- United States

- /

- Insurance

- /

- NYSE:CRD.B

Revenues Working Against Crawford & Company's (NYSE:CRD.B) Share Price Following 40% Dive

The Crawford & Company (NYSE:CRD.B) share price has fared very poorly over the last month, falling by a substantial 40%. Indeed, the recent drop has reduced its annual gain to a relatively sedate 9.3% over the last twelve months.

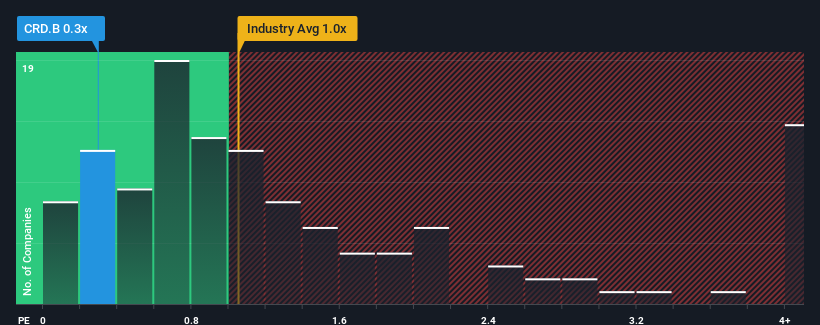

After such a large drop in price, considering around half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1x, you may consider Crawford as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Crawford

How Crawford Has Been Performing

Recent times haven't been great for Crawford as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Crawford will help you uncover what's on the horizon.How Is Crawford's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crawford's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.5% last year. Revenue has also lifted 29% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.7% as estimated by the three analysts watching the company. With the industry predicted to deliver 6.8% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Crawford is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Crawford's P/S Mean For Investors?

The southerly movements of Crawford's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Crawford's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Crawford you should be aware of.

If these risks are making you reconsider your opinion on Crawford, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRD.B

Crawford

Provides claims management and outsourcing solutions for carriers, brokers, and corporations in the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives