- United States

- /

- Insurance

- /

- NYSE:HIG

How Recent Market Volatility Shapes Hartford’s 2025 Value Outlook

Reviewed by Bailey Pemberton

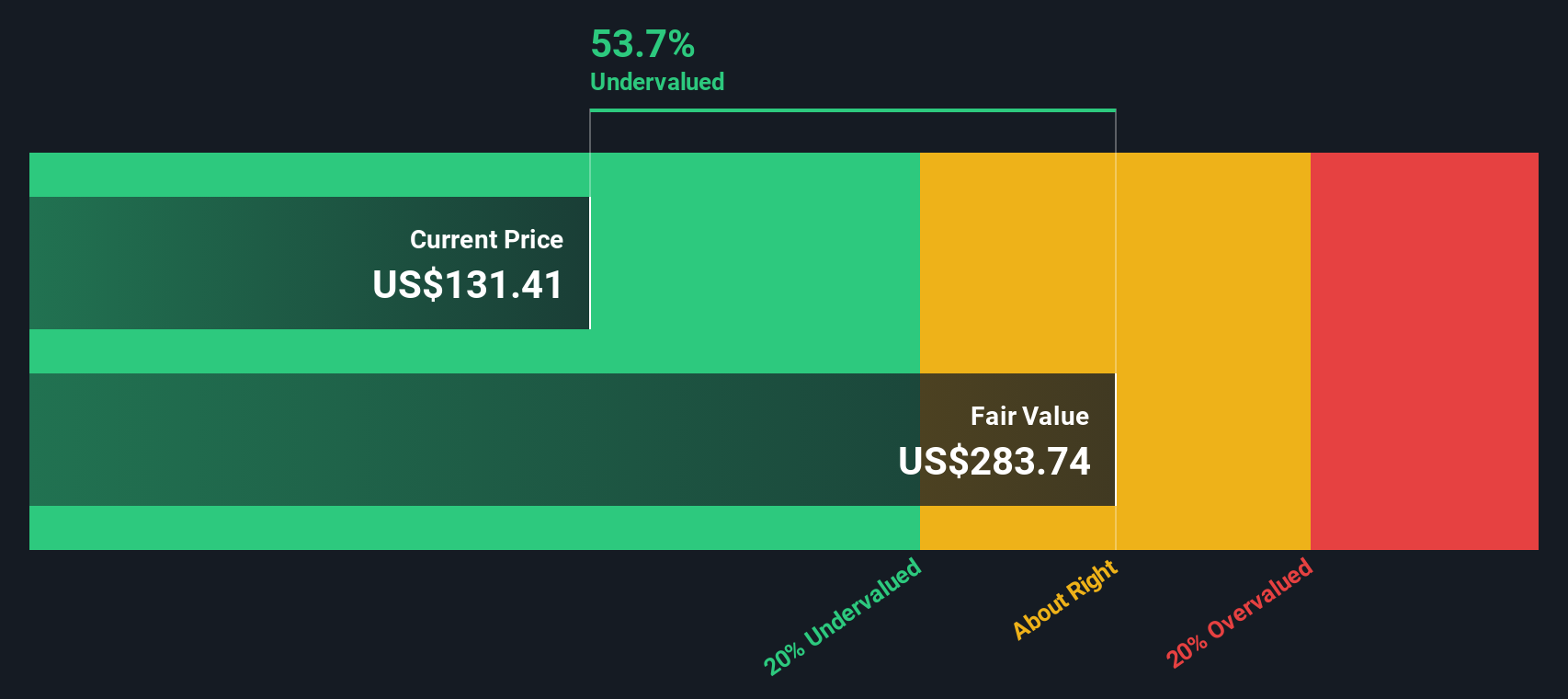

If you are wondering whether now is the right time to buy, hold, or take your gains on Hartford Insurance Group, you are not alone. Investors have watched this insurer steadily outperform for years, but a few recent twists in the stock price have many pausing to reassess. Over the last five years, Hartford’s shares have soared by a remarkable 240.8%. Year-to-date gains still stand at 14.1%, though short-term bumps, with returns down 3.5% over the past week and off 4.7% this month, suggest the market is recalibrating after a stretch of strong excitement.

What’s going on? Several recent market developments have played into shifting risk perceptions around insurance sector stocks, and Hartford has not been immune. Yet even after these recent moves, Hartford's one-year return remains positive at 3.7%. Over the past three years, shareholders have seen their investment nearly double, with a 96.6% return. This combination of impressive sustained growth and short-term volatility leaves many investors wondering: how much is Hartford really worth?

That is where valuation comes in. By conventional measures, Hartford Insurance Group scores a strong 5 out of 6 on our value checklist, meaning it appears undervalued by almost every metric we track. In the next section, we will break down which valuation approaches support Hartford’s investment case and examine exactly how those numbers stack up. And before you make a decision, stick around, as there might be an even smarter lens for understanding value that most investors miss.

Approach 1: Hartford Insurance Group Excess Returns Analysis

The Excess Returns valuation model evaluates how much profit a company is able to generate from its shareholders' equity above the minimum required return, known as the cost of equity. This approach is especially relevant for financial firms like Hartford Insurance Group, as it focuses on the ability to create value over time through superior return on invested capital.

According to the model, Hartford's current book value stands at $60.88 per share, with an average return on equity of 18.38%. The stable earnings per share projected by analysts is $12.98, while the cost of equity is $4.79 per share. This results in an excess return of $8.20 per share, demonstrating Hartford's ability to consistently earn well above its capital costs. Additionally, future estimates suggest the stable book value could rise to $70.65 per share, based on consensus from nine analysts.

Based on these projections, the Excess Returns model estimates Hartford's intrinsic value at $292.42 per share. With the model indicating the stock is trading at a 57.4% discount to its intrinsic value, Hartford appears significantly undervalued using this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hartford Insurance Group is undervalued by 57.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hartford Insurance Group Price vs Earnings

For profitable companies like Hartford Insurance Group, the Price-to-Earnings (PE) ratio is a widely recognized and practical valuation metric. The PE ratio helps investors understand how much the market is willing to pay for each dollar of current earnings, making it especially relevant for insurers with stable and predictable profits.

Interpreting what makes a “normal” or “fair” PE ratio, however, involves more than just comparing numbers. Growth expectations and the perceived risk associated with the company or sector play a significant role. A higher expected growth rate or lower risk profile often justifies a higher PE. In contrast, slower growth or higher risks typically means a lower PE is appropriate.

Currently, Hartford Insurance Group trades at a PE ratio of 10.85x. This is not only below the industry average of 13.18x, but also lower than the peer group average of 11.21x. However, using Simply Wall St’s proprietary “Fair Ratio,” which factors in elements like Hartford’s earnings growth, profit margin, risk profile, industry characteristics and market cap, the appropriate multiple for Hartford is calculated at 14.11x. This tailored approach offers a more accurate valuation reference than industry or peer comparisons alone because it captures all the unique attributes that directly impact Hartford’s value proposition.

Since Hartford’s actual PE is well below its Fair Ratio, it suggests the stock is currently undervalued based on this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hartford Insurance Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative captures your view of Hartford Insurance Group's future; it is your story behind the numbers, where you bring together your fair value estimate, future revenue, earnings and margins based on what you believe will drive the company's success or challenges.

Rather than just focusing on historical ratios or standard forecasts, Narratives let you directly connect a company's story to its financial forecast, and then to a calculated fair value in one simple process. On Simply Wall St’s Community page, you can access Narratives used by millions of investors and see a range of scenarios, all tailored to each investor’s view and easily updated as new news or earnings are released.

This tool helps you act decisively. If your Narrative’s fair value is above the current price, you might decide to buy, but if the numbers reverse, you can quickly reassess. For instance, some investors are optimistic, projecting Hartford Insurance Group could be worth up to $163 per share if its technology investments and disciplined underwriting drive strong future growth. Others take a more cautious stance, setting a fair value as low as $120 to account for industry headwinds and risk.

Do you think there's more to the story for Hartford Insurance Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hartford Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIG

Hartford Insurance Group

Provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives