- United States

- /

- Insurance

- /

- NYSE:HCI

Should HCI Group's (HCI) Rising Dividend and Short Interest Shift Its Risk-Reward Profile?

Reviewed by Sasha Jovanovic

- HCI Group recently went ex-dividend on November 21, 2025, with shareholders of record set to receive a US$0.40 per share dividend on December 19, 2025, amid notable increases in short interest and consistent positive earnings estimate revisions.

- This combination of a higher dividend payout, bullish earnings outlook, and rising short interest highlights heightened investor focus and mixed sentiment around HCI Group's near-term performance.

- We'll explore how the upcoming dividend and positive earnings outlook influence HCI Group's investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

HCI Group Investment Narrative Recap

To be a shareholder in HCI Group, one must believe in the company's ability to sustain earnings and dividend growth through technology-driven insurance underwriting, even as it remains highly concentrated in the Florida market. The recent spike in short interest brings increased market attention, but does not materially change the narrative that the most important near-term catalyst is HCI’s ability to execute on profit and revenue growth, while the biggest risk remains its exposure to large weather events or a shrinking pool of profitable policy acquisitions. Among recent developments, the quarterly dividend announcement set for December 19, 2025, directly ties into HCI’s ongoing commitment to shareholder returns and financial stability. This news backstops the earnings momentum seen across consecutive quarters and illuminates how regular dividends can serve as an anchor for investors focused on income, especially amid mixed market sentiment and elevated short-selling activity. By contrast, investors should be aware that HCI’s sustained reliance on the Citizens Insurance depopulation process has left it vulnerable to ...

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion revenue and $342.7 million earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million earnings increase from $137.6 million today.

Uncover how HCI Group's forecasts yield a $213.75 fair value, a 23% upside to its current price.

Exploring Other Perspectives

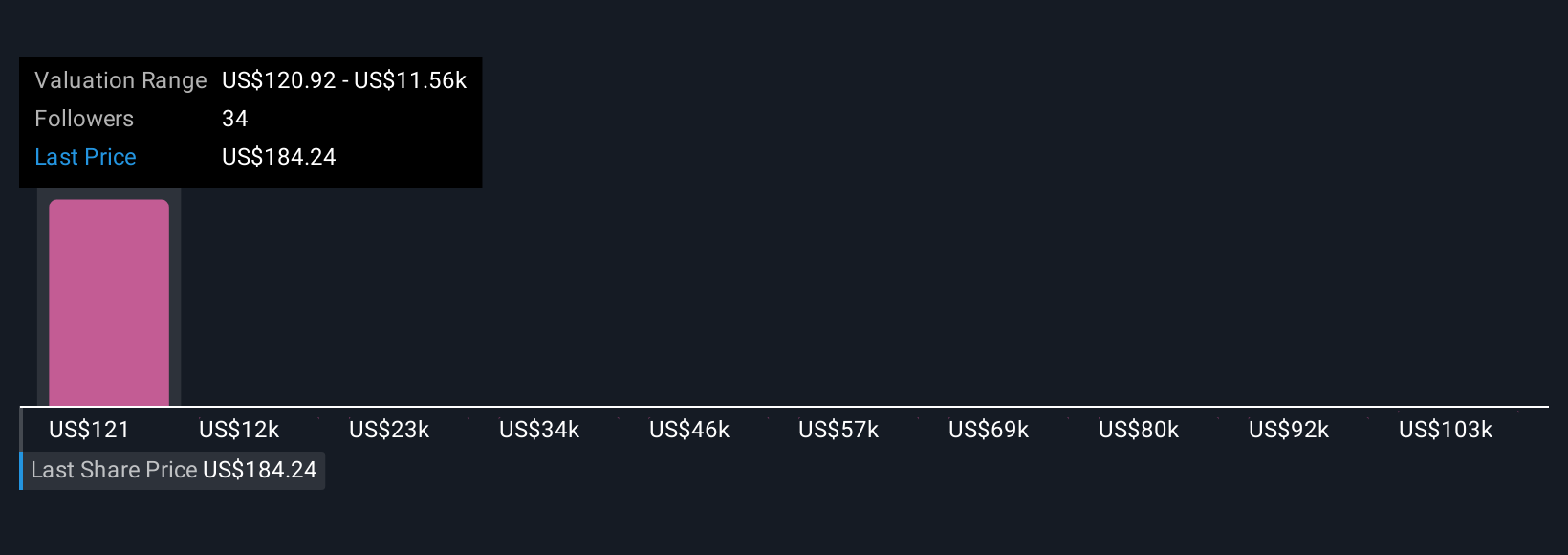

Six community fair value estimates for HCI Group range from US$120.92 to over US$114,561.05, highlighting extreme variation in investor opinion. With concentrated Florida exposure remaining a pressing risk, individual outlooks can diverge sharply, consider reviewing multiple viewpoints when assessing HCI’s prospects.

Explore 6 other fair value estimates on HCI Group - why the stock might be worth 30% less than the current price!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives