- United States

- /

- Insurance

- /

- NYSE:CNO

CNO Financial Group (CNO): Evaluating Shareholder Returns and Current Valuation Outlook

Reviewed by Simply Wall St

CNO Financial Group (CNO) shares have seen a steady ride over the past month, with a slight lift of nearly 2% as investors scan for deeper signals in the insurance sector’s overall direction.

See our latest analysis for CNO Financial Group.

Momentum for CNO Financial Group is gathering pace, with its share price up 8% year-to-date and recent moves building on underlying confidence in the insurance sector. While the share price has moved steadily, the real highlight is a 19% total shareholder return over the last year and an impressive 94% total return in just three years, signaling that growth potential is not just a short-term story.

If you’re keen to expand your investing playbook beyond insurance, consider exploring fast growing stocks with high insider ownership for compelling opportunities in other fast growing companies with strong insider ownership.

This raises a pivotal question: Is CNO Financial Group still trading at a discount that rewards new investors, or has the recent surge already factored in the company’s growth potential and upside risk?

Most Popular Narrative: 5% Undervalued

With the last close at $40.12 and the narrative's fair value set at $42.4, CNO Financial Group looks positioned for a modest upside, according to the most widely followed view. This sets the tone for a debate on what’s driving that valuation gap and which factors ultimately determine how much headroom is left in the share price.

“Accelerating growth in annuity and life/health policy sales, particularly driven by a rapidly aging U.S. population (11,000 Americans turning 65 each day) and increased focus on retirement income solutions, is expanding CNO's addressable market and supporting consistent, repeatable revenue gains. Strong momentum in digital and web-based direct-to-consumer channels, evidenced by 39% year-over-year growth and over 30% of D2C leads now from digital sources, is reducing customer acquisition costs and is expected to drive further margin expansion and scalability.”

Curious how these two megatrends are baked into the narrative’s fair value? There’s a bold forecast beneath the surface. The market may underestimate how quickly digital adoption and changing demographics can reshape earnings and transform valuation assumptions. Which underlying projections justify this price gap? Find out what the full narrative reveals.

Result: Fair Value of $42.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged low interest rates or intensifying competition in the annuities market could present challenges for CNO’s growth outlook and may put pressure on future profitability.

Find out about the key risks to this CNO Financial Group narrative.

Another View: Market Multiples Tell a Cautious Story

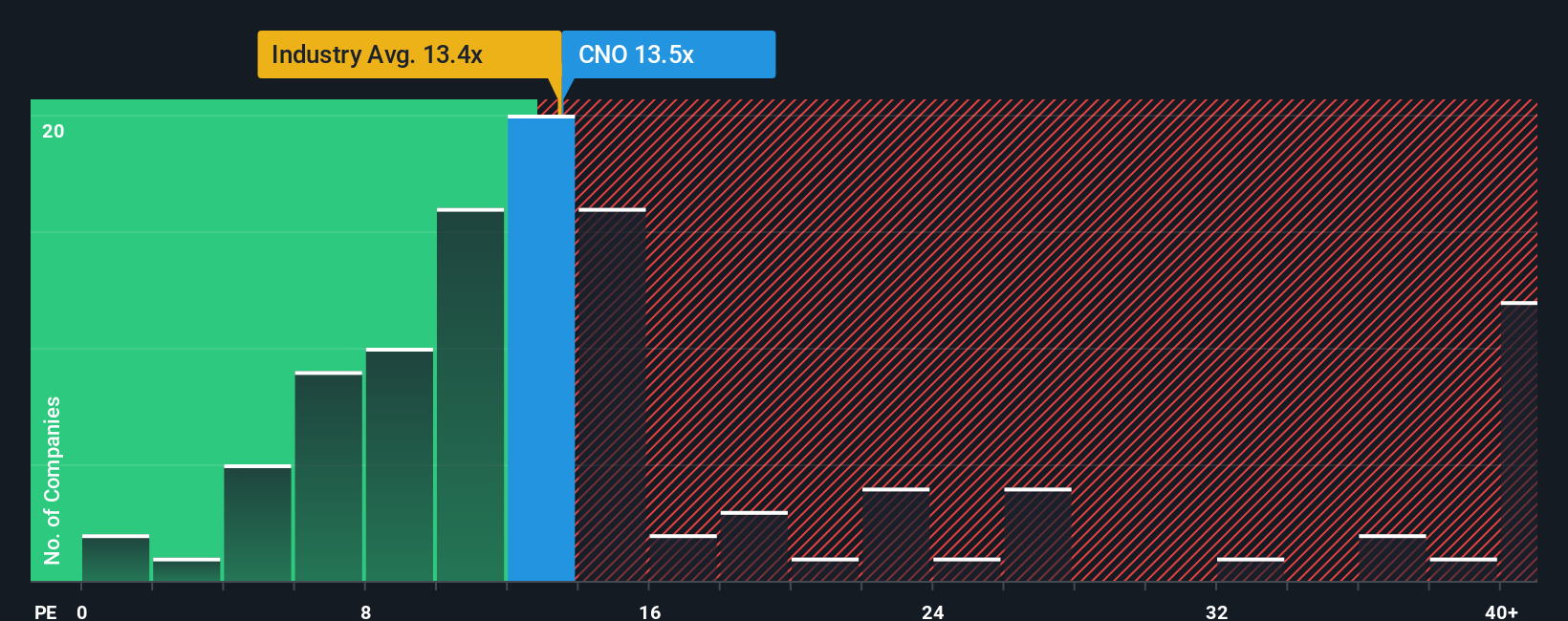

Taking a look at how the market values CNO Financial Group versus its peers, its price-to-earnings ratio stands at 13.5 times, just above the US insurance industry average of 13.4 and notably higher than the peer average of 11.5. The fair ratio is estimated at 14.9, suggesting room for upward movement; however, any deviation from sector norms could also signal risk. Does the market see something others are missing, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CNO Financial Group Narrative

If you think a different angle is worth exploring, or you want to dive deeper into the numbers yourself, building your own narrative is quick and easy. It takes just a few minutes to capture your perspective. Do it your way

A great starting point for your CNO Financial Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the moment to uncover unique stocks that most investors overlook. The next opportunity could be just a click away, so do not let it slip by you.

- Supercharge your portfolio with attractive cash flow potential by exploring these 870 undervalued stocks based on cash flows and spot companies where the market has not caught up yet.

- Capture double-digit yields and boost income with these 17 dividend stocks with yields > 3% featuring strong dividend payers with rewarding payouts above the typical threshold.

- Position yourself at the forefront of technological change by reviewing these 27 AI penny stocks, which highlights innovators leading advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion