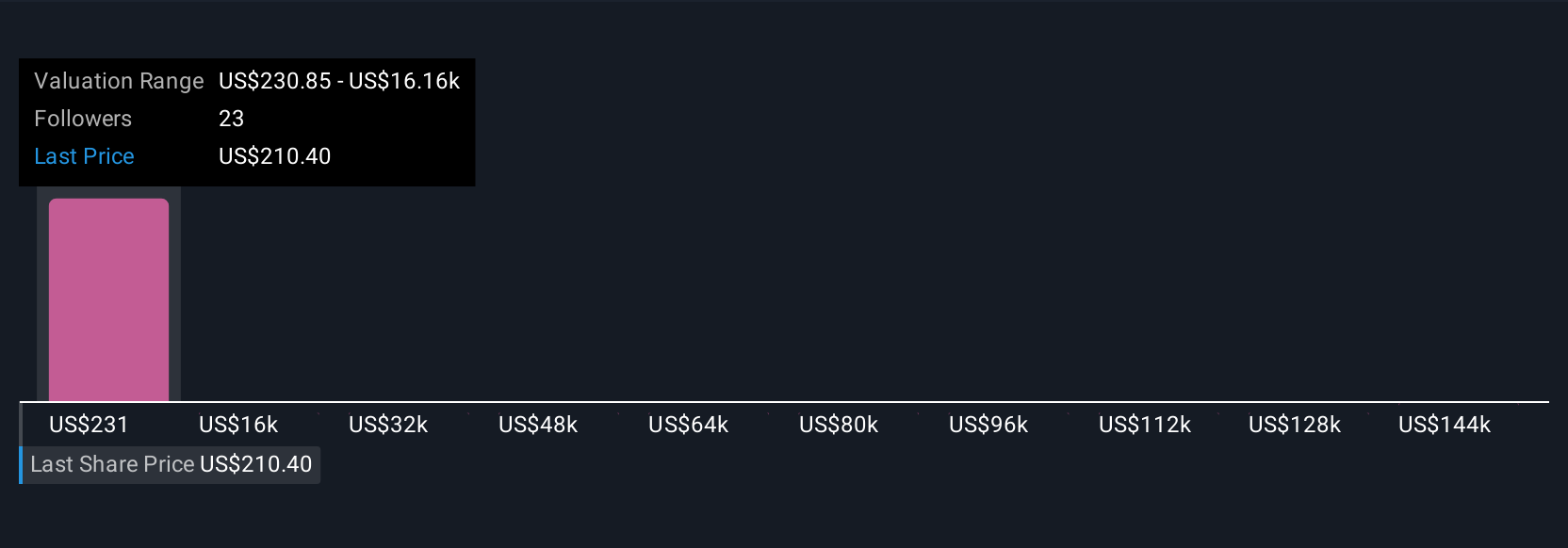

Three individual fair value estimates from the Simply Wall St Community span from US$232 to over US$159,000 per share, reflecting wide variation in investor outlooks. While many see growth opportunities in digital consulting, ongoing softness in insurance pricing could weigh on MMC’s future performance; see how others are approaching these scenarios.

Explore 3 other fair value estimates on Marsh & McLennan Companies - why the stock might be a potential multi-bagger!

Build Your Own Marsh & McLennan Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marsh & McLennan Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marsh & McLennan Companies' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success