- United States

- /

- Insurance

- /

- NYSE:FG

How Surging Premium Growth and Book Value Projections at F&G Annuities & Life (FG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent news, F&G Annuities & Life reported that its net premiums earned have grown at a 19.7% annualized rate over the last two years, outperforming the broader insurance industry and serving approximately 677,000 policyholders. Consensus projections now expect F&G Annuities & Life’s book value per share to increase by 48.8% over the next 12 months, indicating significant anticipated growth in the company's financial strength.

- This robust growth and industry outperformance highlight increasing confidence in F&G Annuities & Life's ability to capitalize on market opportunities and enhance long-term value for its stakeholders.

- We'll explore how the strong outperformance in net premiums earned could reshape F&G's investment narrative and expected future growth trajectory.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

F&G Annuities & Life Investment Narrative Recap

To be a shareholder in F&G Annuities & Life, you need to believe in the company's ability to capitalize on robust growth in net premiums and expand its market reach within the annuity and insurance sector. The recent report of 19.7% annualized growth in net premiums earned points to ongoing momentum; however, the biggest short-term catalyst, continued sales strength in core products, may be partially offset by margin pressure from industry competition. The most pressing risk, the potential for inconsistent revenue if sales growth in multi-year guaranteed annuities (MYGA) slows, remains unchanged based on this news.

Among the company’s recent updates, the Q2 2025 earnings release is especially relevant. While revenue increased year over year, net income decreased, highlighting important context for understanding whether strong top-line momentum can translate to sustainable profit growth as the company navigates industry-specific challenges and execution transitions.

However, investors should be aware that margin compression in a competitive fixed portfolio environment could...

Read the full narrative on F&G Annuities & Life (it's free!)

F&G Annuities & Life's outlook anticipates $6.6 billion in revenue and $839.8 million in earnings by 2028. This projection assumes a 4.7% annual revenue growth rate and an earnings increase of $217.8 million from the current $622.0 million.

Uncover how F&G Annuities & Life's forecasts yield a $37.43 fair value, a 29% upside to its current price.

Exploring Other Perspectives

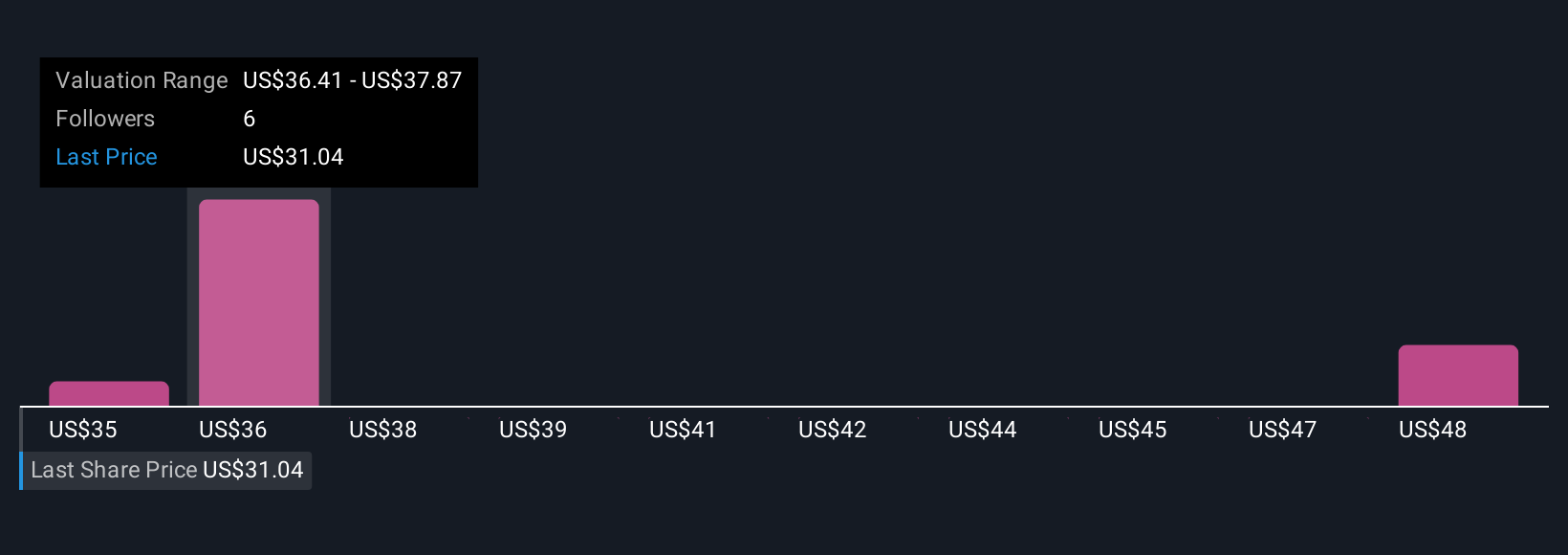

Simply Wall St Community members provided three fair value estimates ranging from US$34.95 to US$49.56 per share. Amid this diversity of opinion, the risk of margin compression highlighted in recent company updates could have broader implications for future earnings and valuation, so consider several viewpoints before deciding your next step.

Explore 3 other fair value estimates on F&G Annuities & Life - why the stock might be worth as much as 71% more than the current price!

Build Your Own F&G Annuities & Life Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your F&G Annuities & Life research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free F&G Annuities & Life research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate F&G Annuities & Life's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FG

F&G Annuities & Life

Provides annuity and life insurance products in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives