- United States

- /

- Insurance

- /

- NYSE:MMC

Has Market Uncertainty Created an Opportunity in Marsh McLennan After Recent Share Price Weakness?

Reviewed by Bailey Pemberton

If you’ve been keeping an eye on Marsh & McLennan Companies lately, you’re probably wondering if now is the right moment to buy, sell, or simply hold tight. The stock has been on something of a journey. Over the last week, shares ticked up 0.6%, a fairly tame uptick, but zoom out and you’ll see a mixed picture: down 1.2% over the past month and off by 4.7% so far this year. Yet, looking back three and five years, investors have enjoyed solid gains of 36.7% and a whopping 85.9%, respectively. That kind of performance certainly catches attention, especially when you’re weighing future potential against today’s price.

Much of this recent movement has tracked broader market developments, with fluctuations in investor sentiment around financial services and shifting perspectives on risk management. While the last twelve months have seen a pullback of 6.9%, some of that reflects changes in how the market values legacy companies versus new disruptors, more than any company-specific setback for Marsh & McLennan. These swings highlight that one day’s dip is rarely the full story with a stable, diversified leader like this.

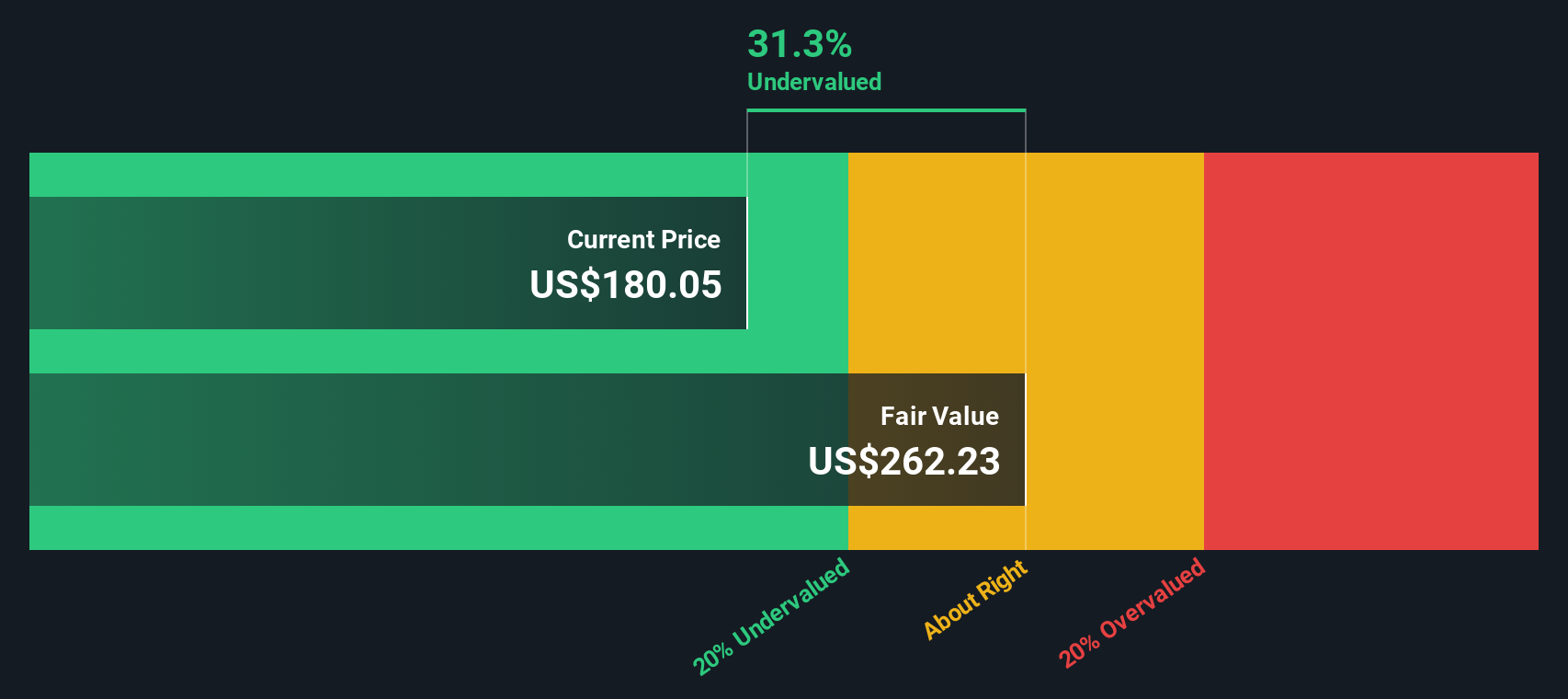

So, is Marsh & McLennan undervalued, or not? The numbers say it passes 3 out of 6 of our key undervaluation checks: not screamingly cheap, but not at all expensive either. Assessing the stock comes down to what you believe about its future, and how those beliefs line up with different valuation methods. Let’s dive into where those approaches agree and disagree, and later on, I’ll share the most insightful measure yet for putting a true value on Marsh & McLennan.

Why Marsh & McLennan Companies is lagging behind its peers

Approach 1: Marsh & McLennan Companies Excess Returns Analysis

The Excess Returns valuation model spotlights how effectively Marsh & McLennan can generate profits above the cost of its equity capital. Put simply, it measures whether the company’s assets consistently earn more than shareholders expect, based on risk. This approach focuses on the sustainability of those extra gains and their impact on long-term intrinsic value.

Let’s look at the relevant figures. The company’s current book value sits at $32.07 per share, projected to climb to $36.27 per share according to weighted future estimates from four analysts. Its projected stable Earnings Per Share (EPS) is $10.73, derived from six analyst forecasts for future return on equity, currently averaging an impressive 29.57%. Against a cost of equity of $2.46 per share, Marsh & McLennan is generating an excess return of $8.27 for each share held, which represents a substantial profitability premium.

Using this methodology, the model estimates an intrinsic value for Marsh & McLennan that is 22.6% higher than its current trading price. This indicates the stock is undervalued relative to its long-term earning power and capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Marsh & McLennan Companies is undervalued by 22.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

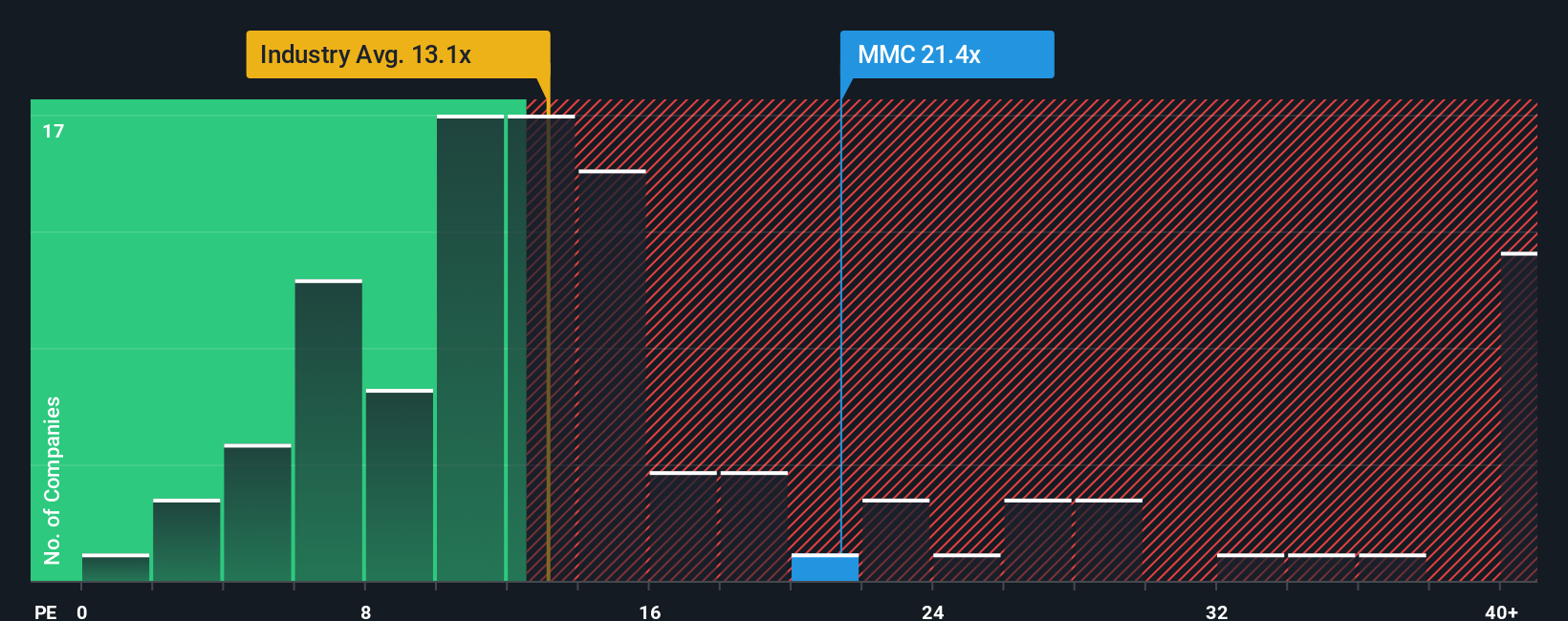

Approach 2: Marsh & McLennan Companies Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested way to value profitable companies like Marsh & McLennan because it relates how much investors are willing to pay for a dollar of current earnings. For businesses with steady profits, the PE ratio reflects both investor growth expectations and the perceived level of risk. Generally, higher anticipated growth or lower business risk justifies a loftier "normal" or "fair" PE ratio, while slower growth or greater uncertainty should drive it lower.

Marsh & McLennan currently trades at a PE ratio of 24x. For context, this is significantly higher than the Insurance industry’s average PE of 14.24x and also above its peer average of 59.49x. But these averages only tell part of the story, since they do not always fully capture a company’s specific prospects, profit margins, business model or risk profile.

This is where the Simply Wall St "Fair Ratio" comes in. It is a tailored metric that considers Marsh & McLennan’s actual earnings growth, risk, profit margins, size, and industry context. For this company, the Fair PE Ratio is estimated at 16.32x. Because this calculation accounts directly for the company’s unique strengths and challenges, it is a more meaningful benchmark than broader industry or peer group averages.

Comparing Marsh & McLennan’s current PE of 24x to its Fair Ratio of 16.32x suggests the stock is trading at a premium to its intrinsic value by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marsh & McLennan Companies Narrative

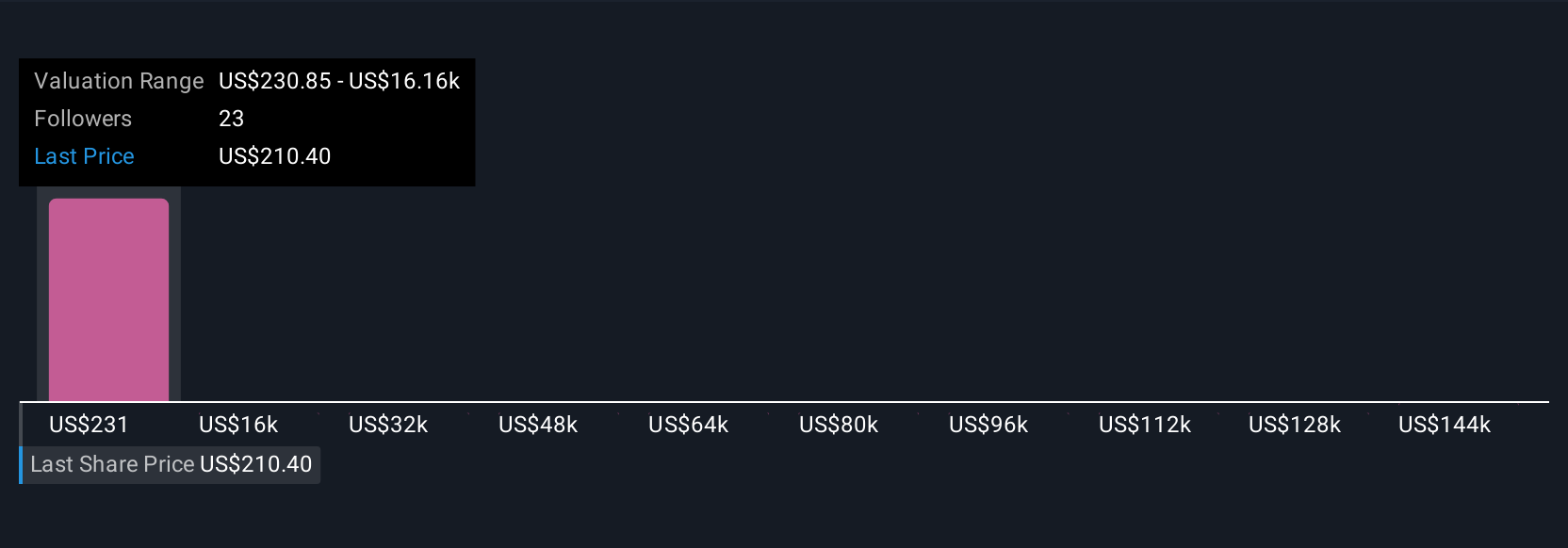

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about a company, how you see its business evolving, what you believe about its future, and the assumptions you make on key numbers like revenue growth, earnings, and profit margins. Narratives bridge the gap between company stories and numbers by letting you turn your perspective into a financial forecast and an estimated fair value.

On the Simply Wall St platform, millions of investors use Narratives on the Community page to weigh in with their own view, making investment decisions far more dynamic than just looking at ratios or analyst reports. Narratives help you decide when to buy or sell by showing whether your Fair Value estimate is above or below the current share price. This gives you a transparent, structured way to challenge or confirm your thinking as new information appears. Since Narratives update automatically with the latest news or earnings releases, your assessments always stay current.

For example, on Marsh & McLennan, some investors see long-term demand for risk advisory supporting a fair value as high as $258 per share, while others are more cautious, setting their outlook at $197. This demonstrates just how much investor perspective shapes valuation.

Do you think there's more to the story for Marsh & McLennan Companies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives