- United States

- /

- Insurance

- /

- NYSE:FNF

How Investors Are Reacting To Fidelity National Financial (FNF) Dividend Hike and Tech-Focused Strategy

Reviewed by Sasha Jovanovic

- Fidelity National Financial recently participated in the Stephens Annual Investment Conference in Nashville, where leadership discussed optimism in the housing market, commercial segment growth, and shareholder returns including a recently announced 4% dividend increase payable December 31, 2025.

- The company also emphasized ongoing investments in AI and technology to reinforce operational efficiency and highlighted its continued focus on capital-light strategies within its F&G segment.

- With these updates, we'll assess how Fidelity National Financial's commitment to increased shareholder returns could influence its investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Fidelity National Financial Investment Narrative Recap

Fidelity National Financial’s story rests on the belief that real estate transaction activity can recover and that ongoing digital investment will ultimately improve margins. The company’s recent dividend increase and optimistic tone at the Stephens Annual Investment Conference do not materially change the short-term business catalyst: a rebound in title transaction volumes amid lingering market volatility, nor do they lessen the biggest risk, which remains further weakness in U.S. housing or persistently high costs pressuring margins.

Of the company’s recent updates, the announcement of a 4 percent dividend increase is especially relevant as it aligns with Fidelity’s stated commitment to returning capital to shareholders. This could appeal directly to income-focused investors, but it does not directly address the near-term headwinds of soft transaction volumes and cost pressures that continue to weigh on earnings momentum.

However, investors should also be aware that in contrast to share repurchases and dividend growth, risks tied to prolonged low title volumes could significantly...

Read the full narrative on Fidelity National Financial (it's free!)

Fidelity National Financial's narrative projects $15.9 billion revenue and $2.1 billion earnings by 2028. This requires 5.3% yearly revenue growth and an increase of $1.0 billion in earnings from the current $1.1 billion.

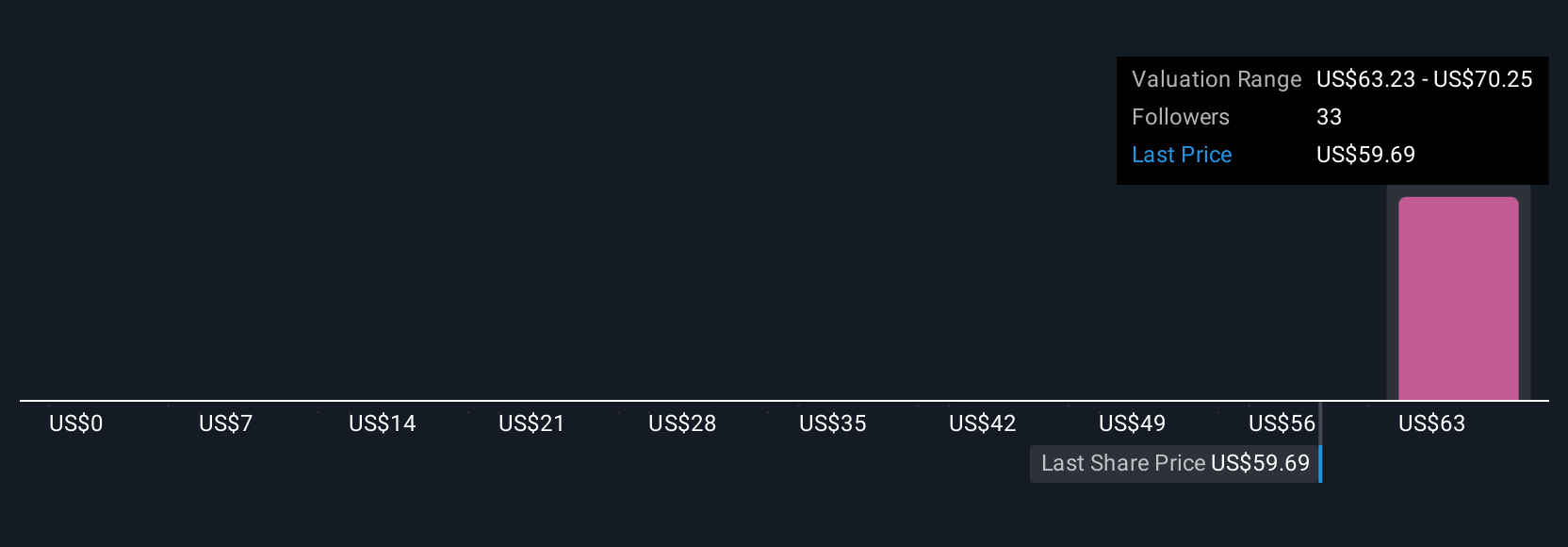

Uncover how Fidelity National Financial's forecasts yield a $70.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community shared fair value estimates for Fidelity, ranging widely from US$35.42 to US$91.64. While these views differ, continued sluggishness in title transaction volumes remains a key watchpoint for the company’s ongoing performance.

Explore 5 other fair value estimates on Fidelity National Financial - why the stock might be worth 39% less than the current price!

Build Your Own Fidelity National Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Fidelity National Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Financial's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNF

Fidelity National Financial

Provides various insurance products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives