- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (NYSE:MET) Unveils AI-Driven Online Protection Tools For Employer-Employee Wellness

Reviewed by Simply Wall St

MetLife (NYSE:MET) announced a new suite of online protection tools aimed at improving employee mental health and wellbeing, marking a significant step forward in its product offerings. This product launch aligns with increasing employee concerns around mental health and escalating parental anxiety about child online safety. Additionally, the company's share buyback activities and strong earnings report, along with strategic executive changes, likely supported the 11% rise in the price over the past month. Meanwhile, market trends showcasing mixed reactions to broader economic uncertainties might have added some weight to this upward movement, making MetLife's performance resonate positively amidst a flat market.

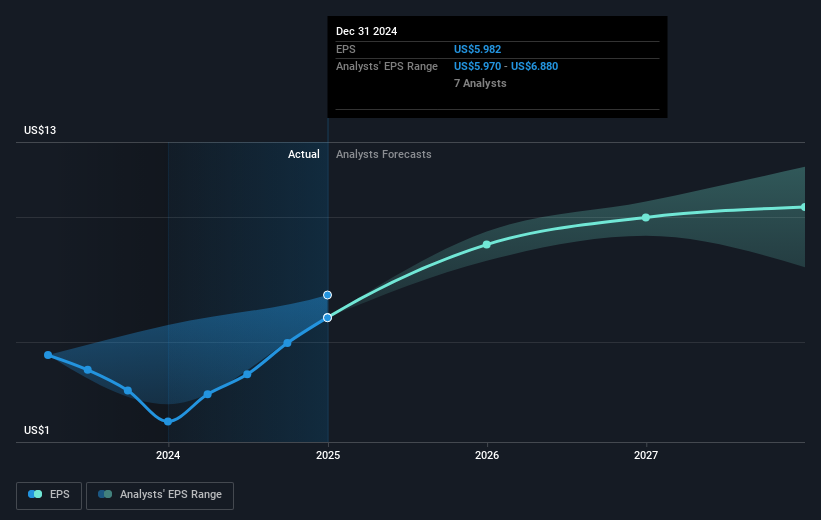

The introduction of MetLife’s innovative online protection tools is set to complement its New Frontier strategy, which focuses on expanding group benefits and asset management. These tools can potentially enhance revenue by addressing growing employee mental health concerns, aligning with MetLife’s aim to boost earnings through diversification. The recent 11% uptick in MetLife's share price reflects market optimism surrounding these product offerings and strategic initiatives, yet it still trades at a 15.5% discount to an analyst price target of US$90.43.

Over a five-year period, MetLife achieved a total shareholder return of 178.07%, underscoring its capacity for long-term growth. However, over the past year, the company’s performance has been in line with the broader US market, which saw an 8.2% return. Compared to the Insurance industry’s 17.1% return, MetLife slightly underperformed over the same period, despite its strong fundamentals and recent earnings growth.

The economic and strategic shifts highlighted in recent announcements may influence revenue and earnings forecasts. Analysts project MetLife's earnings to rise to US$6.2 billion by 2028, but economic headwinds and regulatory changes remain potential obstacles. Nonetheless, with a current trading price of US$76.42, MetLife presents an attractive value compared to its industry peers, suggesting room for upward movement to align more closely with analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives