- United States

- /

- Insurance

- /

- NYSE:FAF

A Look at First American Financial’s (FAF) Valuation Following Its Third-Quarter Turnaround

Reviewed by Simply Wall St

First American Financial (FAF) just released its third-quarter results, showing a big swing from last year's net loss to solid net income. Revenue also jumped, which highlights the company’s clear turnaround and renewed financial momentum.

See our latest analysis for First American Financial.

Following these upbeat results, First American Financial’s share price momentum has been steady, now trading at $62.14. Stronger earnings and recent share buybacks seem to have brightened investor sentiment. The company has delivered a 12-month total shareholder return of 2.8% and a notable 59.6% over five years. While short-term price swings have been modest, long-term performance suggests that sustained profitability could keep the stock in focus for investors who value resilience and gradual growth.

If you’re interested in what else might be showing persistent growth or renewed momentum, it’s a great time to discover fast growing stocks with high insider ownership.

With shares trading below analyst price targets and the business showing a strong rebound, investors may wonder whether First American Financial is now undervalued, or if the market is already pricing in its improved outlook and future growth potential.

Most Popular Narrative: 20.8% Undervalued

With First American Financial's fair value estimated at $78.50 and a last close price of $62.14, the narrative projects considerable upside ahead. The fair value is well above today's share price and points to a market discount given current expectations.

"Accelerating adoption and rollout of proprietary technology platforms such as Endpoint and Sequoia, aimed at automation of title and refinance transactions, are expected to unlock operational efficiencies and reduce processing costs. This is anticipated to support higher net margins over the next 2-3 years."

Want to see what assumptions are fueling this bullish price target? The narrative leans heavily on tech automation and a future profit profile that could outpace many peers. Curious which aggressive growth projections undergird this big valuation leap? Dive deeper to uncover the numbers and logic driving this fair value case.

Result: Fair Value of $78.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges in the housing market and a potential slowdown in commercial segment momentum could quickly put this positive outlook to the test.

Find out about the key risks to this First American Financial narrative.

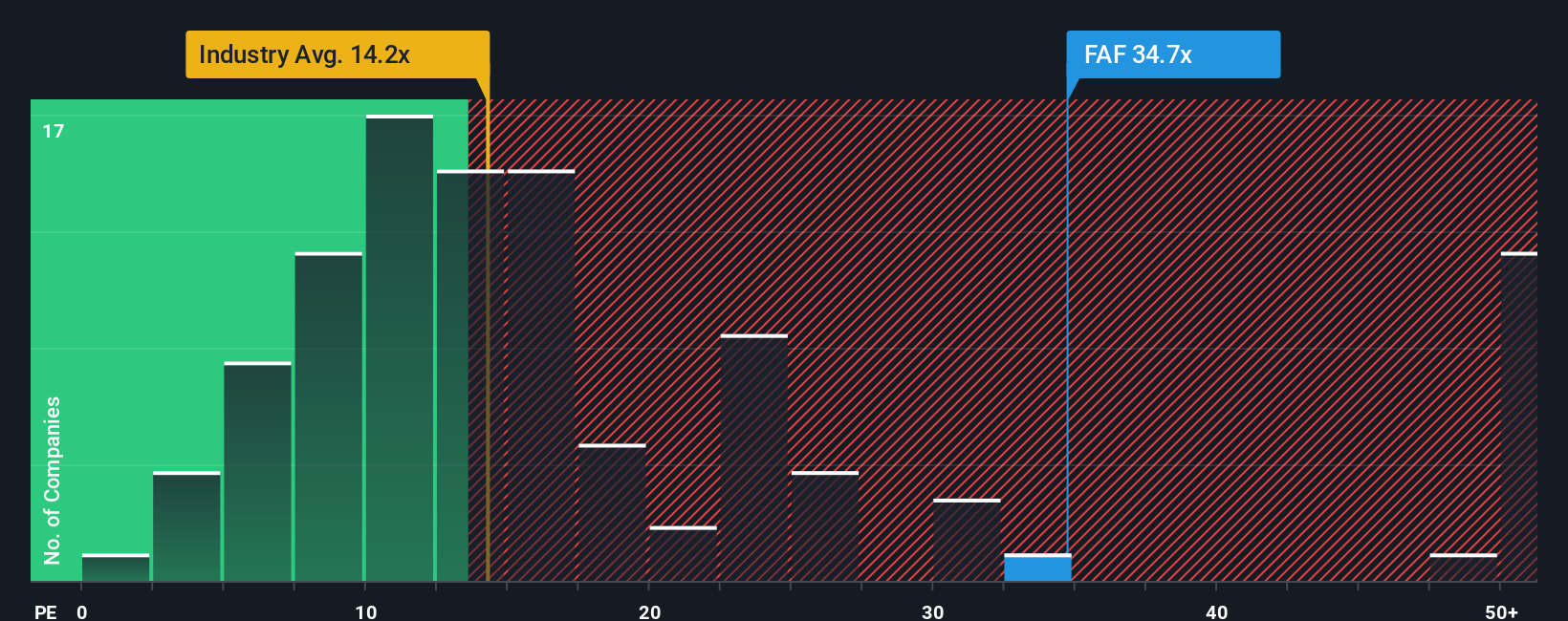

Another View: Are Market Multiples Sending a Different Signal?

While the fair value case appears strong, looking at market-based valuation tells a slightly different story. First American Financial trades at a price-to-earnings ratio of 13.1x, which is higher than its peers at 10.9x but just below the industry average of 13.4x. The fair ratio sits at 14.1x, suggesting the stock is fairly priced relative to broad benchmarks. However, investors should weigh whether this premium is justified given past earnings volatility and value risk.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First American Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First American Financial Narrative

If you want to chart your own course or dig deeper into the data, you can develop your own narrative in under three minutes, and Do it your way.

A great starting point for your First American Financial research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your chance to move ahead and expand your portfolio with handpicked opportunities you simply won’t find by sitting on the sidelines.

- Unlock income streams and boost your returns by scanning these 18 dividend stocks with yields > 3% that consistently offer yields above 3%.

- Gain a tech edge by analyzing these 26 AI penny stocks leveraging rapid advances in artificial intelligence to fuel growth and market leadership.

- Capitalize on future trends by targeting these 28 quantum computing stocks pioneering breakthroughs in computing and driving innovation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives