- United States

- /

- Insurance

- /

- NYSE:HCI

Does HCI Group (HCI) Blend Tech Ambitions and Capital Returns to Shape Its Future Strategy?

Reviewed by Sasha Jovanovic

- The board of directors of HCI Group, Inc. declared a regular quarterly cash dividend of US$0.40 per common share, scheduled for payment on December 19, 2025 to shareholders of record as of November 21, 2025.

- Alongside this announcement, HCI Group’s majority-owned Exzeo Group filed for a proposed IPO, while the company also reported quarterly earnings exceeding expectations, underlining ongoing progress in both insurance operations and technology innovation.

- We'll explore how Exzeo Group's IPO filing and the robust quarterly results may influence HCI Group's evolving investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

HCI Group Investment Narrative Recap

To own shares of HCI Group, investors need to believe in the company’s ability to balance Florida insurance growth with technology innovation, all while successfully managing exposure to weather risks and a shrinking pool of profitable policies. The newly declared cash dividend and Exzeo Group’s IPO filing reinforce HCI’s focus on rewarding shareholders and building value, but these moves do not materially shift the biggest short-term catalyst, unlocking value from Exzeo, or the principal risk of Florida catastrophe losses and policy growth headwinds.

Of the recent announcements, the proposed IPO of Exzeo Group stands out as the development most closely tied to HCI’s evolving story. As Exzeo has been core to HCI’s underwriting precision and margin profile, this potential separation could amplify both the upside of a focused technology platform and the risk of lower operational synergy, connecting directly to the company’s most pressing catalyst and risk. Yet, investors should pay special attention to how concentrated Florida exposure remains a double-edged sword for earnings and ...

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion in revenue and $342.7 million in earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million increase in earnings from the current level of $137.6 million.

Uncover how HCI Group's forecasts yield a $202.50 fair value, in line with its current price.

Exploring Other Perspectives

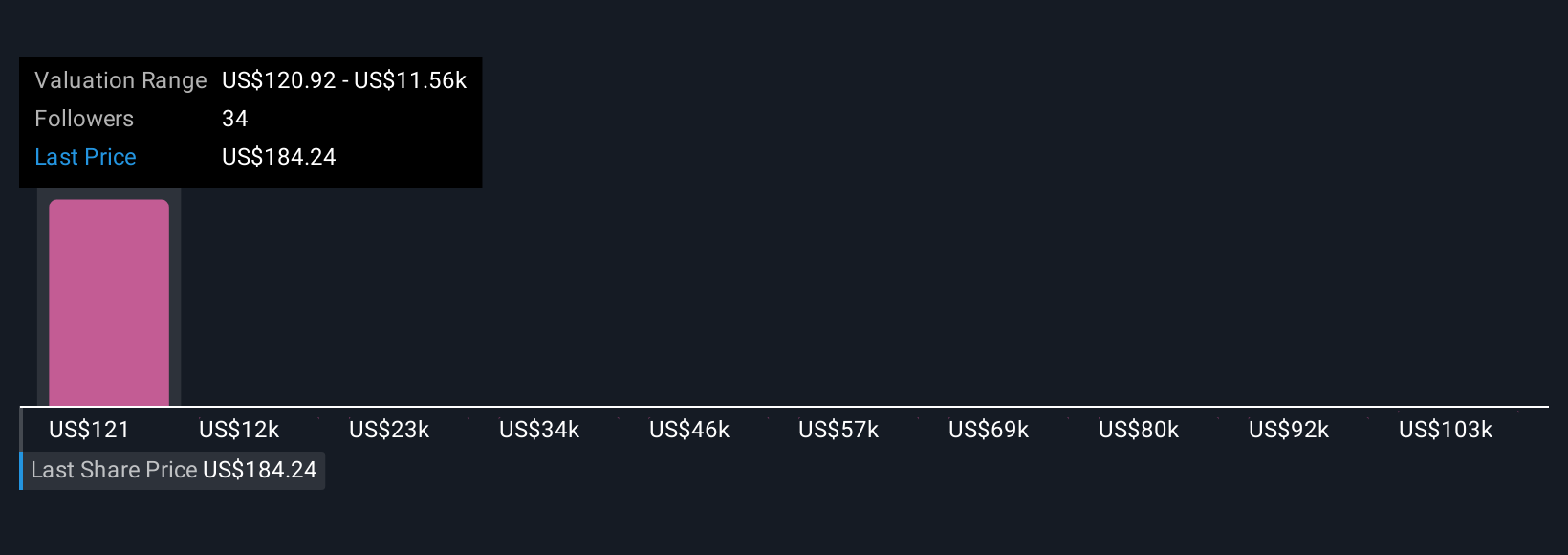

The Simply Wall St Community’s six fair value estimates for HCI Group range widely from US$120.92 up to US$114,561.05. While these numbers reflect very different outlooks, many also point to concerns about HCI’s continued reliance on a shrinking pool of attractive Florida policies and the implications for future growth, inviting you to explore these varied perspectives further.

Explore 6 other fair value estimates on HCI Group - why the stock might be a potential multi-bagger!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives