Stock Analysis

- United States

- /

- Insurance

- /

- NYSE:MKL

Markel Group's (NYSE:MKL) investors will be pleased with their decent 44% return over the last five years

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Markel Group Inc. (NYSE:MKL) share price is up 44% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 16%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Markel Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

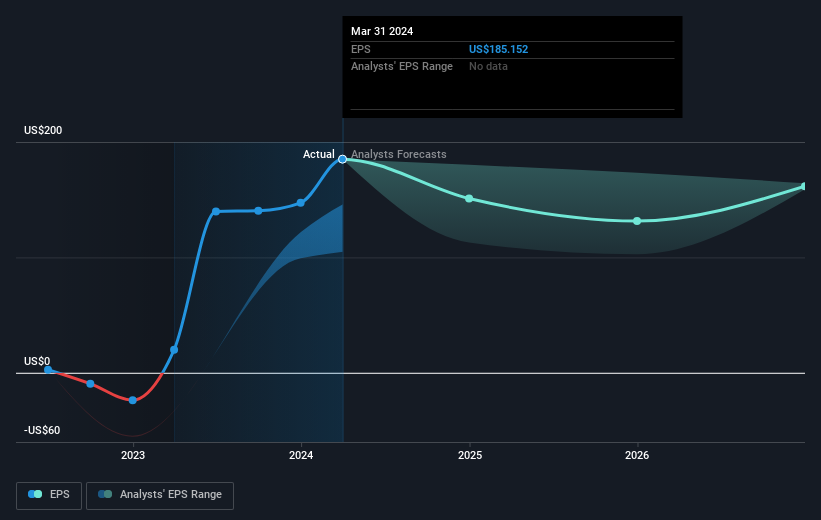

During five years of share price growth, Markel Group achieved compound earnings per share (EPS) growth of 38% per year. The EPS growth is more impressive than the yearly share price gain of 8% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 8.23 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Markel Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Markel Group provided a TSR of 16% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 8% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Markel Group is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Markel Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Markel Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

A diverse holding company, engages in marketing and underwriting specialty insurance products in the United States, Bermuda, the United Kingdom, and Germany.

Undervalued with solid track record.