- United States

- /

- Insurance

- /

- NYSE:EG

Does Everest Group’s 2025 Valuation Reflect Its Recent Share Price Slide?

Reviewed by Bailey Pemberton

- Wondering if Everest Group is quietly turning into a value opportunity, or if the market is rightly skeptical at current levels, you are not alone.

- The stock has slipped about 13.7% year to date and is down 14.3% over the last 12 months, even though it still sits roughly 48.2% higher than it did five years ago. This combination often signals shifting views on risk and longer term growth.

- Recent headlines have focused on the reinsurance sector adjusting to changing catastrophe risk and pricing dynamics, with Everest often cited as a key player in that reshaping market. At the same time, regulatory developments and capital deployment decisions across the industry have kept investors debating which names are positioned to benefit most as conditions evolve.

- Right now, Everest Group scores a 3/6 valuation check, meaning it screens as undervalued on half of the key metrics we track. That sets us up to compare what traditional valuation methods say versus a more holistic way of thinking about value that we will get to by the end of this article.

Find out why Everest Group's -14.3% return over the last year is lagging behind its peers.

Approach 1: Everest Group Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above its cost of equity, then projects and discounts those extra profits to estimate what the business is worth today. In simple terms, it asks how effectively Everest Group turns shareholder capital into value over time.

For Everest Group, the model starts from a Book Value of $366.07 per share and a Stable EPS of $58.17 per share, based on weighted future Return on Equity estimates from seven analysts. With a Cost of Equity of $29.86 per share, that leaves an Excess Return of $28.31 per share, supported by an Average Return on Equity of 13.55%. Analysts also expect Stable Book Value to rise to $429.28 per share, based on forecasts from eight analysts.

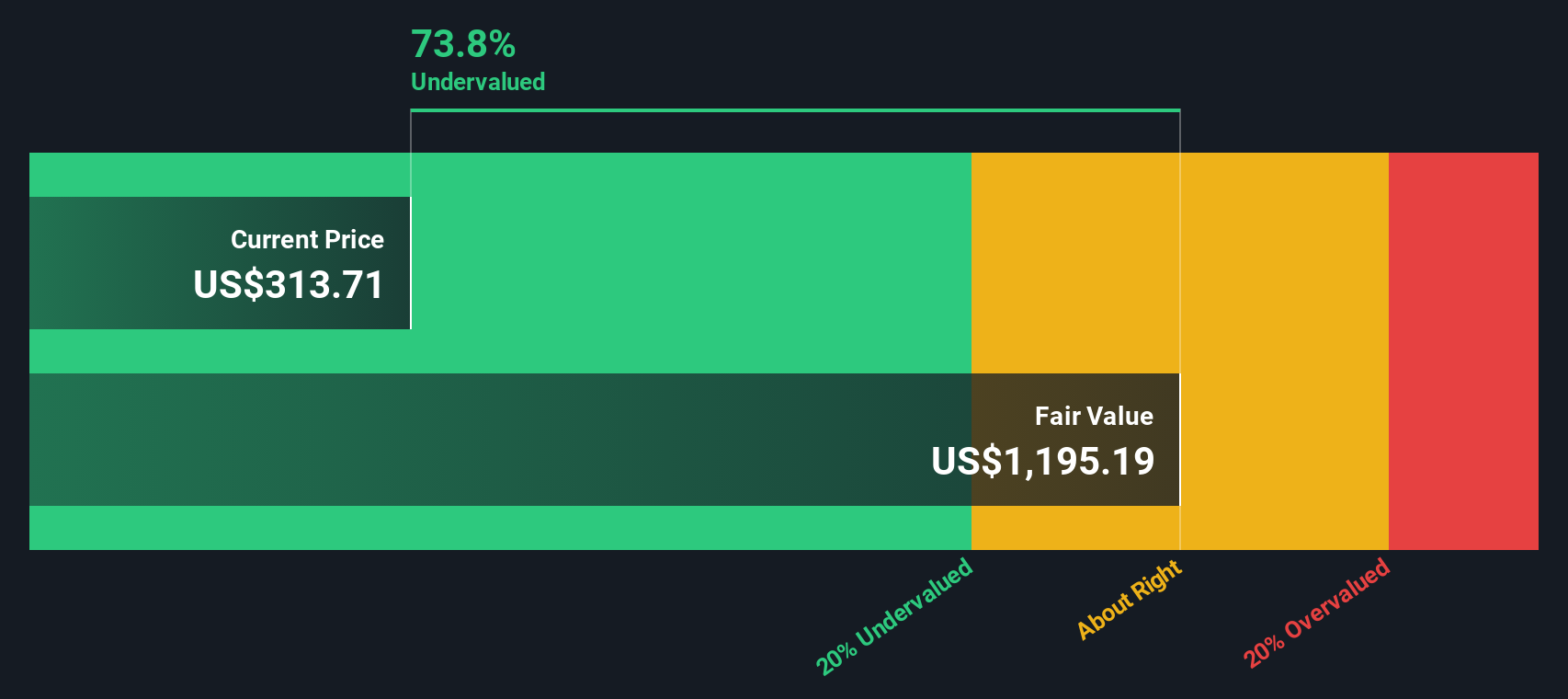

Putting these inputs together, the Excess Returns framework arrives at an intrinsic value of roughly $1,195 per share. Compared with the current market price, this implies Everest Group is about 73.8% undervalued. This indicates that the market price reflects a significant discount to the value implied by its forecast returns on equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Everest Group is undervalued by 73.8%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Everest Group Price vs Earnings

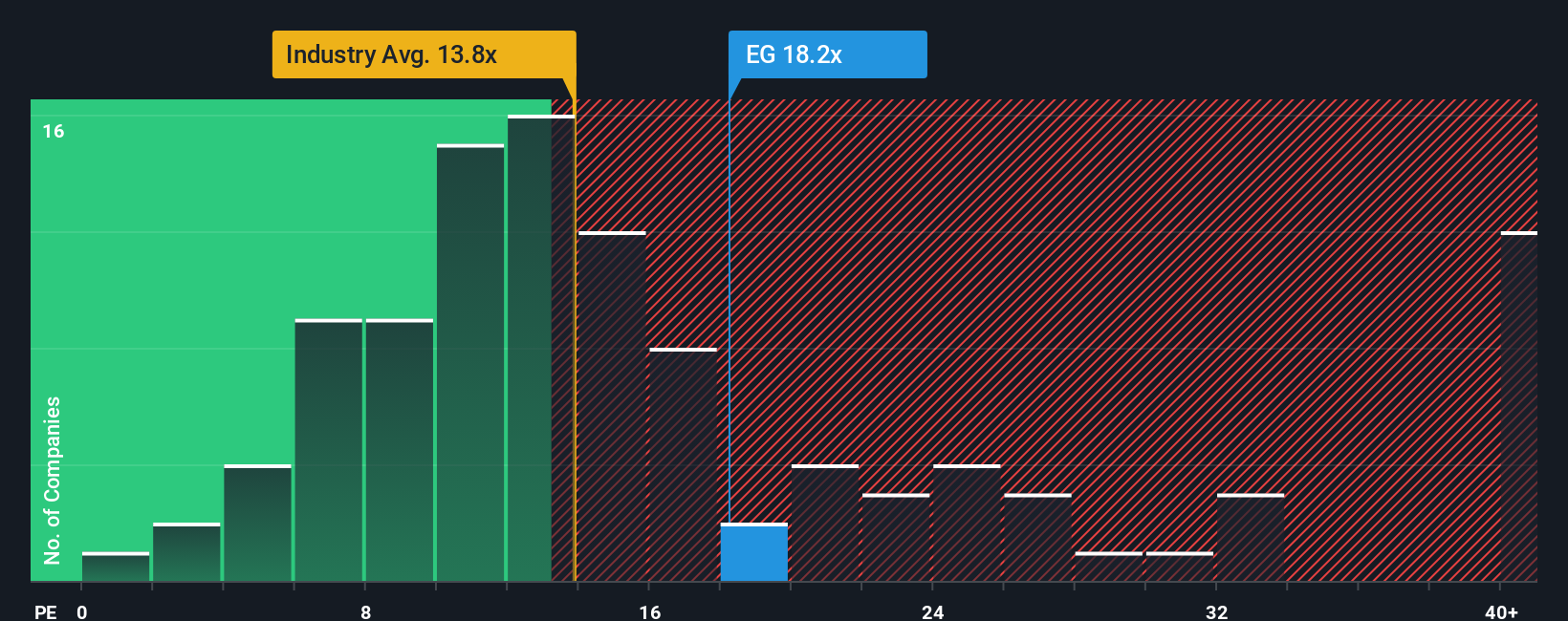

For a consistently profitable insurer like Everest Group, the price to earnings, or PE, ratio is a practical way to gauge value because it directly links what investors pay to the earnings the business generates today. In general, faster expected earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually push a fair PE lower.

Everest currently trades on a PE of about 24.1x, which is notably higher than the Insurance industry average of roughly 13.0x and above the broader peer group average of around 15.0x. At first glance, that premium might make the stock look expensive compared to its sector. However, Simply Wall St’s proprietary Fair Ratio for Everest is 25.6x, which estimates what a suitable PE should be after factoring in its specific earnings growth profile, risk characteristics, profit margins, industry positioning and market cap.

Because the Fair Ratio is tailored to Everest’s fundamentals, it offers a more nuanced benchmark than straightforward comparisons with industry or peers. With the actual PE of 24.1x sitting below the Fair Ratio of 25.6x, the shares appear modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Everest Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about a company to the numbers you expect it to deliver by linking your view of Everest Group’s competitive position, risks and opportunities to a concrete forecast for revenue, earnings and margins, and then to a Fair Value that you can easily compare with the current share price to inform your decision. On Simply Wall St’s Community page, used by millions of investors, Narratives turn this process into an accessible tool that automatically updates when fresh information arrives, such as new earnings, reserve charges or strategy shifts, so your thesis and Fair Value evolve with the facts instead of going stale. For Everest Group, one investor might build a bullish Narrative that leans into margin expansion and sets Fair Value near the top of recent analyst targets around $483, while another could focus on catastrophe risk, reserve uncertainty and slower growth to anchor a more cautious Narrative closer to $360, and both perspectives can co-exist, be tracked over time and be refined as the story unfolds.

Do you think there's more to the story for Everest Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EG

Everest Group

Through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026