- United States

- /

- Insurance

- /

- NYSE:HG

Should Investors Reassess Hamilton Insurance Group After Latest 3.8% Weekly Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with Hamilton Insurance Group stock right now? You are not alone. After a year of outsized returns, nearly 26% year-to-date and 22.9% over the last twelve months, the stock has become a talking point for both seasoned investors and those just starting their portfolios. Yet in the past week, shares have dipped by 3.8%, a sign that even on the way up, there is plenty of short-term volatility to navigate.

This recent fluctuation comes in the context of broader insurance sector trends, including shifting risk appetites and evolving market dynamics. Despite the slight dip this week, the stock’s stability over the past month and far stronger longer-term performance suggest that most investors still see growth potential. Throughout industry conversations, Hamilton Insurance Group has increasingly been mentioned as undervalued by several fundamental metrics.

How undervalued? According to a structured valuation review, think of it as a six-point checklist, Hamilton Insurance Group scores a solid 5 out of 6. That is an impressive mark, and it is why many investors are keeping a close watch on the company as a potential long-term holding.

So, how does Hamilton Insurance Group stack up as an investment? Let’s break down those valuation checks, compare them to what matters most for shareholders, and then take a look at the smarter ways to use all this analysis to make confident, well-informed decisions about the stock.

Approach 1: Hamilton Insurance Group Excess Returns Analysis

The Excess Returns model evaluates a company based on how much value it generates above the required return for its investors, focusing heavily on return on equity and projected growth. This method helps investors understand how efficiently Hamilton Insurance Group is putting its capital to work relative to the cost of that capital.

According to this valuation, Hamilton Insurance Group stands out with a Book Value of $25.55 per share and a Stable EPS of $4.99 per share, based on weighted future Return on Equity estimates from four analysts. The Cost of Equity is $2.19 per share, which translates to an Excess Return of $2.81 per share. The average Return on Equity is an impressive 15.49 percent, and Stable Book Value projections rise to $32.25 per share, sourced from three different analyst estimates.

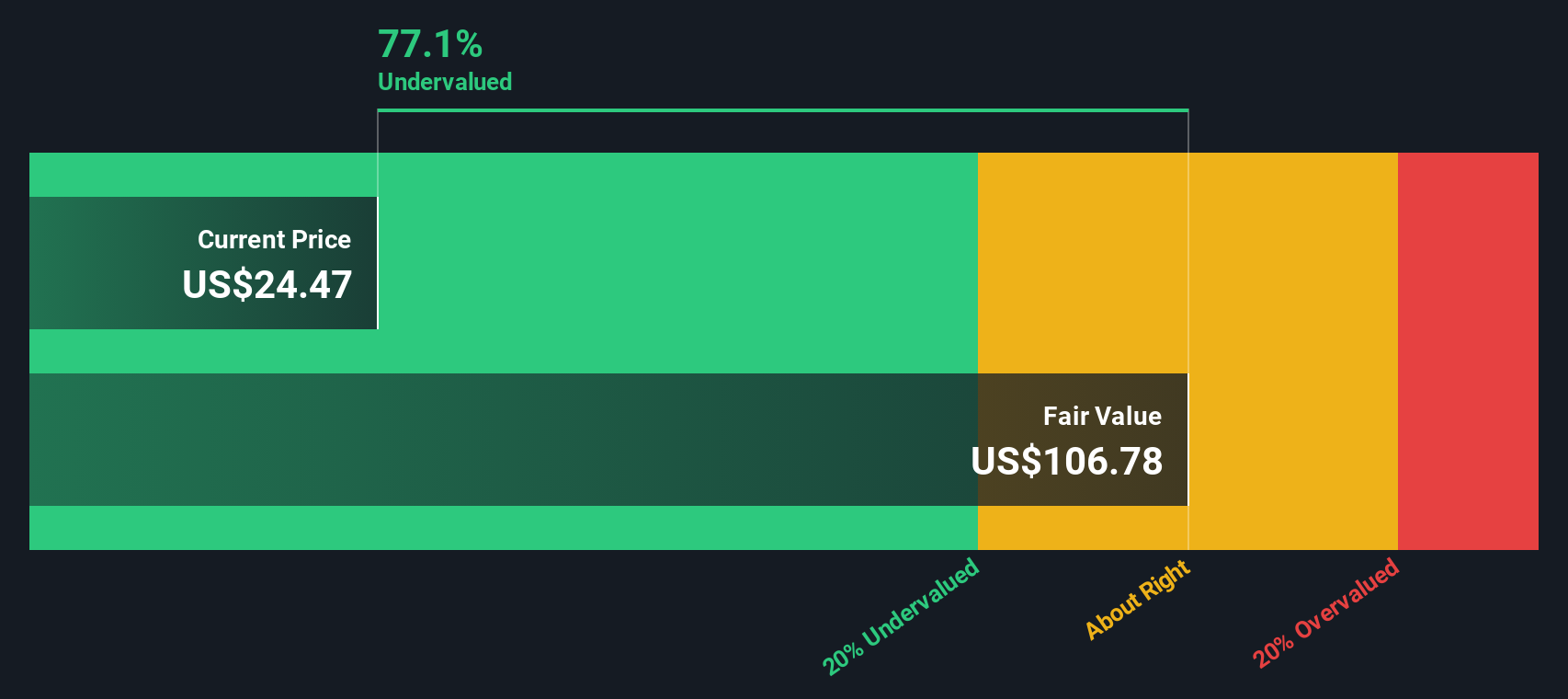

This model estimates an intrinsic value for Hamilton Insurance Group stock that is roughly 78.3 percent above its current trading price. This suggests the stock is undervalued by a substantial margin based on its excess returns on invested capital. The numbers indicate solid profitability and discipline, both of which support long-term shareholder value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hamilton Insurance Group is undervalued by 78.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hamilton Insurance Group Price vs Earnings

For profitable companies like Hamilton Insurance Group, the Price-to-Earnings (PE) ratio is a go-to metric for quickly gauging value. Since earnings reflect the company’s actual profit generation, comparing the share price to those profits helps investors understand what they're really paying for each dollar of earnings.

Determining what counts as a "normal" or "fair" PE ratio depends on several factors, especially growth expectations and risk. Businesses with above-average growth rates or lower business risks often deserve a higher PE, while those facing headwinds or more uncertainty might trade at a discount.

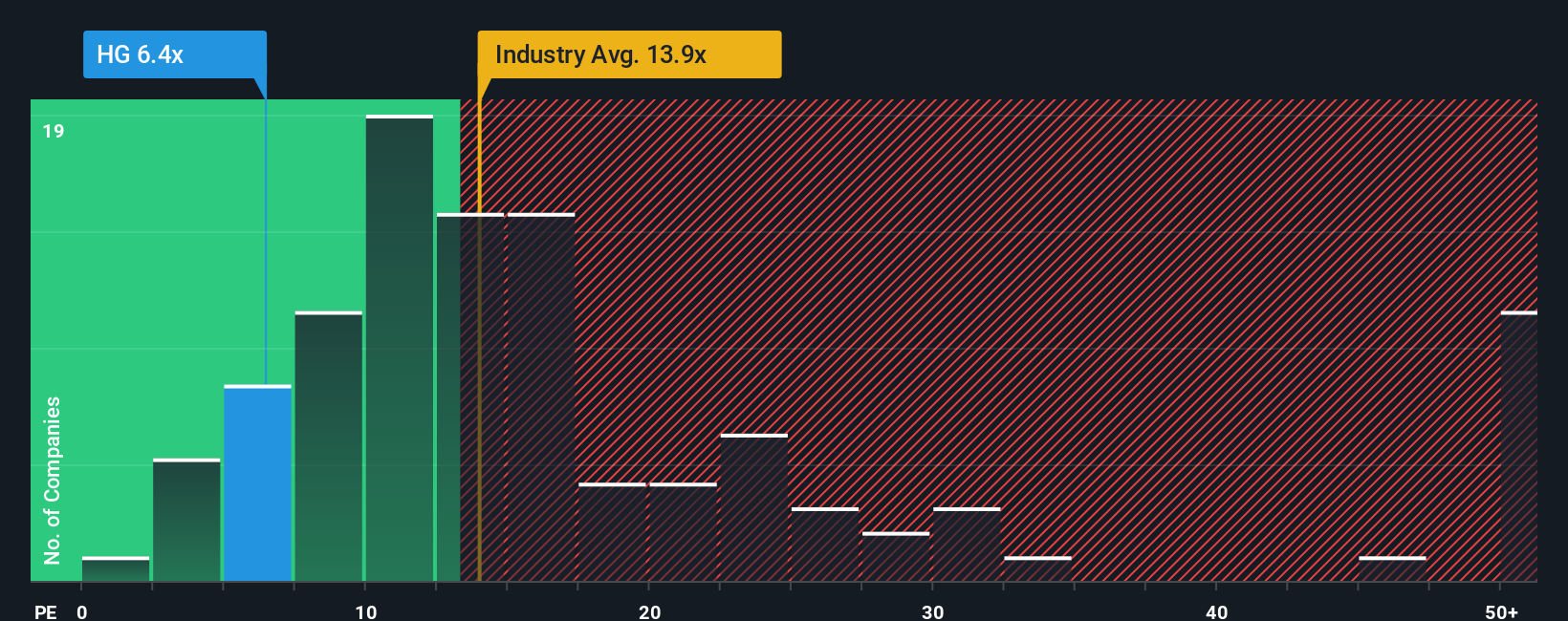

At present, Hamilton Insurance Group trades at a PE of 6.19x, which is considerably lower than both the insurance industry average of 13.65x and its direct peer group average of 11.87x. This signals that, compared to others, the market is pricing Hamilton Insurance Group quite cheaply.

The “Fair Ratio,” which is Simply Wall St’s proprietary PE multiple, takes into account not just growth and profits, but also factors like risk, market cap, and industry norms to set a more tailored benchmark. This is a step above just referencing industry or peer averages because it accounts for the company’s unique earnings profile and market environment.

Hamilton Insurance Group’s Fair Ratio is 13.35x. Its actual PE of 6.19x is meaningfully below this level, making a strong case the stock is undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hamilton Insurance Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about Hamilton Insurance Group, made practical by connecting your views on the business, such as future revenue growth, profit margins, and fair value, to a clear set of numbers. It bridges the gap between what’s happening in the real world and what those trends mean for valuation, bringing the company’s story and a financial forecast together in one accessible tool.

On Simply Wall St’s Community page, Narratives are easy for anyone to use and update. Millions of investors already tap into them. Narratives help you spot when to buy or sell by comparing Fair Value (what the company is really worth given your assumptions) to the current share price, and they automatically adjust as soon as new news or financials come out.

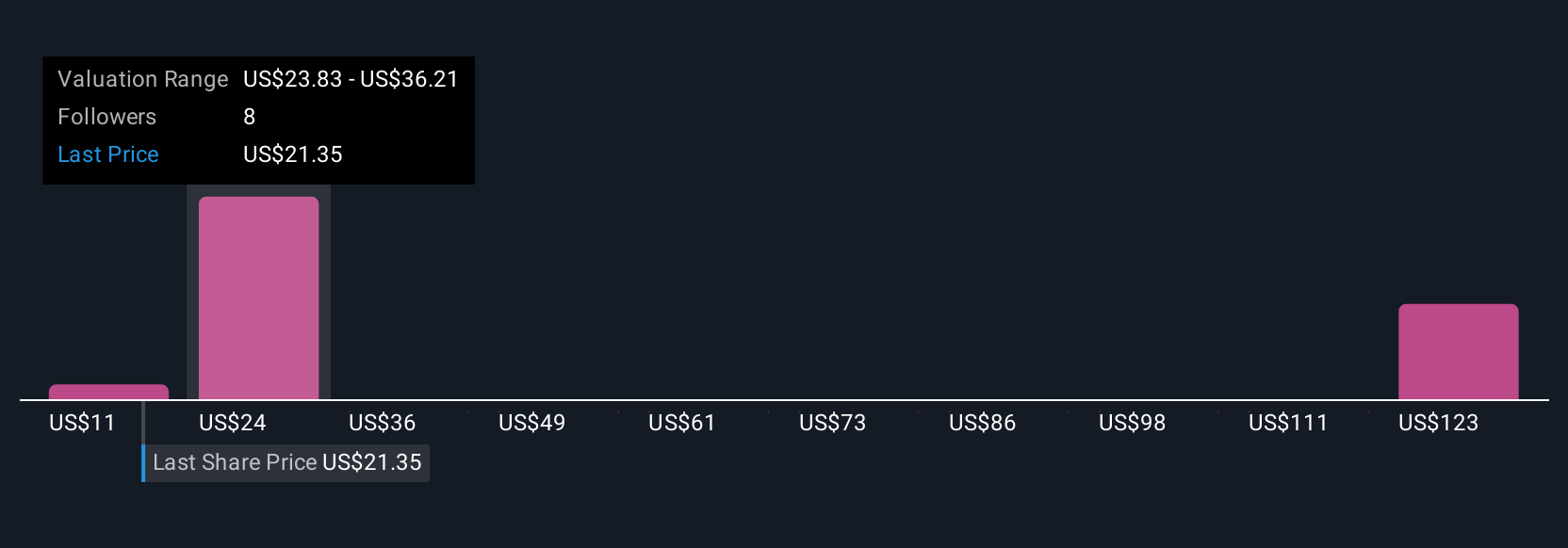

For Hamilton Insurance Group, some investors build bullish Narratives around continued digital transformation and specialty insurance growth, leading them to estimate a fair value as high as $29.00 per share. Others highlight risks and put fair value as low as $23.00 per share, providing a powerful example of how Narratives let you see and compare every perspective in a dynamic, transparent way.

Do you think there's more to the story for Hamilton Insurance Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives