- United States

- /

- Insurance

- /

- NYSE:LMND

Lemonade (LMND) Is Up 13.9% After Reporting Narrower Losses and Strong Q2 Revenue Growth - What's Changed

Reviewed by Simply Wall St

- Lemonade, Inc. announced its second quarter 2025 earnings, reporting revenue of US$164.1 million and a reduced net loss of US$43.9 million compared to the same period last year.

- Improved financial results and persistent institutional investor interest highlight Lemonade's ongoing efforts to enhance operational efficiency and expand its market position through technology.

- We'll explore how Lemonade's narrowing net losses and substantial revenue growth impact the company's broader investment narrative and future outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Lemonade Investment Narrative Recap

To be a shareholder in Lemonade, you need to believe in its ability to translate rapid technology-driven growth into sustainable revenue gains, while narrowing losses and carving out market share in a crowded insurance space. The recent earnings, showing record US$164.1 million revenue and reduced net loss, support the story of operational improvement, but don't materially alter the biggest catalyst (accelerating top-line growth via new markets and products) or the main risk (balancing continued growth with the path to profitability and managing claim volatility).

One of the most relevant recent moves was the July 2025 launch of Lemonade Car in Indiana, following similar expansion efforts across the US and Europe. This expansion is in line with Lemonade’s aggressive push into new geographies and verticals, reinforcing the core catalyst of revenue growth through product and regional diversification.

Yet, in contrast to this growth, investors should also be aware that Lemonade’s expanding product lineup may intensify exposure to claims volatility and...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion in revenue and $197.0 million in earnings by 2028. This requires 43.7% yearly revenue growth and a $401.0 million earnings increase from -$204.0 million today.

Uncover how Lemonade's forecasts yield a $35.33 fair value, a 35% downside to its current price.

Exploring Other Perspectives

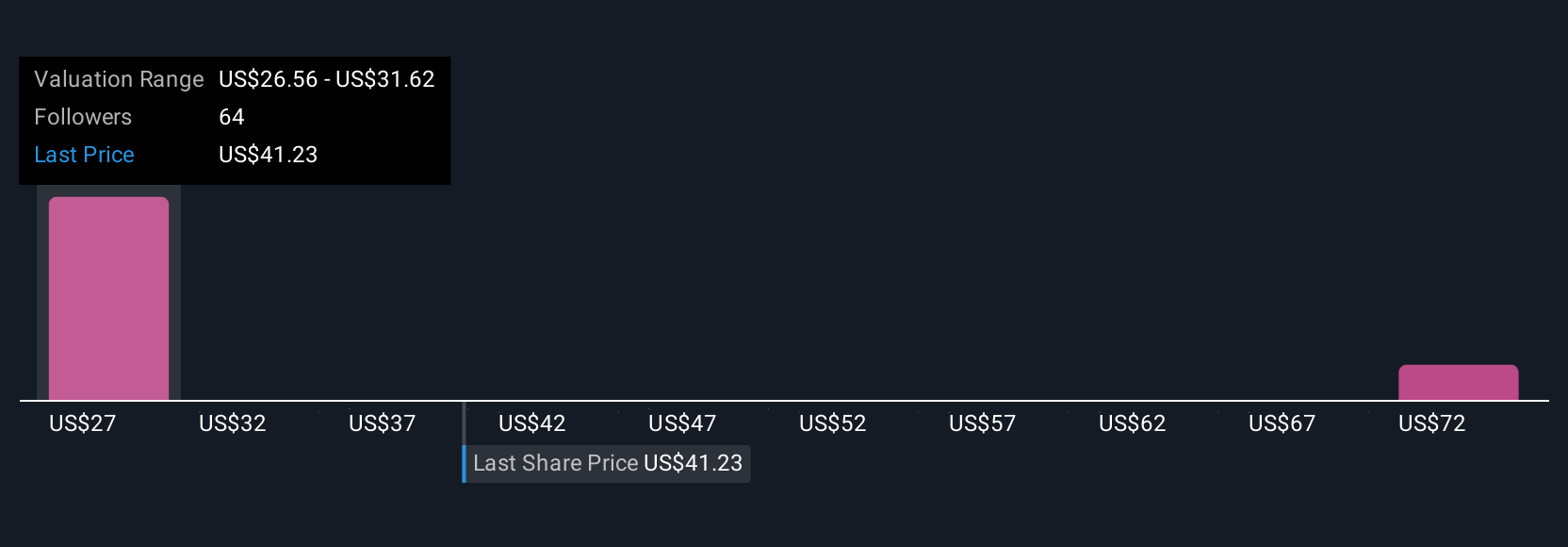

Ten fair value estimates from the Simply Wall St Community span from US$26.56 to US$77.14, reflecting a wide range of investor viewpoints. With revenue growth outpacing the industry but persistent net losses, it is important to consider how profitability challenges could shape Lemonade’s future, explore what other investors are seeing that you might not have considered.

Explore 10 other fair value estimates on Lemonade - why the stock might be worth less than half the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

No Opportunity In Lemonade?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives