- United States

- /

- Insurance

- /

- NYSE:HG

Where Does Hamilton Insurance Group Stand After Its 31% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Hamilton Insurance Group stock right now? You are not alone. With so many investors on the hunt for value, it is easy to see why this insurance name keeps popping up in conversations about smart picks and untapped opportunities. Hamilton's share price has had its quiet spells, but take a closer look and you will spot some compelling momentum, up more than 31% year-to-date, with a matching one-year return at 31%. That is a clear sign the market is gaining confidence in the company, even if the last month or two has brought only slight moves. The past 30 days saw a modest 0.9% bump, while the last week was essentially flat, down just 0.3%. This performance is steady, if not spectacular, for a stock that has already powered ahead this year.

So, the real question is whether Hamilton Insurance Group is still undervalued after this impressive run, or if it is finally getting the recognition it deserves. On the surface, the valuation case looks pretty robust: Hamilton earns a value score of 5 out of 6, based on several key checks that we will break down shortly. That is the kind of stat that makes value-focused investors sit up and take notice. Let us dive into the most common valuation approaches to see where Hamilton stands, and stay tuned for a deeper take on how to really measure what this stock may be worth.

Approach 1: Hamilton Insurance Group Excess Returns Analysis

The Excess Returns model is designed to assess how effectively a company generates returns above its cost of equity. It measures how much additional value management can create for shareholders, beyond what investors could expect from a fairly safe investment.

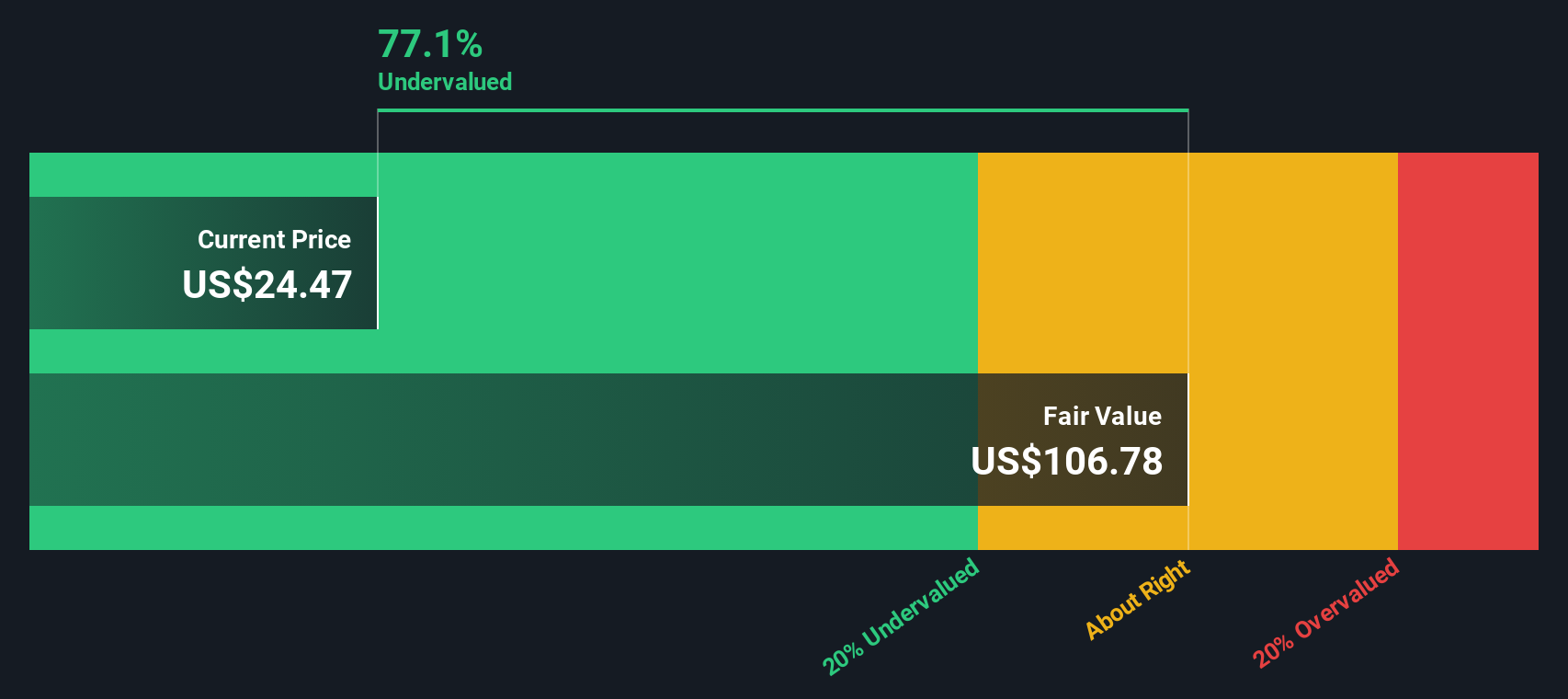

For Hamilton Insurance Group, the data looks compelling. The company reports a book value of $25.55 per share and a stable earnings per share (EPS) of $4.93, as predicted by a consensus of five analysts. Its cost of equity is $2.15 per share, while the calculated excess return is $2.78 per share. This reflects an average return on equity of 15.51%. Projections estimate a stable book value rising to $31.80 per share, indicating a healthy future capital base.

Using this model, the estimated intrinsic value per share is $106.96. This suggests a significant 77.0% discount compared to the current share price. In other words, the market appears to be underpricing Hamilton based on its ability to generate superior returns for shareholders.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hamilton Insurance Group is undervalued by 77.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hamilton Insurance Group Price vs Earnings

For profitable companies like Hamilton Insurance Group, the price-to-earnings (PE) ratio is often a go-to valuation metric. The PE ratio offers a snapshot of how much investors are willing to pay for each dollar of current earnings, helping to gauge whether a stock is pricey or a bargain relative to its profits. Growth prospects and perceived risks play a big role here, since faster-growing or lower-risk companies typically command higher PE multiples.

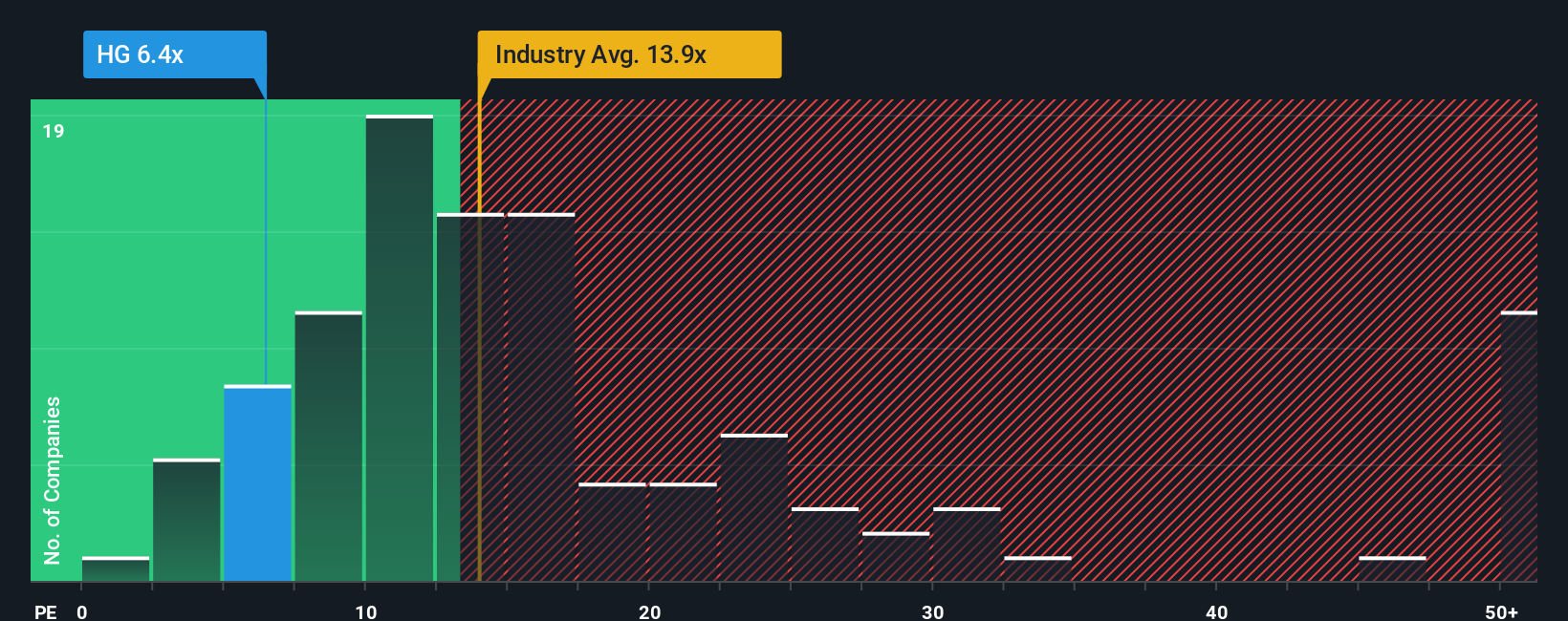

Hamilton currently trades at a PE ratio of 6.47x. This is well below the insurance industry average of 14.23x and significantly undercuts the peer average of 18.92x. Even so, just looking at industry or peer comparisons can be misleading because they ignore important differences in growth rates, profit margins, and risk profiles.

That is where Simply Wall St’s proprietary Fair Ratio comes in. Unlike basic peer or industry averages, the Fair Ratio estimates what a “normal” PE should be for Hamilton based on its earnings growth, risk profile, industry context, profit margin, and market capitalization. For Hamilton, the calculated Fair Ratio is 13.64x. This is more than double the stock’s current PE, indicating the market could be undervaluing the company, especially when factoring in its fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hamilton Insurance Group Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful feature designed to help you interpret what truly drives a stock’s value. A Narrative is essentially your investment story, connecting your outlook for a company (like its future revenue, margins, and fair value) with the numbers, so you can put personal assumptions behind your valuation instead of relying solely on typical models.

Narratives create a direct link between a company’s story, including its key growth drivers, risks, and competitive landscape, and your financial forecast, then translate all of that into a dynamic fair value. On Simply Wall St’s Community page, millions of investors share and refine their Narratives, making it easy and accessible to compare viewpoints and build your conviction.

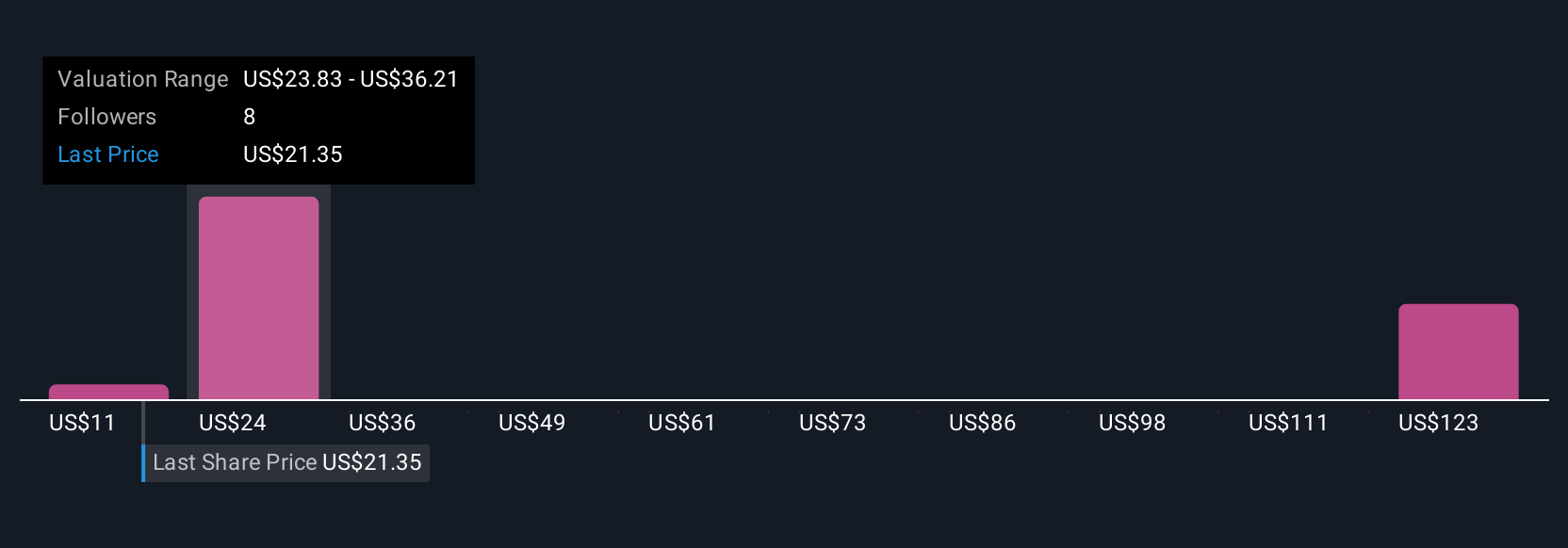

With Narratives, you can instantly compare fair value to the current price and decide when it might be time to buy or sell, while your view stays updated automatically whenever major news or earnings are released. For example, for Hamilton Insurance Group (NYSE:HG), one investor may see a fair value as high as $29.00 due to optimism about specialty insurance growth and global expansion. Another, more cautious, investor estimates a fair value of just $23.00 given concerns about volatile reinsurance markets and competitive pressures.

Do you think there's more to the story for Hamilton Insurance Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives