- United States

- /

- Insurance

- /

- NYSE:LNC

How the New Evergreen Royalties Fund Could Shape Lincoln National's (LNC) Capital-Light Growth Strategy

Reviewed by Sasha Jovanovic

- On September 25, Lincoln Financial and Partners Group announced the launch of the Lincoln Partners Group Royalty Fund, the first evergreen private markets royalties fund offered to individual investors in the US, spanning sectors such as pharmaceuticals, music, media, and energy transition.

- This move diversifies Lincoln National's product lineup and opens access to alternative investments for retail clients, showcasing the company's push into innovative solutions alongside new annuity offerings.

- We'll examine how the launch of this cross-sector royalties fund could further reinforce Lincoln National's expanding capital-light strategy and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Lincoln National Investment Narrative Recap

To be a shareholder in Lincoln National, you need confidence in the company's ongoing shift toward a capital-light, diversified product mix and ability to deliver steady returns despite ongoing market uncertainty. The launch of the Lincoln Partners Group Royalty Fund signals ambition to innovate and broaden competitive advantages, but the near-term catalyst, successful growth of these capital-efficient offerings, remains mostly unaffected by recent headlines, while legacy business risks tied to volatile annuity products persist.

Among Lincoln's recent announcements, the release of the Lincoln Level Advantage 2 Income annuity stands out for its relevance. This product complements the core objective of expanding less capital-intensive income solutions, which can help offset headwinds from outflows and fee pressures in more mature business lines.

Yet, despite these advances, investors should not overlook the contrasting challenge of ongoing exposure to legacy variable annuity risks…

Read the full narrative on Lincoln National (it's free!)

Lincoln National's outlook anticipates $21.0 billion in revenue and $1.6 billion in earnings by 2028. This implies a 5.2% annual revenue growth rate and a $0.6 billion increase in earnings from the current $1.0 billion.

Uncover how Lincoln National's forecasts yield a $43.42 fair value, a 11% upside to its current price.

Exploring Other Perspectives

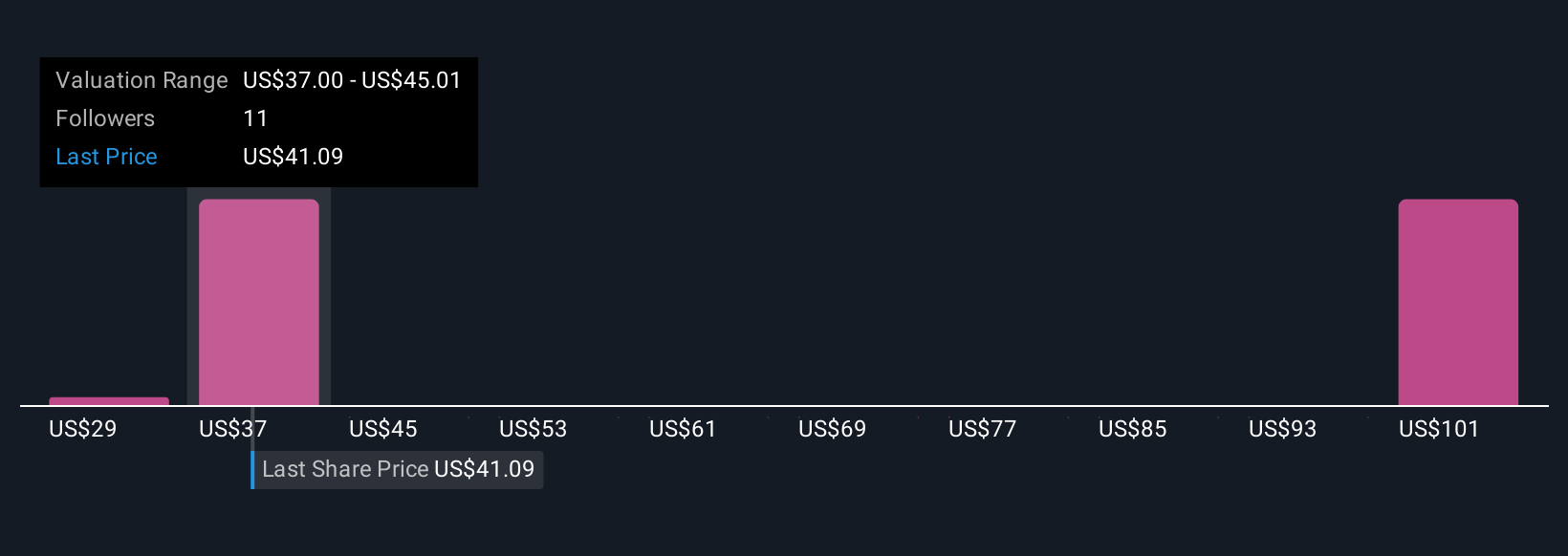

Three fair value estimates from the Simply Wall St Community range from US$28.99 to US$81.52 per share, highlighting wide divergences in outlook. In light of persistent risks from legacy annuities, these varying opinions reflect the different ways participants weigh growth potential against structural headwinds, inviting you to compare several perspectives for a fuller view.

Explore 3 other fair value estimates on Lincoln National - why the stock might be worth 26% less than the current price!

Build Your Own Lincoln National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lincoln National research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lincoln National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lincoln National's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNC

Lincoln National

Through its subsidiaries, operates multiple insurance and retirement businesses in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives