- United States

- /

- Insurance

- /

- NYSE:LNC

Lincoln National (LNC): Margin Compression Reinforces Value Narrative for Earnings-Focused Investors

Reviewed by Simply Wall St

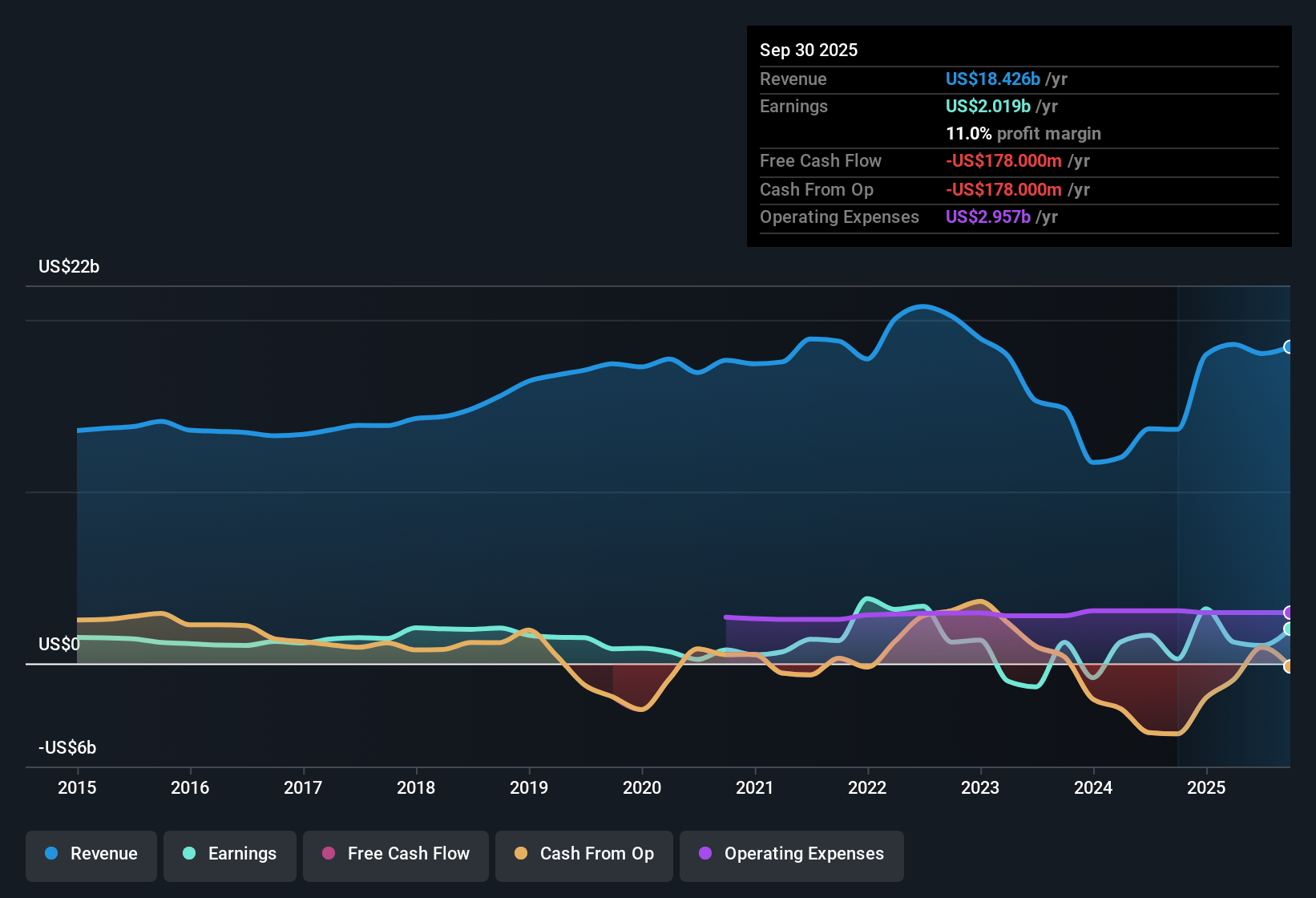

Lincoln National (LNC) is forecast to grow revenue at 3.5% per year, notably slower than the US market’s 10.3% rate. However, earnings are expected to rise 16.6% annually versus the broader US market’s 15.7% pace, even as net profit margin compressed to 5.8% from 12% a year ago. Against a backdrop of declining earnings averaging -5.4% per year over the past five years and a downtrend in profit margins, this new guidance points to profit growth ahead, but not at a rapid pace.

See our full analysis for Lincoln National.The next section breaks down how these earnings figures measure up against the prevailing narratives. This section highlights where investor expectations might shift.

See what the community is saying about Lincoln National

Margin Expansion Set to Reverse Recent Declines

- Analysts project net profit margin will rise from 5.8% now to 7.7% in three years, signaling a turnaround from last year's margin compression and giving investors a clearer target for future profitability.

- The analysts' consensus view highlights that ongoing digital modernization and investments in scalable, higher-margin products are expected to boost operational efficiency and long-term net margin growth.

- This approach is designed to counter legacy product risk and support sustained earnings improvement, tying future success to the effectiveness of technology upgrades and product mix shifts.

- However, consensus also notes persistent risks from legacy annuities and technology integration challenges could limit how much of this margin expansion the company actually realizes.

- Stronger net margins could validate analyst optimism, but much depends on the company’s ability to execute on these transformation initiatives. 📊 Read the full Lincoln National Consensus Narrative.

Share Dilution Puts Spotlight on Per-Share Growth

- With shares outstanding expected to climb 7.0% annually over the next three years, investors cannot rely solely on headline profit growth and must look closely at earnings per share progression to get a true sense of value creation.

- The analysts' consensus view acknowledges that while higher overall earnings, forecast up to $1.6 billion by 2028, represent a positive shift, gains at the company level may not fully translate into per-share benefits given dilution.

- The consensus narrative stresses that real upside will require Lincoln’s product innovation and cost discipline to not just grow profits but also to outpace the increase in share count. This remains a key tension for long-term holders.

- This dynamic, more than top-line or absolute profit gains, could ultimately determine how investors judge future earnings reports.

Valuation Discount Remains Deep Versus Industry

- At a price-to-earnings ratio of 7.4x, Lincoln National is trading well below the US insurance industry average of 13.2x and its peer group at 10.3x. This reinforces the view that the stock is priced for caution despite signs of profit recovery.

- The analysts' consensus view points out that, although the consensus price target is just 0.4% above the current share price of $40.69 (compared to the allowed target of $43.75), this minimal upside reflects a market that sees the fair value as largely realized unless profit growth or margin expansion materially beats forecasts.

- Analysts argue that unless company execution or industry momentum surprises on the upside, this value gap indicates investors may need fresh catalysts to re-rate the stock further.

- The discount’s persistence highlights that current favorable metrics are already being weighed against ongoing structural risks, limiting near-term revaluation potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lincoln National on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these numbers tell another story? In just a few minutes, you can shape your perspective into a fresh narrative: Do it your way.

A great starting point for your Lincoln National research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite signs of profit recovery, Lincoln National’s persistent share dilution and modest forecasted growth may hinder meaningful per-share value gains for investors.

If reliable, consistent earnings growth is your priority, check out stable growth stocks screener (2114 results) to find companies delivering steady results regardless of the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNC

Lincoln National

Through its subsidiaries, operates multiple insurance and retirement businesses in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives