- United States

- /

- Insurance

- /

- NYSE:LNC

Lincoln National (LNC) Is Up 5.2% After Profit Rebound and Mixed Q3 Results – Has Sentiment Shifted?

Reviewed by Sasha Jovanovic

- Lincoln National Corporation recently announced third-quarter results, reporting US$4.56 billion in revenue and net income of US$445 million, a turnaround from a net loss a year ago, while also declaring a quarterly dividend of US$0.5625 per depositary share on its 9.000% Non-Cumulative Preferred Stock, Series D, payable in December 2025.

- This mixed performance, featuring stronger than expected earnings per share despite revenue falling short of projections, highlights improved profitability even as revenue pressures persist.

- With Lincoln National’s earnings per share surpassing forecasts but revenue missing targets, we’ll consider how this affects the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lincoln National Investment Narrative Recap

To be a shareholder in Lincoln National today, you need to believe in its recovery story, centering on a shift toward higher-margin, less capital-intensive products and its ability to manage risks from legacy annuity guarantees. The recent Q3 earnings beat on profitability, despite revenue coming in below forecasts, is a sign of improved operational execution; however, it does not materially change the need to address ongoing revenue pressure, which remains the most important short-term catalyst, or the persistent capital strain risk from legacy products.

Among the recent developments, Lincoln National's announcement of a quarterly dividend on its 9.000% Non-Cumulative Preferred Stock, Series D, stands out as most relevant. The continuation of this dividend may offer reassurance to income-focused investors, especially while the company’s ability to maintain a strong capital position is center stage following improved but mixed quarterly results.

In contrast, investors should be mindful that capital strain from legacy variable annuity products could still create volatility for Lincoln National’s future earnings if...

Read the full narrative on Lincoln National (it's free!)

Lincoln National's outlook anticipates $21.0 billion in revenue and $1.6 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 5.2% and a $0.6 billion increase in earnings from the current $1.0 billion level.

Uncover how Lincoln National's forecasts yield a $43.75 fair value, a 4% upside to its current price.

Exploring Other Perspectives

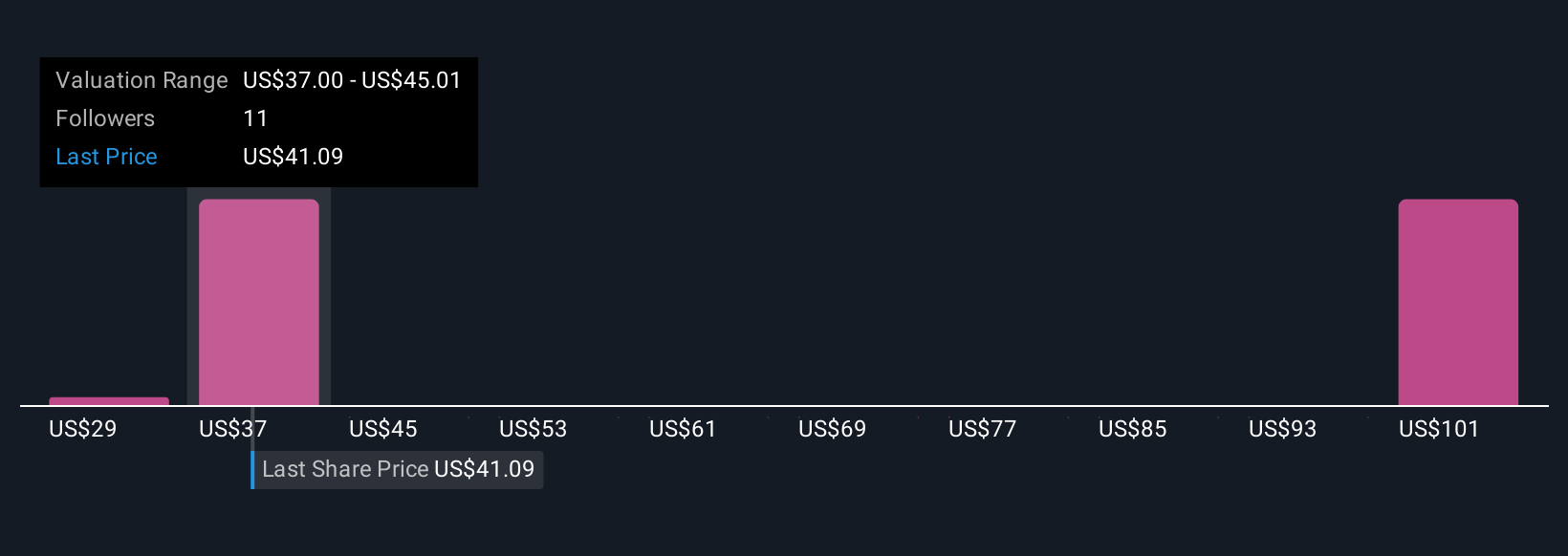

The Simply Wall St Community’s fair value estimates for Lincoln National span from US$28.99 to US$92.24, reflecting three distinct outlooks. While many are watching the company’s portfolio shift to more capital-efficient offerings, the risk from older annuity guarantees continues to shape discussions about Lincoln’s future performance.

Explore 3 other fair value estimates on Lincoln National - why the stock might be worth over 2x more than the current price!

Build Your Own Lincoln National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lincoln National research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lincoln National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lincoln National's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNC

Lincoln National

Through its subsidiaries, operates multiple insurance and retirement businesses in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives