- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Evaluating Valuation After Fed Rate Cut Signals Spark Stock Surge

Reviewed by Simply Wall St

Mercury General (MCY) stock climbed after comments from New York Federal Reserve President John Williams signaled potential interest rate cuts. For insurers, a shift in rates often means stronger bond portfolio values and a friendlier outlook for financial stocks.

See our latest analysis for Mercury General.

Mercury General’s momentum has been impressive, with a 41.99% share price return year-to-date and a particularly strong 18.55% jump over the past month. While the latest rally was sparked by renewed optimism about interest rate cuts, the stock’s three-year total shareholder return of 180.67% suggests there is long-term growth potential, even when factoring in market volatility and industry risks.

If this kind of rebound has you thinking beyond the insurance sector, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

After such a dramatic run-up and strong long-term returns, the big question remains: is Mercury General still trading at an attractive valuation, or are investors already pricing in much of the company’s future growth potential?

Most Popular Narrative: 6.6% Undervalued

Mercury General's most widely followed narrative sets a fair value above its recent closing price, drawing attention to what is driving that premium. The consensus anchors its view on the company's operational strengths as well as projected financial trends. This offers insight amid recent market shifts.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Curious about the quantitative muscle behind this optimistic valuation? The narrative places weight on certain assumptions for growth, margins, and earnings. These numbers could surprise you. Find out what powers the price target and where the bold projections take a leap.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major wildfire losses or sustained surges in reinsurance costs could quickly undermine confidence in Mercury General’s bullish outlook.

Find out about the key risks to this Mercury General narrative.

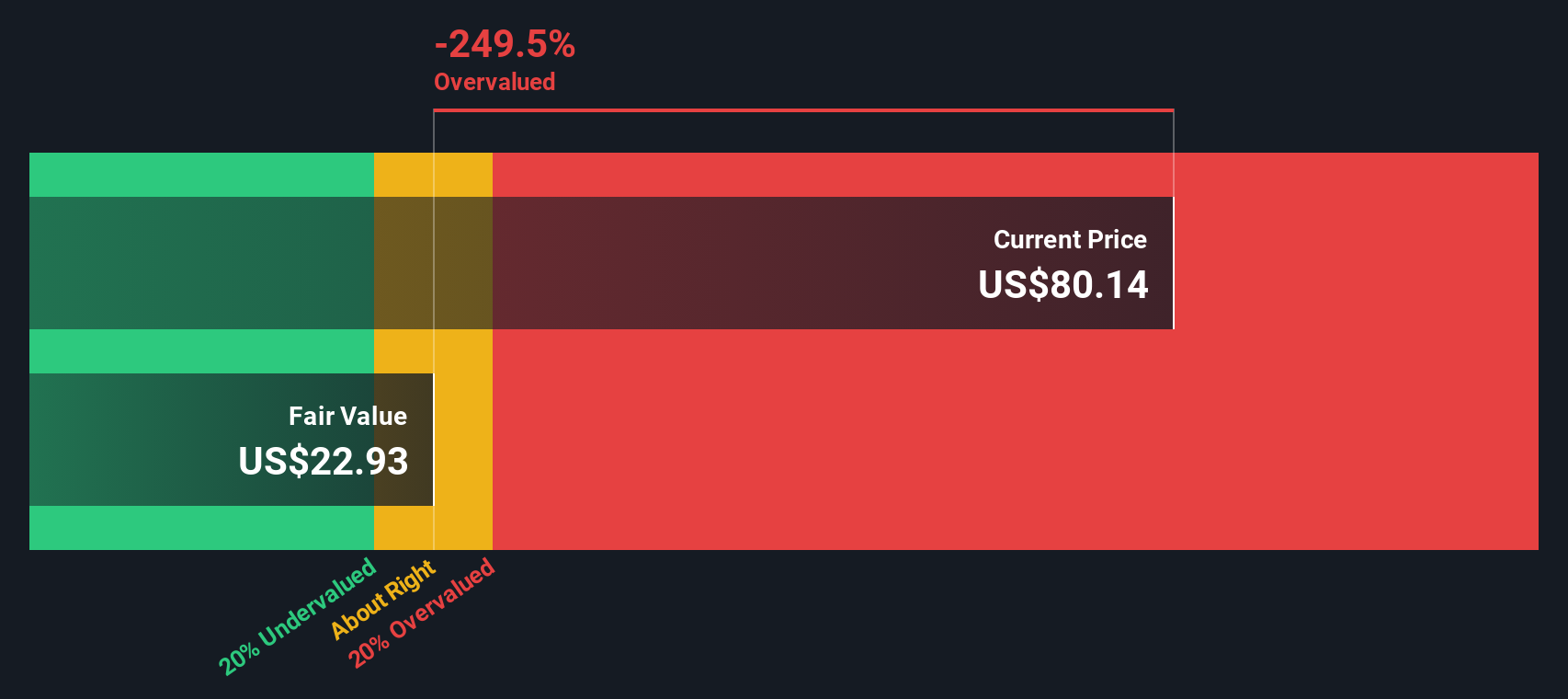

Another View: Discounted Cash Flow Model Challenges the Multiple Approach

While the market multiple analysis points to Mercury General being a bargain compared to its peers and the broader US market, the SWS DCF model presents a different perspective. According to our DCF, Mercury’s current share price is above its fair value estimate, suggesting the stock may be overvalued if future cash flows are lower than expected. Which view will prove more accurate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Let Simply Wall Street guide you toward stocks with real momentum, emerging technology, and steady potential you don’t want to miss out on.

- Boost your returns by tapping into these 926 undervalued stocks based on cash flows with significant upside, identified by robust fundamentals and compelling valuations.

- Catch the AI-driven companies at the forefront. See which names are making breakthroughs with these 25 AI penny stocks right now.

- Strengthen your portfolio with reliable income by targeting these 15 dividend stocks with yields > 3% offering yields above 3% and strong payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success