- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (MET): Exploring Valuation Following Lower Earnings and Completion of Major Share Buyback

Reviewed by Simply Wall St

MetLife (MET) just posted its third quarter earnings, revealing a decline in both revenue and net income compared to last year. Alongside these results, the company has completed a major share buyback round.

See our latest analysis for MetLife.

Despite some recent turbulence, MetLife’s share price has managed to hold up, closing at $78.64 after the latest earnings and buyback news. The 1-year total shareholder return is down a modest 2.9%, but long-term holders have fared well with a nearly 100% total return over five years. This signals solid value for patient investors.

If you’re reassessing your strategy after MetLife’s recent moves, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and a substantial buyback just completed, the real question now is whether MetLife represents genuine undervaluation or if the market is already factoring in future growth prospects.

Most Popular Narrative: 15.4% Undervalued

With MetLife’s recent close at $78.64, the most widely followed narrative places its fair value much higher, suggesting the market could be missing key drivers. This sets the stage for a deeper look at what is behind this discrepancy.

Strategic expansion of asset-light, fee-generating businesses (like employee benefits, asset management, and longevity reinsurance), combined with disciplined capital management, supports higher return on equity and more consistent, less capital-intensive earnings growth.

Want to know how earnings momentum and leaner business lines fuel such a bullish outlook? It all comes down to future growth assumptions and a profit model that dares to challenge the sector norm. Curious why this narrative stands apart? Dive into the full story behind these bold projections.

Result: Fair Value of $93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in investment returns and slower digital adoption present real threats that could undermine MetLife’s projected long-term growth and profitability.

Find out about the key risks to this MetLife narrative.

Another View: What Do Earnings Ratios Say?

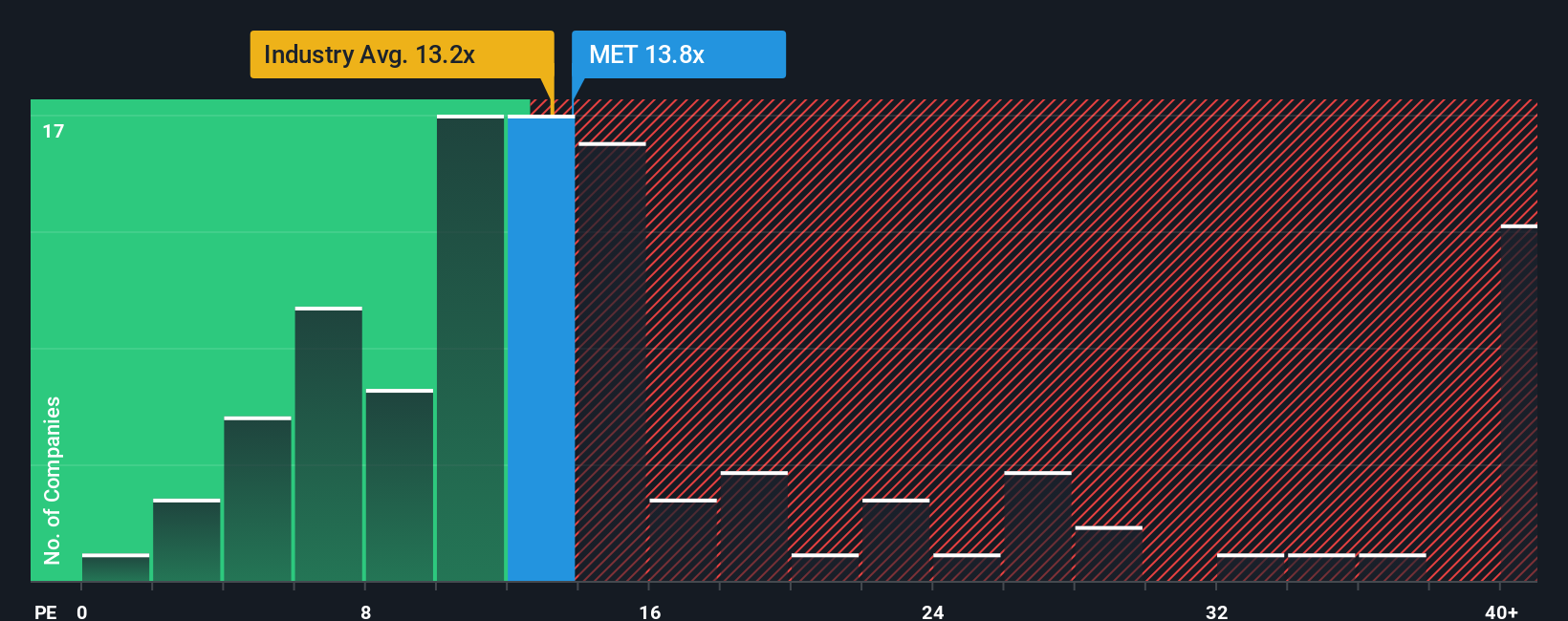

Looking at price-to-earnings, MetLife is currently trading at 14.3x, which is not only above the US Insurance sector average of 13.2x but also higher than its peer group average of 13.7x. However, our fair ratio estimate for MetLife is 17.9x. This gap could mean an opportunity if the market re-rates the stock towards that fair ratio, or a sign of valuation risk if returns stay muted. Will the P/E eventually reflect more optimism, or does the current premium leave little room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MetLife Narrative

Keep in mind, if you have a different perspective or want to dive into your own research, building your personal MetLife narrative takes just a few minutes. Do it your way

A great starting point for your MetLife research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio by tapping into smarter stock picks that reflect the biggest market trends and hidden growth drivers. Don’t wait—these fast-moving opportunities are time sensitive.

- Position yourself for long-term returns by targeting cash-generating businesses among these 873 undervalued stocks based on cash flows with robust fundamentals and attractive valuations.

- Spot innovation’s next wave when you track medical disruptors in these 31 healthcare AI stocks and align with breakthroughs transforming healthcare delivery and tech.

- Boost your passive income with steady, above-average yields through these 16 dividend stocks with yields > 3% and secure a stronger financial future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives