- United States

- /

- Insurance

- /

- NYSE:CNO

How CNO’s Orlando Unit Closure and Job Reductions Could Reshape Its Efficiency Story for Investors (CNO)

Reviewed by Sasha Jovanovic

- Earlier this week, CNO Financial Group announced the closure of an underperforming Orlando business unit, resulting in hundreds of job reductions beginning in January 2026 and continuing through mid-year.

- This step underscores management’s focus on optimizing operational efficiencies and adapting its cost structure amid shifting industry demands.

- We’ll examine how CNO’s decision to shutter an unprofitable unit may influence its investment narrative and long-term efficiency goals.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CNO Financial Group Investment Narrative Recap

To be a shareholder in CNO Financial Group, investors typically need to believe in the company's ability to unlock value through operational efficiency, stable earnings, and adaptation to evolving customer needs in the retirement and insurance sectors. The recent move to close an underperforming Orlando unit signals management’s ongoing focus on cost management, though this specific development is unlikely to materially alter core short-term catalysts, such as digital channel growth, or change the most significant risk to earnings related to interest rate pressures and industry competition.

Among relevant updates, CNO recently reaffirmed its quarterly dividend of US$0.17 per share, a sign of continued commitment to returning capital to shareholders despite ongoing adjustments to its operating structure. This steady capital return, alongside periodic share buybacks, reinforces the company’s focus on generating shareholder value as other cost-reduction initiatives take place across the business.

However, investors should also be aware that rapid shifts toward direct-to-consumer digital insurance models remain a risk to margins if CNO’s digital transformation does not keep pace with...

Read the full narrative on CNO Financial Group (it's free!)

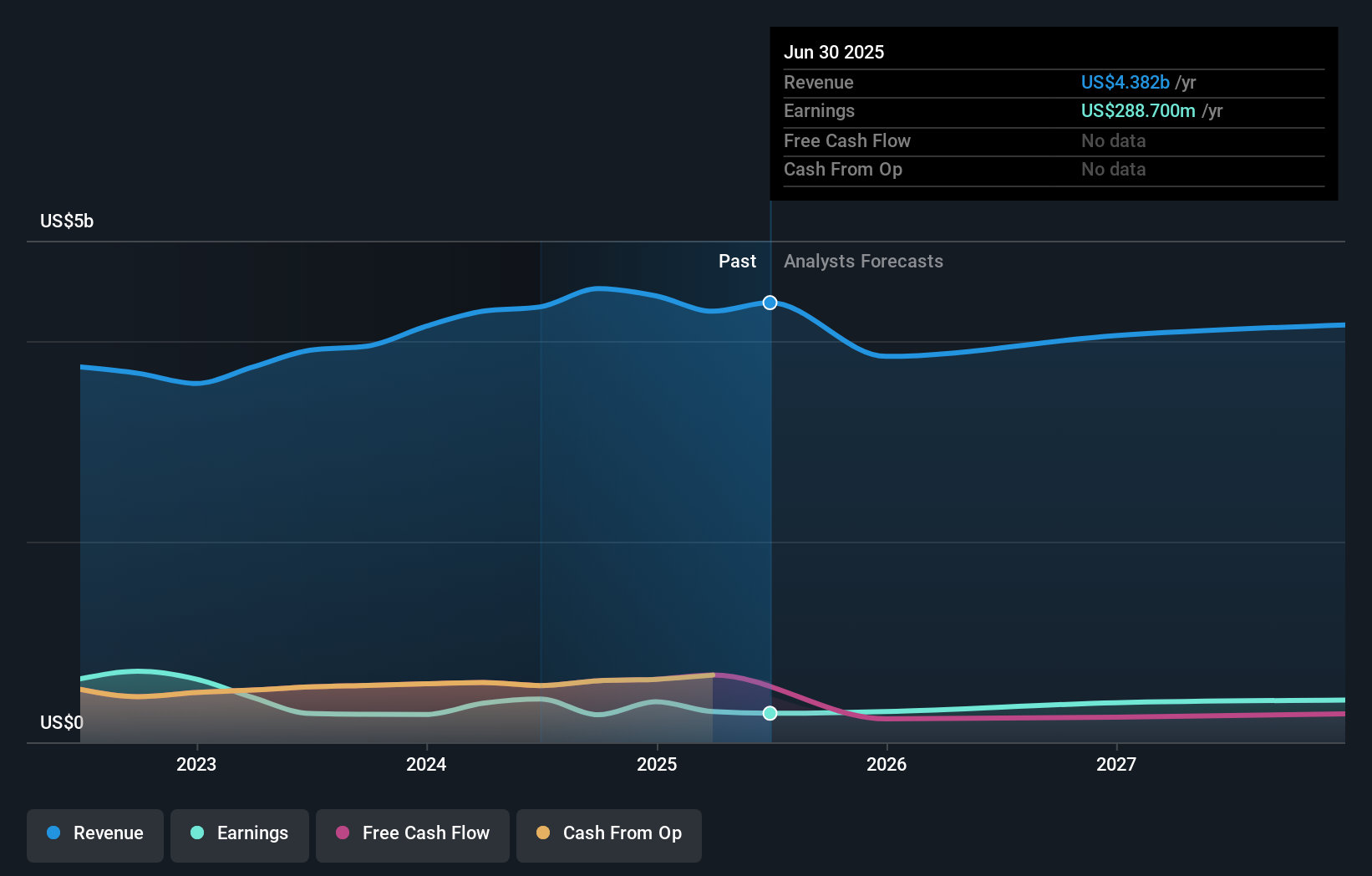

CNO Financial Group's narrative projects $4.3 billion in revenue and $432.2 million in earnings by 2028. This requires a -0.8% annual revenue decline and a $143.5 million earnings increase from $288.7 million today.

Uncover how CNO Financial Group's forecasts yield a $44.40 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has submitted one fair value estimate for CNO at US$44.40 per share. While these opinions provide an interesting benchmark, accelerating growth in digital direct-to-consumer channels is a theme that could shape different outcomes for the company's performance going forward.

Explore another fair value estimate on CNO Financial Group - why the stock might be worth just $44.40!

Build Your Own CNO Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNO Financial Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CNO Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNO Financial Group's overall financial health at a glance.

No Opportunity In CNO Financial Group?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success