- United States

- /

- Insurance

- /

- NYSE:LMND

Will Geoff Seeley’s Appointment Signal a New Marketing Edge for Lemonade’s (LMND) Expansion Strategy?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Lemonade appointed Geoff Seeley, Chief Marketing Officer of PayPal, to its Board of Directors as a Class I director, with a term expiring at the 2027 annual meeting.

- Seeley's extensive leadership experience scaling international consumer brands and driving digital adoption in highly competitive industries introduces relevant expertise to Lemonade's board as the company expands across markets and insurance lines.

- We'll explore how the addition of a seasoned marketing leader like Seeley may influence Lemonade's outlook and long-term expansion strategy.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lemonade Investment Narrative Recap

To be a shareholder in Lemonade, you need to believe in its potential to redefine insurance through technology and international expansion, while managing risks tied to competition, underwriting, and cost control. The addition of Geoff Seeley to the board brings marketing expertise that could help refine customer acquisition strategies, but it is not a material enough event to affect the company's most immediate catalyst, demonstrating improved operating leverage and sustainable margin expansion, or shift the biggest risk, which remains operational execution in a fast-moving, competitive sector.

Among recent announcements, Lemonade's expansion into the auto insurance market, now available in states representing 42% of the U.S. car insurance sector, stands out. This growth move is central to the company's outlook, yet success hinges on Lemonade's ability to balance aggressive customer acquisition with improvements in core business metrics such as loss ratios and operating margins. But with heightened competition from traditional and new insurtech providers, investors should also be aware that...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion in revenue and $201.4 million in earnings by 2028. This requires 44.9% yearly revenue growth and a $405.4 million earnings increase from current earnings of -$204.0 million.

Uncover how Lemonade's forecasts yield a $46.50 fair value, a 11% downside to its current price.

Exploring Other Perspectives

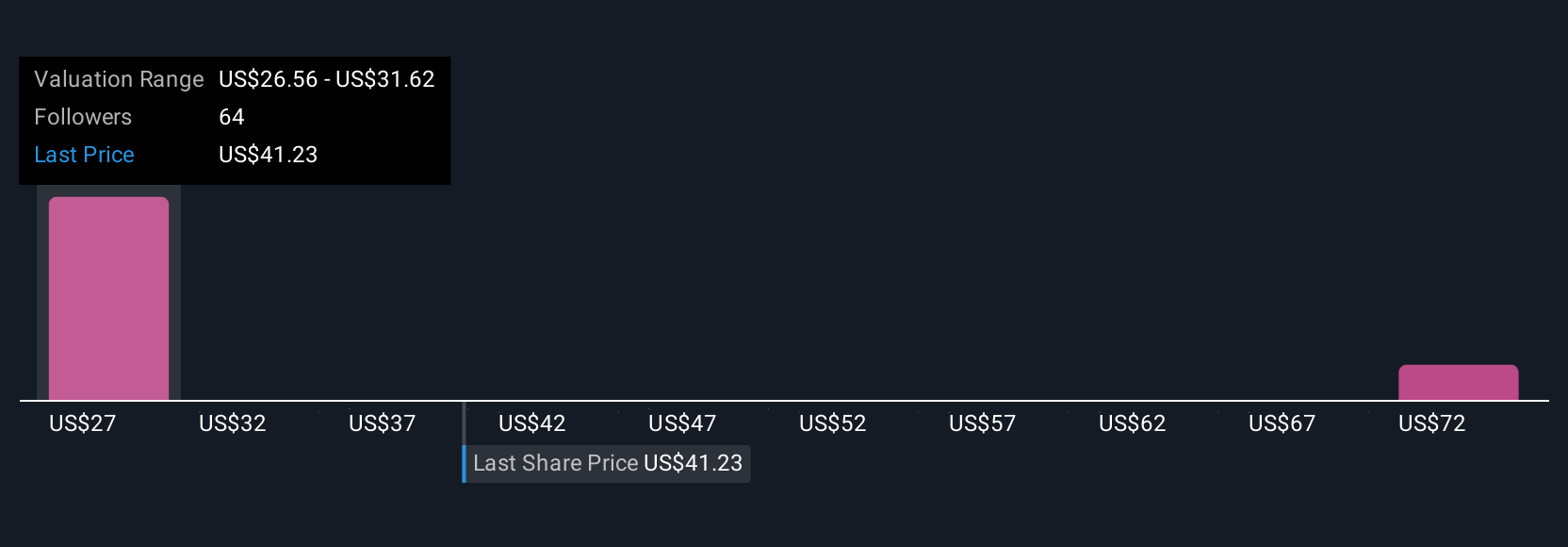

Thirteen private investors from the Simply Wall St Community estimate Lemonade's fair value between US$23.34 and US$77.14 per share. While many see revenue growth as a catalyst, you should compare these views with the risk that sustained losses may delay profitability.

Explore 13 other fair value estimates on Lemonade - why the stock might be worth less than half the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion